Happy and Healthy New Year

Also posted today: THE RULE OF 20 STRATEGY GOES ALL CASH

U.S. Durable Goods Orders Dragged Down by Defense Aircraft in November

The advance reading for November indicated that durable goods orders fell 2.0% m/m (-3.7% y/y) following a 0.2% m/m rise in October, revised down from 0.6%. A 1.5% increase had been expected in the Action Economics Forecast Survey. The primary cause for the unexpected outsized decline was a 72.7% m/m collapse in orders for defense aircraft, which led to a 38.2% m/m drop in overall defense orders. Orders excluding defense rose 0.8% m/m in November following an unchanged reading in October. So, apart from weakness in defense, the report was not as weak as the headline decline indicated.

Orders for nondefense capital goods excluding aircraft, a key indicator of business investment plans, edged up 0.1% m/m (0.5% y/y) in November on top of a 1.1% m/m jump in October. Shipments of nondefense capital goods excluding aircraft, a good indicator of current business spending on equipment, fell 0.3% m/m after a downwardly revised 0.7% m/m gain in October. The October/November average of core capital goods shipments is about unchanged from the Q3 average, auguring about unchanged business spending on equipment in Q4 in the NIPAs, but this would be much better than the 3.8% q/q saar decline reported in Q3.

While the collapse in defense aircraft orders dragged down the overall transportation category (-5.9% m/m), orders for motor vehicles and parts actually rebounded, rising 1.9% m/m in November, reflecting the resolution of the GM strike, after having declined significantly each of the previous three months. (…)

No growth in over 20 years…

No growth in the last 5 months, nor the last 8 months…

Normally we exclude volatile aircrafts from this series but Boeing’s problems will reverberate throughout the manufacturing and service sectors in 2020.

Chicago-based Boeing plays a big role in the U.S. economy: It is the largest U.S. manufacturing exporter and one of the nation’s top private employers. And the MAX is its best-selling plane.

The plane maker employs around 12,000 workers at its 737 assembly plant in Renton, Wash. Production of the 737 MAX also supports thousands of jobs across a network of over 600 suppliers and hundreds of other smaller firms in the global MAX supply chain. (…)

Many suppliers had said they favored Boeing maintaining some production, citing the risk of losing workers in a tight labor market during a halt. They said furloughing staff and stopping machinery would be harder than lowering production, and that restarting assembly lines would be costly. (…)

The grounding has also caused problems for airlines that operate the MAX. Carriers around the world have pared routes, paused expansion and canceled thousands of flights they had planned to operate with the grounded aircraft. (…)

U.S. Initial Claims for Unemployment Insurance Fell by 13,000

But the 4-w moving average is, once again, bumping against the upper side of its 2-year range.

Workers Get Bigger Raises as Labor Market Tightens Wages for the typical worker—nonsupervisory employees who account for 82% of the workforce—are rising at the fastest rate in more than a decade, a sign that the labor market has tightened.

(…) Pay for the bottom 25% of wage earners rose 4.5% in November from a year earlier, according to the Federal Reserve Bank of Atlanta. Wages for the top 25% of earners rose 2.9%. Similarly, the Atlanta Fed found wages for low-skilled workers have accelerated since early 2018, and last month matched the pace of high-skill workers for the first time since 2010. (…)

Twenty-nine states have increased minimum wages above the federal level, and 21 of those will lift the level again in 2020. (…)

U.S. New Home Sales Gain in November, but from Revised Lower Levels

Sales of new single-family homes increased 1.3% m/m (+16.9% y/y) in November to 719,000 units SAAR. However, the November gain comes from levels that were revised sharply lower in both September and October. September sales were revised from 738,000 to 730,000 and October sales were revised from 733,000 to 710,000. The Action Economics survey had expected sales of 735,000 in November. So, even though sales increased in November, the marked downward revisions meant that November sales were well below expectations.

Although interpretation of this month’s reading has been influenced by the downward revisions, there is no mistaking the surge in new home sales over the past year. (…)

Germany Calls for European Firewall Against U.S. Sanctions German politicians have called on Europe to adopt protective measures against U.S. sanctions after Washington managed to halt completion of a new submarine gas pipeline linking Russia directly to Germany.

