Pandemic Savings Are Gone: What’s Next for U.S. Consumers?

From the San Fran Fed:

The latest estimates of overall pandemic excess savings remaining in the U.S. economy have turned negative, suggesting that American households fully spent their pandemic-era savings as of March 2024. However, consumer spending has remained strong in recent months, which raises an important question: What’s next? (…)

Cumulative pandemic-era excess savings

Note: Excess savings calculated as the accumulated difference in actual de-annualized personal savings and the trend implied by data for the 48 months leading up to the first month of the 2020 recession as defined by the National Bureau of Economic Research.

Source: Bureau of Economic Analysis and authors’ calculations.Consumers could use their non-pandemic-related savings as another source of funding for their household consumption. Many households saw notable gains in their equity and other asset holdings over the past year (Abdelrahman, Oliveria, and Shapiro 2024). Also, households across the income distribution now own notably more nonfinancial assets, such as real estate holdings and vehicles, relative to pre-pandemic levels, according to Distributional Financial Accounts data from the Federal Reserve Board. To the extent that households are able to access funding from these less liquid assets, consumer spending could continue at a robust pace going forward. Finally, consumers could use debt—such as credit cards and personal loans—to further support their current spending habits, although the current elevated interest rate environment means that the cost of using credit is higher than in the decade preceding the pandemic recession. (…)

Recall that retail sales have been choppy this year. January was very weak, bad weather. February bounced back, good weather, but really only made up for January. March? Did the early Easter and the Amazon sale create the illusion of strength?

Bank of America’s data confirm my contention that March retail demand was not as strong as generally thought after March’s release (Roaring Lion???). It also looks like services were also on the weak side in March.

In fact, on a seasonally adjusted (SA) basis, total card spending per household fell 0.7% month-over-month (MoM) in March, following the 0.4% rise in February.

Spending on services fell 1.1% MoM SA in March, with weakness in both lodging and restaurant spending, while retail spending (excluding restaurants) decreased by 0.3% MoM.

Employment growth needs to be sustained.

U.S. Jobs Growth Set to Slow, Conference Board Says Conference Board’s employment trends index fell to 111.25 in April

U.S. jobs growth could stall in the second half of 2024, with signs of a slowing labor market, according to monthly gauge of employment trends

The Conference Board’s employment trends index fell to 111.25 in April from a downwardly revised 112.16 in March, the private-research group said Monday.

“The labor market is beginning to show signs of cooling following a period of very strong growth since the pandemic recession,” said Will Baltrus, associate economist at The Conference Board.

However, substantial job losses are unlikely to occur over the coming months, as employers are still facing labor shortages, Baltrus said. (…)

The eight leading indicators of employment aggregated into the Employment Trends Index include:

- Percentage of Respondents Who Say They Find “Jobs Hard to Get” (The Conference Board Consumer Confidence Survey®)

- Initial Claims for Unemployment Insurance (U.S. Department of Labor)

- Percentage of Firms with Positions Not Able to Fill Right Now (© National Federation of Independent Business Research Foundation)

- Number of Employees Hired by the Temporary-Help Industry (U.S. Bureau of Labor Statistics)

- Ratio of Involuntarily Part-time to All Part-time Workers (BLS)

- Job Openings (BLS)*

- Industrial Production (Federal Reserve Board)

- Real Manufacturing and Trade Sales (U.S. Bureau of Economic Analysis)**

*Statistical imputation for the recent month

**Statistical imputation for two most recent months

In red are the indicators that declined in April. Orange is more appropriate for Job Openings because Indeed Job Postings are down again in April and for Industrial Production, up in February and March but going downward since September 2023. Manufacturing and trade sales also seem to have peaked in December.

I find it very odd that 2 of the 8 indicators are “goods” sensitive and none measures service providers which procure 86% of all jobs in the U.S.. The Conf. Board should modernize its ETI and LEI indicators.

As shown yesterday, April’s PMIs revealed a rare drop in services employment.

That said, we may be defying gravity:

US banks report weaker loan demand, Fed survey says

U.S. banks reported renewed weakening in demand for industrial loans and a decline in household demand for credit in the first quarter of the year, according to a Federal Reserve survey of senior loan officers published on Monday.

The net share of large and medium-sized banks reporting tightening standards for commercial and industrial loans ticked up to 15.6%, from 14.5%, the survey showed. A rising share of banks reported weaker demand for C&I loans.

For commercial real estate loans of all types, however, the share of banks tightening standards shrank to the lowest in two years. A declining share reported weaker demand for CRE loans; foreign banks reported an overall rise in demand for CRE loans.

For households, a rising share of banks reported tightening standards for auto loans, while a shrinking share of banks did so for credit cards and other types of consumer loans, the survey showed.

Household loan demand deteriorated across all categories, the survey showed, with demand for auto loans at its weakest in a year.

CPI-New vehicles is up 20% since 2019, Sales are down 5% and flat since June 2023.

