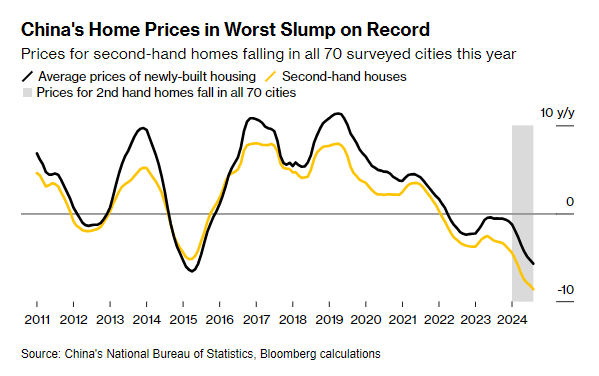

China’s Latest Round of Property Stimulus Fails to Inspire Markets Markets largely shrugged off the new measures, which were milder than expected

Authorities plan to fast-track credit for struggling property developers, and aim to renovate 1 million apartments in so-called urban shantytowns, a strategy used during the prior real-estate slump, the housing ministry and other policymakers said Thursday at a highly anticipated press conference.

More funds will be deployed for housing projects on the government’s “white list,” with 4 trillion yuan, equivalent to $550 billion, in loans to be available by the end of this year, Minister of Housing and Urban-Rural Development Ni Hong said, urging banks to lend to as many projects as possible.

Projects on Beijing’s “white list” are eligible for government-backed financing to complete unfinished apartments and ensure delivery of homes.

Markets largely shrugged off the news, which was milder than what many expected after an aggressive round of economic stimulus last month. (…)

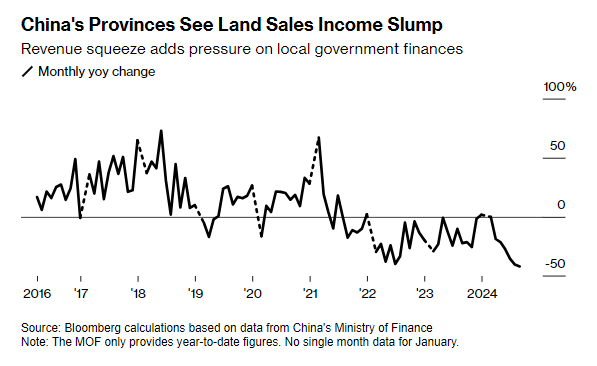

China launched a similar state-financed slum redevelopment program in 2015. Back then, local governments compensated the residents of demolished homes with cash or new housing, and state policy banks provided loans to local governments to finance the program. (…)

“This is because the proceeds of the loans will be parked at the escrow accounts and cannot be used to service debt or fund new projects,” she said. “The aim of the white list is to accelerate the construction of pre-sold but incomplete homes,” so its expansion won’t help reduce China’s excess property inventory or lift expectations about home prices, she added. (…)

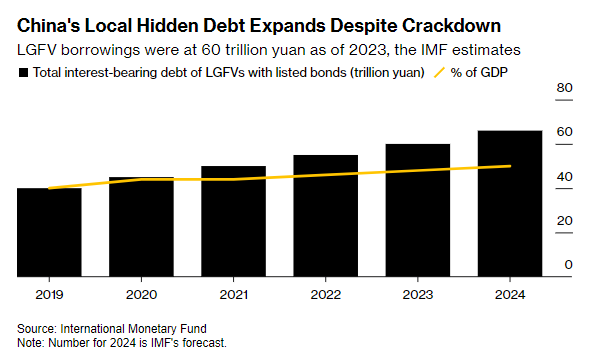

The urban-renewal project is also smaller than the previous reconstruction program in 2015-2018, and may take much longer to implement due to developers’ strained liquidity and local governments’ squeezed wallets, she added. (…)

“Homebuyers’ demand is tougher to control,” she said. “The government can roll out favorable policies, but whether households bite depends on a lot of factors.” (…)

- Japan’s Exports Fall Most Since 2021 Amid Global Slowdown Shipments to China, US, Europe all decline amid weak demand

(…) Shipments to China sank 7.3%, reversing gains of 5.2% the month before, while those to the US and Europe fell 2.4% and 9%, respectively. (…)

Japan’s Wage Deal Timeline May Shape BOJ View on Next Rate Hike Largest labor union reportedly seeks 5% or more in wage hikes

The country’s largest labor union federation is reportedly seeking 5% or more in wage hikes again next year, an early indication that upward pressure on pay will remain at least as strong as this year. Negotiated wage gains tracked by the Rengo federation hit a 33-year record of 5.1% in 2024. (…) Still, the scale of those pay deals hasn’t spread to all parts of the country’s workforce. Average cash earnings through August this year have averaged 2.3%, leaving wage gains trailing behind even stronger growth in prices.

AI CORNER

TSMC Hikes Revenue Outlook in Show of Confidence in AI Boom

The main chipmaker to Nvidia Corp. and Apple Inc. now expects sales to climb roughly 30% in US dollar terms this year, up from previous projections for about a mid-20% rise. That’s after TSMC reported better-than-predicted earnings for the September quarter. And it foresees capital expenditure rising in 2025 from roughly $30 billion this year.

