CONSUMER WATCH

- we’re not seeing weakening, for example, in retail spending. So overall, we see the spending patterns as being sort of solid and consistent with the narrative that the consumer is on solid footing and consistent with the strong labor market.” – JPMorgan Chase ($JPM ) CFO Jeremy Barnum

- “Both our consumer and commercial customers have remained resilient… Both credit card and debit card spend were up in the third quarter from a year ago. And although the pace of growth has slowed, it is is still healthy.” – Wells Fargo ($WFC ) CEO Charlie Scharm

Then this:

US consumers see higher long-run inflation, rising delinquency risk

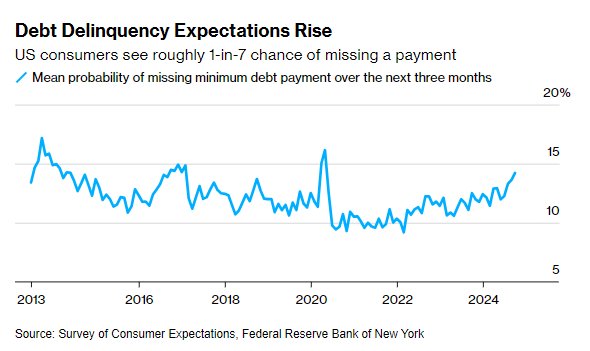

Americans said they expected higher inflation over the longer run last month, as their expectations of credit turbulence rose to the highest level since April 2020, the Federal Reserve Bank of New York said in a report on Tuesday.

While inflation a year from now is seen holding steady at 3%, three years from now it is seen at 2.7% from August’s 2.5% estimate, and at 2.9% in five years, from 2.8% in the August survey, the bank said in its latest Survey of Consumer Expectations.

Meanwhile, while perceptions and expectations for credit access improved, the report found that expected credit delinquency rates continued to rise and hit the highest level in over four years. The report noted the average expected probability of missing a debt payment over the next three months rose for a fourth straight month to 14.2%, from August’s 13.6%, suggesting some Americans are facing increased issues with managing their borrowing.

While that perceived probability was highest among households with incomes below $50,000, the largest increase was among respondents with household income above $100,000. Those respondents saw the greatest chance of falling into delinquency in 10 years. (…)

![]() Speaking of consumer confidence, LVMH yesterday told analysts:

Speaking of consumer confidence, LVMH yesterday told analysts:

Chinese consumer confidence has sunk to COVID-era lows, noting a “marked deterioration” at its fashion and leather goods business, home to Louis Vuitton and Dior, with sales in mainland China at the division falling by a mid-single digit percentage.

New York Manufacturing Contracts as Orders, Shipments Weaken

- October index of business conditions slumps to five-month low

- At same time, near-term outlook climbs to three-year high

The Federal Reserve Bank of New York’s October general business conditions index slid 23.4 points to a five-month low of minus 11.9, figures issued Tuesday showed. Readings below zero indicate contraction, and the figure was weaker than all estimates in a Bloomberg survey of economists.

At the same time, the six-month outlook for overall activity increased to a three-year high of 38.7, indicating the state’s manufacturers are more upbeat about the economy’s prospects. (…)

A measure of current new orders dropped nearly 20 points to minus 10.2 after climbing a month earlier to the highest since April 2023. The index of shipments decreased almost 21 points to minus 2.7.

The employment index, however, rebounded to 4.1 — the first expansion in a year — while a measure of hours worked also climbed.

Meanwhile, the New York Fed’s gauge of prices paid for materials increased to a six-month high of 29, while an index of prices received by state manufacturers also accelerated. (…)

An Easier Path For Bank of Canada Monetary Policy

Canada’s September CPI offers a decisive data point, in our view, that should see the Bank of Canada (BoC) step up the pace of easing, and lower its policy interest rate by 50 bps at next week’s monetary policy announcement.

September headline inflation slowed more than consensus economists expected to 1.6% year-over-year, and while that deceleration was driven by an 8.3% decline in energy prices, there were also indications that underlying price pressures are contained. Services inflation slowed to 4.0%, the smallest increase in services prices since September of last year.

