New feature: EDGE AND ODDS’ DaiLY CHAT.

Most days, I will provide a link to an AI generated chat on the day’s post courtesy of Google’s NotebookLM. Not totally satisfying but worth offering to readers on the go. No support charts however and some AI generated conclusions not really mine….

And there is much more on the blog itself.

And if you sense hallucinations, editorializing and patronizing, I will totally fault AI ![]() .

.

September CPI: Minor Turbulence

The bumpy ride to slower inflation continued in September. Overall consumer prices rose 0.2%, which was a tick higher than the Bloomberg consensus. Despite the somewhat larger-than-expected outturn, prices over the past year are up 2.4%, which marks the lowest one-year change in consumer prices since February 2021.

Consumers received some respite at the pump in September, with gasoline prices falling 4.1% last month. However, grocery store prices picked up sharply, increasing 0.4%. This was the largest monthly gain in nearly two years and was driven by a jump in egg prices (+8.4%) and the relatively volatile food component of fruits & vegetables (+0.9%). Even with September’s jump, prices for food at home have risen 1.3% over the past year, down from a 12-month pace of 2.4% this time last year and a recent peak of 14% in the summer of 2022.

Excluding food and energy prices, core CPI came in at 0.3% (0.31% unrounded). This was modestly higher than we expected. Core goods prices rose 0.2% in the month, halting a six-month streak of deflation for prices in the goods sector. Small increases for prices of new and used vehicles contributed to the move higher, as did a 1.1% increase in apparel prices. Lower prices for medical care goods and recreation goods helped keep the increase in core goods prices in check.

Core services inflation was 0.4% in September (0.36% unrounded), a modest cooldown from the 0.41% pace registered in August. The drivers of services inflation in September were much different from what took place the prior month. Owners’ equivalent rent came in at 0.3% in September, reversing the puzzlingly-strong 0.5% reading in August. Rents rose 0.3%, a tenth slower than September. However, outside primary shelter, services inflation jumped on the back of higher prices for airfares (+3.2%), motor vehicle insurance (+1.2%) and medical care services (+0.7%).

Looking through the month-to-month noise, the underlying trend in core services inflation in recent months seems to have been between 0.3% and 0.4%, about a tenth or so stronger than the monthly pace that prevailed before the pandemic.

Overall core CPI inflation has risen at a 3.1% annualized pace over the past three months, slightly below the year-ago pace (+3.3%) and about a percentage point faster than core CPI inflation in 2019.

The September CPI report is consistent with our view that, while the overall trend in core inflation remains lower, further improvement is likely to be slower-going. The deflationary impulse to goods prices has waned with supply chain pressures no longer receding and inventories largely replenished.

The downdraft to overall inflation from food and energy also has weakened, with the risks to energy costs for the time-being seeming to lie to the upside. However, we look for services inflation to continue to slow as housing inflation eases further and service providers benefit from tamer input cost growth for goods and labor.

While the next leg lower in inflation may take more time, the good news is that with the jobs market remaining in good shape and solid growth in productivity, average hourly earnings growth, up 4.0% over the past year, continues to outpace inflation. Thus, we do not see slower improvement on the inflation front as an impediment to real spending and output.

While today’s inflation report may make some of the more hawkish members of the FOMC somewhat more reluctant to ease monetary policy further at the Committee’s next meeting on November 7, we do not believe it is strong enough to warrant a pause. With inflation continuing to slow on trend and upward pressure on prices dissipating amid a cooler labor market and encouraging trends in productivity, there is still likely scope in the near term for policy to “recalibrate” further.

There are many ways to skin a cat, many more ways to skin a CPI report. Trying to keep it simple:

- The Fed aims at ~2.0% core inflation. On a MoM annualized basis, it was 4.5% in Jan-March, it slipped to 0.7% in June but it has increased every month to reach 3.7% in September.

- Services prices followed the same path, from 6.9% in Jan-March to 1.5% in June and 4.5% in September, roughly the trend in wages (see below).

- The surprise last month was in durables prices, up 1.0% monthly after 15 consecutive monthly declines. Not because of the heavy weights new or used vehicles (+0.2% and 0.3%) but because of several items such as vehicle parts and equipment (0.9%), furniture (1.7%), cookware (5.7%) and jewelry (4.7%).

A monthly aberration? Maybe, but also consider that

- commodity prices ex-energy bottomed in the spring and are up about 15% since.

- Deflation from China may also have reached its worst readings:

Services (64% of CPI and 81% of core-CPI) have re-accelerated to just below 5% and not only because of shelter (+4.7% YoY ).

Services less rent spiked 0.6% MoM in September after being flat for 2 months. Medical care, transportation services, airline fares were the main drivers last month but others were contributors in previous months since wages are the main factor in services inflation.

The Atlanta Fed updated its Wage Growth Tracker yesterday: whether we look at the total, the stayers or the switchers, the 3-m moving average has stabilized just under 5% growth.

In my August 26 Lucky Fed! post I wrote “there is no such thing as an immaculate disinflation. China’s inability to boost its domestic economy deflated imported goods and oil prices which kept inflation expectations anchored. Part of the normalization of the labor market came from surging immigration. The fundamentals of supply/demand normally arising from a “very restrictive monetary policy” have not really materialized just yet.”