“The demand is real and I believe it’s just the beginning,” Wei said, echoing a number of executives including Nvidia’s CEO. In terms of overall chip demand, “everything’s stabilized and start to improve.” (…)

Wei said he expects revenue from AI server processors to more than triple this year, yielding a mid-teens percentage of total sales in 2024.

It’s planning more plants in Europe with a focus on the market for artificial intelligence chips, according to a senior Taiwanese official. That’s on top of construction underway in Japan, Arizona and Germany.

Amazon has become the third tech company in as many weeks to announce a massive nuclear investment to fuel the energy-sucking data centers that bring you generative AI.

Amazon Web Services, still the world’s largest cloud computing provider, said it will spend $500 million to fund nuclear projects in Virginia and Washington state. The news follows recent nuclear announcements from peers Google and Microsoft, the latter of which recently inked a deal to reopen a shuttered nuclear reactor at Pennsylvania’s infamous Three Mile Island.

The nuclear industry has been in decline for years because of concerns over safety in the event of a meltdown. But the gen AI boom’s massive energy needs have rekindled interest in the carbon-free energy source.

For Amazon, that includes partnering with Virginia’s Dominion Energy utility company to develop small modular nuclear reactors, or SMRs. These small-scale fission facilities are a fraction of the size of a traditional nuclear plant, quicker to fire up, and less expensive to build.

Amazon has previously committed to spending $40 billion on a data center expansion in Virginia through 2040, which might partly explain the state’s warm embrace.

World Set for Cheaper Energy on Shift From Oil and Gas, IEA Says

The world is heading into an era of cheaper energy prices as a shift towards electricity use leaves behind surpluses of oil and gas, the International Energy Agency predicted.

Global demand for all fossil fuels will stop growing this decade, while supplies of oil and LNG are set to climb, the IEA forecast in its annual long-term report. Meanwhile, an ongoing surge in electricity consumption led by China is on track to accelerate, it said.

“The world is set to enter a new energy market context in the second half of this decade because underlying market balances for oil and gas are easing,” IEA Executive Director Fatih Birol said in an interview. “Bar major geopolitical conflicts, we will be entering a period where prices will see significant downward pressures.” (…)

Electricity use has grown at twice the pace of total energy demand over the past decade, and, driven by China, will increase six times as fast during the coming 10 years, according to the agency. Electric vehicles will account for 50% of new car sales worldwide by 2030, up from 20% currently, it predicted.

“In energy history, we’ve witnessed the Age of Coal and the Age of Oil – and we’re now moving at speed into the Age of Electricity,” said Birol.

The agency reiterated its view that demand for oil and gas will hit a plateau this decade. Nonetheless, oil supplies are climbing amid new output from the US, Brazil, Canada and Guyana, and there is a looming “wave” of liquefied natural gas projects.

A “huge addition” of around 270 billion cubic meters of new LNG capacity is scheduled by 2030, according to the report. Even some clean energy technologies, like solar photovoltaic, will see a surplus.

Crude prices can continue to trade between $75 and $80 a barrel, but only if OPEC and its allies restrain output further, according to the report.

Led by Saudi Arabia, OPEC+ is already holding back record spare capacity of around 6 million barrels a day following a series of production cutbacks, a level that the IEA expects will reach 8 million barrels by 2030.

“The rise of electric mobility, led by China, is wrong-footing oil producers,” it said. (…)

Goldman Sachs Group Inc. forecasts that oil demand will continue rising through to 2034. (…)

Related: Power Play

The state of corporate insiders

The insider activity database we use is from Bloomberg and goes back to March 2010. This is not a lot of data to work with. However, we have chosen to use it as it provides the most reliable database we could find. Some of what follows is based on my earlier work with data from a different source.

Our Corporate Insider Buy/Sell Ratio indicator shows a ratio of the total number of corporate insiders of S&P 500 companies that have bought shares on the open market during the past six months versus those that have sold shares. Because insiders typically only buy if they have confidence that their company (and stock) will do well, insider buying is considered a stronger signal than insider selling. When buying picks up quickly and dramatically, it tends to be an excellent sign for the stock market, so quick increases in this ratio tend to be a positive sign for stocks.

The chart below highlights all dates when the indicator registered a weekly reading of 0.14 or higher. We see five distinct periods.

The table below summarizes S&P 500 performance following all dates (including overlaps) highlighted in the chart above. Note the very favorable performance results, particularly for six and twelve months.

For comparison, the table below summarizes SPX performance for all database dates starting in 2010. Note that results are lower across the board.

The bottom line: When insiders aggressively buy shares, you should probably consider doing the same. (…)

It bears repeating that corporate insider activity is best used not as a standalone trading “system” – triggering “All In” or “All Out” signals – but as a “weight of the evidence” tool. Insider buying can often be “too early” – i.e., they may start buying into a market decline and keep buying as the market tanks.

Because they typically have a multi-year time frame, this almost invariably works out well as they buy when their companies’ shares are down or in the process of bottoming out and then wait patiently for a rebound and rally.

Not every investor is wired to invest this way. Likewise, corporate insider selling does not necessarily generate “timely” sell signals anywhere near a notable market top.

The simple method highlighted above does an excellent job of allowing investors to designate insider activity as “favorable” or “not meaningful” at any given time. For now, that approach is still sitting in the “favorable” camp.