China Offers Cash for Urban Revamp, Testing New Ways to Boost Growth

China will hand out billions of yuan to help cities renovate run-down public buildings and upgrade infrastructure, as policymakers seek ways to inject life into an economy weighed down by a housing slump.

Fifteen qualified cities can get as much as 1.2 billion yuan ($166 million) each, the Ministry of Finance said in a statement late Monday. The money will go to improve pipelines, power networks or drainage systems, and to overhaul public buildings and ensure they’re accessible for children and older people, it said. The program is due to last for three years.

Urban renovation, along with affordable housing and multi-functional infrastructure, is one of Beijing’s “three major projects” seen as key to offsetting a property slump that has dragged consumer confidence down. The People’s Bank of China said last year it’s ready to back them with 500 billion yuan in loans.

The Ministry’s statement offers rare details about the magnitude of direct government funding for the projects, which will likely start on a trial basis and then potentially get rolled out more broadly. (…)

The statement also suggests China will increase the role of fiscal policy, in coordination with monetary easing, to help finance the three major projects in a more sustainable way, Pang said.

China’s Thrifty Travelers Show Consumer Confidence Is Weak

Travelers made 28.2% more trips but spending only rose 13.5% from the 2019 break, the Ministry of Culture and Tourism said in a statement Monday. This translates to a 11.5% drop in spending for each traveler over the holiday ending Sunday, according to banks including Societe Generale, Goldman Sachs Group Inc. and Citigroup Inc.

“Spending per head softened and was again below the pre-pandemic level, owing partly to more tourist flows towards lower-tier cities, and suggesting continued consumption downgrading,” said Goldman economists including Lisheng Wang in a note late Monday, adding that more policy support is needed to sustain the recovery of the services sector. The 2019 holiday was one day shorter. (…)

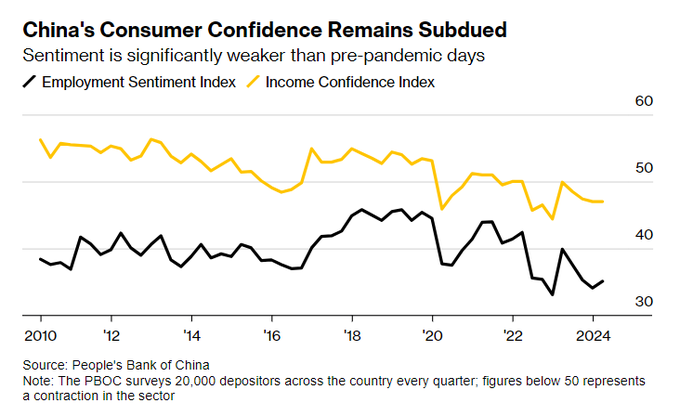

Less than one in four residents wanted to spend more while an growing share of the urban population wanted to save in the first quarter, according to a survey by the People’s Bank of China. (…)

While big cities like Beijing and Shanghai remained popular, many more opted for cheaper destinations and small towns, online travel agency Trip.com Group said in a Sunday statement. (…)

Bookings for hotels and tourist spots in tier-3 or lower-ranked cities in the country’s northwest and west more than doubled during the break from the same period a year earlier, according to data released by Tongcheng Travel Holdings, another tourism agency. (…)

Global Bond Rally Faces Supply Test as US Refunding Kicks Off

The global bond rally ignited by hopes of lower interest rates in the US will face its first big test on Tuesday, with the Treasury starting sales that will total $125 billion this week.

Investors who have been piling into bonds since Federal Reserve Chair Jerome Powell struck a less-hawkish-than-feared tone last week will have to absorb $58 billion in three-year Treasuries on Tuesday as part of the so-called quarterly refunding auctions. A combined $67 billion of 10- and 30-year Treasury securities will come later this week. (…)

The continuation of the rally hinges on upcoming economic data and next week’s US inflation report for April is the most important market driver. While there are signs of deceleration in some areas of the US economy, inflation remains sticky — a reality that may limit what the central bank can do and means bond yields are likely stuck in their recent ranges. (…)

Amundi, Pictet Lead Contrarian Wave to US Stock Exceptionalism

To some investors, the US exceptionalism that’s fueled the record-breaking rally on Wall Street has run its course.

Despite resilient consumption and artificial intelligence optimism, US economic growth slid to an almost two-year low last quarter while inflation stayed high. Confidence is starting to waver, with the S&P 500 Index ending a five-month winning streak in April following a series of major earnings misses.

These are signs that playbooks founded on expectations that the world’s No. 1 economy and its companies will outdo others even with higher rates are flawed, according to contrarians including Pictet Asset Management and Amundi SA. Instead, there are better opportunities in Europe and Asia, given more benign valuations and inflation outlooks, they said.

US exceptionalism “is overrated,” said Luca Paolini, chief strategist at Pictet. “There’s probably too much optimism about the US in terms of growth and too much pessimism about the rest of the world.” (…)

Last week, BofA’s Michael Hartnett also called the coming end of U.S. exceptionalism. I discussed that on February 21: American Exceptionalism: Don’t Extrapolate