Meanwhile, the average core CPI remains close to the central bank’s 2% inflation target, rising 2.4% over the past 12 months, by a 2.4% annualized pace over the past six months, and by 2.1% annualized over the past three months.

Meanwhile, while Canadian activity data is a bit more mixed, we also believe it is consistent with a 50 bps rate cut next week.

July GDP rose 0.2% month-over-month, although the advance estimate is for a flat outcome in August, which, if realized, would leave the level of July-August GDP just 0.25% above its April-June average—tracking well below the Bank of Canada’s Q3 growth forecast of around a 0.7% quarter-over-quarter (not annualized) gain.

More recent activity and survey data are not quite as soft. September employment rose by 46,700, driven by full-time jobs, and the unemployment rate fell to 6.5%. Offsetting that strength to some extent, the labor report also showed that wage growth eased by more than expected, to 4.5% year-over-year. Finally, the BoC’s Q3 business outlook survey showed a modest improvement in expectations for future sales, and the headline business outlook indicator improved to -2.3, although that reading for the business outlook indicator is still reflective of overall net pessimism rather than net optimism. (…)

Accordingly, we now forecast the BoC will lower its policy rate by 50 bps to 3.75% at its October 23 announcement, and by a further 25 bps to 3.50% in December. In 2025, we expect 25 bps rate cuts in January, March and June, which would bring the policy rate to 2.75% by middle of next year.

Among the factors we think will see the Bank of Canada revert back to smaller 25 bps increments following the October move are policy interest rates that are moving somewhat closer to neutral, hints of improvement in some of the more recent activity data, and the potential for (and desire to avoid) excessive Canadian currency weakness.

That said, relative to our prior forecast we see the Bank of Canada lowering interest rates more quickly to the same 2.75% terminal rate we had previously anticipated. Moreover, we view the risks as still tilted toward even faster monetary easing should inflation remain contained, and if growth in economic activity disappoints.

NBF concurs with Wells Fargo but sees 2 consecutive 50s:

Energy prices certainly contributed to September’s weakness, and a certain reversal is to be expected in October as geopolitical tensions rose. That said, it was rather encouraging to note the trend in food prices, which have been contained for the past two months, and the shelter component, which posted its lowest rise in 25 months.

For their part, the Bank of Canada’s core inflation measures (CPI-trim and CPI-median), which are designed to eliminate the impact of the most volatile components, moved on average at a pace in line with the Bank of Canada’s target between August and September. On a three-month annualized basis, the pace of the average of those two measures is running essentially on target at 2.1%.

The effect of the restrictive monetary policy and the cooling of the economy currently underway are even more apparent when we look at inflation excluding the housing component, which is evolving at a rate of just 0.4% year-on-year.

Note that 4 provinces are now in deflation based on this measure: Quebec, Manitoba, New Brunswick and Saskatchewan.

More specifically, rents and mortgage interest costs are the two components that have driven up shelter over the past year. On an annual basis, inflation excluding mortgage interest costs fell from 1.2% to just 1.0% in September. Since mortgage interest costs are directly related to central bank actions, we have long argued that annual inflation should be analyzed without this category.

The same applies to the analysis of real policy rates, and recent developments are a cause for concern, as recent rate cuts have not been significant enough to make monetary policy less restrictive. Indeed, the inflation-adjusted policy rate excluding mortgage interest cost is the tightest since 2007.

With widespread inflation a thing of the past in Canada, and inflation expectations having continued to improve in the light of consumer and business surveys published by the BoC last Friday, we believe that the door is wide open for the Bank of Canada to bring its policy rate back to neutral (between 2.5% and 3.0%) as quickly as possible. Job gains in September were not enough to stabilize the employment rate, and surveys do not point to any improvement in the medium term.

The Canadian economy needs oxygen from the central bank to stabilize. We expect a 50bps cut in October and another of the same magnitude in December.

Goldman Sachs:

With softer inflation likely to raise the Governing Council’s concerns about inflation undershooting its target and Q3 GDP growth likely to miss the BoC’s forecast, we now expect that the BoC will deliver a 50bp cut at next week’s meeting before resuming a 25bp per-meeting pace until reaching a terminal rate of 2.5% in June 2025 (lowered from 2.75% previously).