Weird Things Are Happening in the Bond Market Treasuries are wobbling without the usual collateral damage.

(…) Yields on 10-year US Treasuries have risen nearly 70 basis points since the Federal Reserve’s punchy half-point initial rate cut on Sept. 17.

What’s even more unusual is that US sovereign bonds are having a wobble without instruments that are usually correlated coming along for the ride — with the exception of UK gilts, for similar fiscal worries. The US dollar has strengthened 4% over the past month, so it’s evident foreign money isn’t fleeing US assets; it’s just not being parked in the usual safe spot of Treasuries.

(…) the most startling disconnect is within the US fixed-income space – with corporate credit spreads tightening despite the exodus from the sovereign benchmark. High-yield spreads have narrowed 150 basis points in the past year – and are near record tightness. Debt capital markets are in rude health with new bond deals this year matching the volumes and variety of credit quality as in the pandemic’s banner years.

With so much in Goldilocks territory, Washington must be the problem here. The economy is broadly ticking along nicely, but importantly neither is it too hot. (…)

This isn’t really an inflation-driven scare either, as the Fed’s preferred core Price Consumption Expenditure gauge is close to its 2% target. Persistent weakness in the crude oil price would normally be helping bonds. Yields on Treasury Inflation-Protected Securities have matched about half of the increase registered by their nominal brethren, but now return 2% after inflation — close to the most generous since the global financial crisis.

What is notable in the past month is a rise in the cost of buying downside option protection — along with pressure in the repurchase markets. That indicates not only an increase in portfolio hedging but also short positions being put on. Bond-market volatility is the highest since late last year but this may shelve off sharply post Nov. 5.Fear of the unknown is an ephemeral thing even if nothing much in the real economy has changed. Any incoming administration’s capacity to splurge fiscally will be heavily limited, not just legislatively but by bond-market appetite. Reality will hit hard if nothing can be funded. Once the event risk of the election passes, the elastic of the fundamental valuation relationship of the global bond benchmark to other asset classes could well snap back.

Some clues:

- Stronger for longer:

(Ed Yardeni)

- Deficit Threat Drives Bond Yields Higher Investors expect Trump would increase budget gap with tax cuts

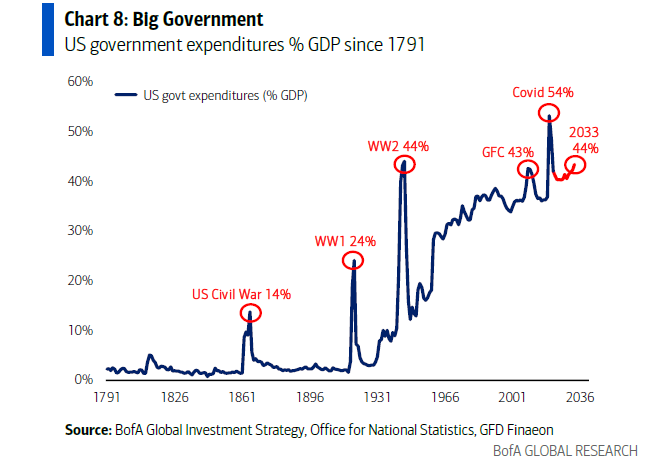

The prospect of a rising federal budget deficit is fueling a sharp climb in bond yields, with investors betting a challenging fiscal situation might only get worse after the election.

Treasury yields, which rise when bond prices fall, jumped Monday after a $69 billion government auction of 2-year notes attracted tepid demand from investors. That marked the latest leg in a weekslong bond-market selloff that began after a run of strong economic data undercut bets on rate cuts from the Federal Reserve.

The auctions aren’t poised to get smaller soon. When the Treasury Department releases its quarterly borrowing plans on Wednesday, it will almost certainly maintain record-large debt sales over the next three months. There is also a chance that it could hint that further increases are coming next year, according to some analysts.