I advised to

- Watch China trying to mend its housing mess and boost domestic demand

(it’s seems to be trying harder lately) - Watch oil prices

(up 10% in recent weeks) - Watch the USD

- Watch immigration (elections)

Note also that my CPI-Essentials index (food, energy, shelter) is now up 2.9% YoY from 5.4% one year ago and 4.4% last May. The consumer is in good shape.

John Authers says mission accomplished:

Inflation Is Finally Losing Its Power Over Markets The stubbornness of services still needs grinding down, but the Fed has won this war of attrition.

(…) US inflation has not completed its journey to the Federal Reserve’s target, but it is dull again, and that suggests that much of the Fed’s work is done. (…)

What was so dull? If we break down inflation into its four main components, we find that it’s substantially all about services at this point. That’s been true for a while. Goods prices are deflating, but helped cause some of the disappointment because that’s happening less quickly than earlier in the year:

Simplifying that chart, this is how core services’ contribution to overall inflation compares to all of the index’s other components. The great spike in price rises that came the year after the pandemic was almost comprehensive, and it has run its course. What remains is grinding down the services inflation that followed the rest, and tends to be driven by wages:

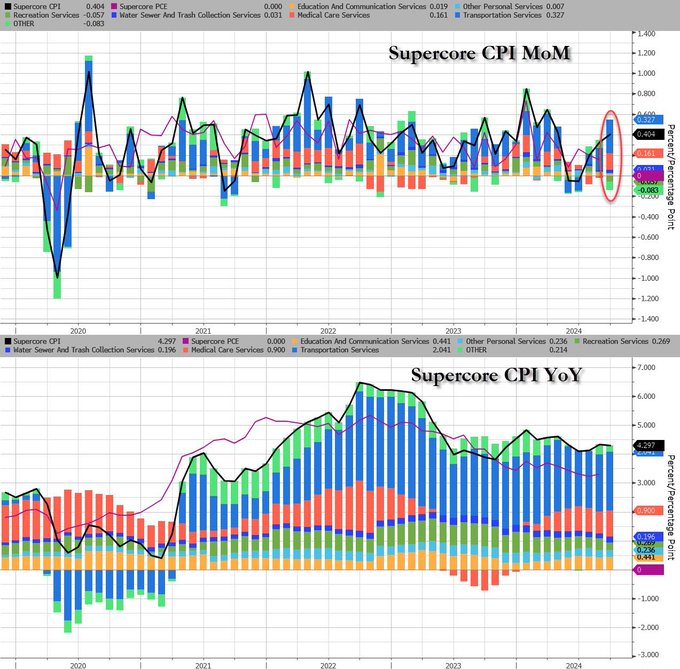

On this front, the Fed’s favored “supercore” measure of inflation, of services excluding shelter prices, has some bad news. It’s ticking up again, and the annual rate remains above 4%. That would make continued jumbo interest rate cuts difficult:

Other measures are more hopeful. The Fed sets great store by the trimmed mean, as calculated by the Cleveland Fed, in which the outliers are stripped out and an average taken of the rest. It’s declining but still a little above 3%. Sticky prices that take a while to change are also falling slowly, and are now at 4%:

If there’s reason for concern, it’s that the period of steep decline seems to be over (and goods prices have even ticked up again), with headline inflation still above 2%. TS Lombard’s Stephen Blitz produces a diffusion index of the proportion of Consumer Price Index components whose three-month average is higher than their 12-month rolling average — a measure of whether the trend is increasing or decreasing. On that basis, it looks like inflation has come to rest at a level that is still too high for comfort: (…)

Hmmm…

Here’s the detailed supercore CPI courtesy of zerohedge:

Remember that supercore conveniently excludes rent which, as Ed Yardeni says is disconcerting:

The waiting game for shelter inflation to fall isn’t going as planned. We still expect shelter CPI inflation to decline as price increases for new market rentals slowed. But the recent upticks in the 3-month annualized rates are disconcerting.

US Jobless Claims Soar to Year High, Hit by Helene and Auto Cuts Initial filings rose by 33,000 to 258,000 in the latest week

On an unadjusted basis, more than half of the advance was tied to states affected by Helene, including North Carolina and Florida.

Michigan, home to a number of auto assembly plants, led all states with a nearly 9,500 increase in applications — the most since the first week of July. (…)

The jobless claims data are likely in for stretch of volatility in the wake of hurricanes Helene and Milton, which landed in Florida on Wednesday night, complicating efforts by the Federal Reserve to accurately gauge underlying developments in the US labor market. While many people in the southeastern US are unable to work because of the storms’ destruction, some may also have difficulty or delay applying for unemployment benefits. (…)

“The hurricane influence is not unusual for this time of year, but the scope of Helene’s destruction points to a heavy and prolonged bulge in initial claims,” he said. (…)

Three Fed Officials Shrug Off CPI Report, Bostic Open to Pause NY Fed’s Williams says appropriate to continue moving rates

Three Federal Reserve policymakers on Thursday were unfazed by a higher-than-forecast September inflation report, suggesting the US central bank can continue lowering interest rates, but a fourth hinted he may favor a pause at their next meeting.

“Month to month, there’s wiggles and bumps in the data, but we’ve seen this pretty steady process of inflation moving” downward, New York Fed President John Williams said during an event at Binghamton University. “I expect that that will continue.”

Bank of Chicago President Austan Goolsbee, in an interview on CNBC, said “the overall trend” for inflation over 12 to 18 months was clearly moving down. His counterpart from the Richmond Fed, Thomas Barkin, said inflation was “definitely headed in the right direction.” (…)