Most investors expect the budget deficit to remain elevated no matter who wins in next week’s elections, with the cost of spending programs such as Medicare and Social Security climbing faster than federal revenues. Still, many think the budget gap will expand the most if Republicans sweep control of both the White House and Congress, leading to extensions of old tax cuts and the possible addition of new ones.

That view has been evident in recent days, with longer-term Treasury yields climbing as betting markets showed former President Donald Trump’s chances of victory increasing. Trump’s campaign proposals would expand deficits by $7.5 trillion over a decade, according to a recent analysis—more than double Kamala Harris’s proposals. (…)

Deficits typically grab the attention of investors when there is a major shift in the fiscal outlook, as can often happen around an election.

TD Securities estimates that the fiscal year 2025 deficit will be around $2 trillion under any political scenario, up from $1.8 trillion in the fiscal year that just ended on Sept. 30.

The election outcome could make a bigger difference the following year, with TD estimating a $2.2 trillion deficit under a Republican sweep versus a $2.05 trillion deficit if Harris wins but faces a divided Congress, a scenario that polls suggest also has a good chance of happening. That gap can largely be explained by the expiration of 2017 tax cuts at the end of 2025, which analysts expect would be fully extended by Republicans, but only partially extended if Democrats hold some power. (…)

Bills made up 21.7% of outstanding Treasurys at the end of last month. That is a little higher than the 15%-20% range recommended by a private-sector Treasury advisory group in 2020 but still below the long-term average of about 22.4%.

In a recent report, analysts at Goldman Sachs argued that there is a chance that Treasury officials on Wednesday could signal openness to increasing coupon auction sizes next year to avoid a scenario in which the share of bills climbs too high.

But analysts at BNP Paribas struck a relatively relaxed tone on the issue. “Having more T-bill flexibility allows for steady coupon issuance,” they wrote in a recent report, adding that “T-bills are easier to absorb for markets.”

- The Federal Government debt “will soon be expanding at an annual rate of over $1.0 trillion just to cover the net interest outlays of the Treasury.” (Ed Yardeni)

- According to the Peterson Foundation, the United States spent $820 billion on national defense during fiscal year 2023, which amounted to 13% of federal spending. Defense spending in 2023 was less than the average for the last decade, which was 15% of the budget. For fiscal year 2025, the proposed defense budget of $850 billion represents about 3% of GDP vs 3.5% in 2023 and 2.9% in 2024. Procurement of weapons and systems also accounted for a smaller share of the total defense budget:

But today’s WSJ editorial might be waking many up to this reality:

(…) the world is also different than it was when Mr. Trump left office in 2021. The dictators he says he got along with then are on the march now and they’re working together more than they ever have. North Korean troops are fighting for Russia against Ukraine, and Russia is shielding North Korea from nuclear sanctions enforcement. China and Iran are also helping Russia.

The U.S. military’s advantage over adversaries has also declined, a fact that Mr. Trump has done little to acknowledge or warn about in his campaign. It will take more than flattery and unpredictability to reestablish American deterrence, and that will include Western rearmament and reliable alliances.

Here’s the CBO current projections. Realistic?

I spare you on Medicare/Medicaid and social security but the path is clear:

Deficits don’t matter, until they do.

China Industrial Profits Extend Drop as Deflation Takes Toll

Last month’s industrial profits at large Chinese companies fell 27.1% from a year earlier, after a 17.8% plunge in August, the National Bureau of Statistics said in a statement Sunday. Profits decreased 3.5% in the first nine months from the same period in 2023.

The data was “affected by factors such as high base in the same period last year” the bureau said in a statement.

Industrial profits provide a key measure of the financial health of factories, mines and utilities that can affect their investment decisions in the months to come. (…)

Deepening deflation in producer prices was likely a drag on company earnings despite faster growth in industrial output, Bloomberg Economics said before the release. Factory-gate prices extended declines for a 24th straight month in September, with the recent drop accelerating, reflecting weak domestic demand.

The country’s top legislative body will hold a highly anticipated session in Beijing on Nov. 4 to 8, as investors watch for any approval of further fiscal stimulus to revive growth. (…)