The bipartisan U.S. move initiated by Congress last week threatened sanctions against companies working on completing Nord Stream 2, Europe’s biggest energy-infrastructure project, which the U.S. and some European countries fear could give Russia some control over the continent’s energy supplies and boost revenues for an increasingly belligerent Kremlin.

The move prompted Swiss pipe-laying company Allseas Group S.A. to stop work on the $10 billion pipeline, just weeks from completion. The pipe would double direct gas shipments to Germany by Russian’s state-owned gas giant PAO Gazprom. (…)

Some German officials say that fortifying Europe’s defenses against U.S. sanctions could require closer cooperation with Russia and China at a time when President Trump is pressuring EU allies to side with Washington in its trade, technology and geopolitical disputes with Beijing.

Others questioned Washington’s motivations, saying that the sanctions were driven by the desire to increase exports of American liquefied natural gas, or LNG. (…)

One goal would be to create a separate financial infrastructure that would allow European companies to escape the scope of U.S. sanctions. The banks involved would have to be based in jurisdictions out of the U.S.’s reach, such as China or possibly Russia, the official said.

“Washington is treating the EU as an adversary. It is dealing the same way with Mexico, Canada, and with allies in Asia. This policy will provoke counter-reactions across the world,†this official said.

Some European officials have even toyed with the idea of adopting sanctions of their own against the U.S., for instance to deter policies they think endanger the environment. (…)

Russia, China and Iran launch Gulf of Oman war games US rivals project increased Middle East influence with first joint naval exercises

EARNINGS WATCH

Nothing new on the S&P 500 universe except that trailing EPS were revised down a little to $163.78.

However, we started to see results from some early Q4 reporters. As of December 24, 17 Russell 1000 companies had reported: the beat rate was 88% and the surprise factor was +4.1%.

TECHNICALS WATCH

Lowry’s Research’s analysis remains very positive “consistent with the

strongest phase of a bull market.†It says demand is expanding in a fashion symmetric to the decline in supply. “Historically, the strongest market

rallies have shown a balanced expansion in

Demand and contraction in Supply.†Lowry’s also notes that strong market breadth continues to record new

highs “displaying few signs of ageâ€.

SENTIMENT WATCH

Sentiment drives excesses and we seem to be in that phase where the no-recession scenario, the “end†of the trade war, and a sidelined Fed are creating strong expectations of positive economic and financial environments. This is reflected in Lowry’s technical analysis (strong, broad demand vs low supply) and rising P/Es as investors are more than willing to value equities on forward potential earnings.

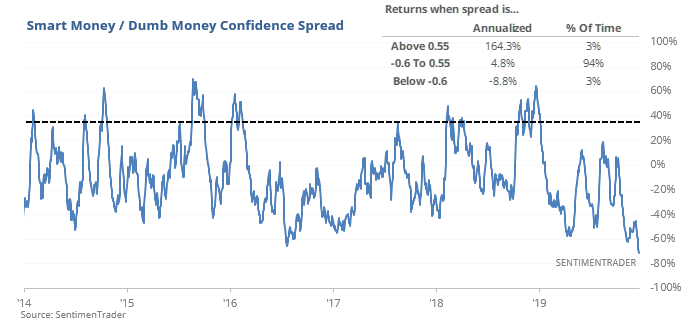

SentimenTrader points out that “the spread between Smart and Dumb Money Confidence widened further, stretching to a threshold rarely achieved in the past 20 years.

The spread got this wide in the initial investor euphoria exiting the 2001-02 bear market. But the idea that our current environment is anything like May 2003 is highly questionable, so it’s not unreasonable to discount that signal’s positive future returns. The other times this happened, the S&P 500 showed minimal (and only temporary) gains versus higher-than-average risk over the short- to medium-term.

Jason also notes that the Equity Put/Call ratio “has been pushed to its lowest level since June 2014, as “more than twice as many call options were traded than put options.â€

When the equity Put/Call ratio made a 1 year low, the S&P’s returns over the next 1-3 months were quite poor.

As one would expect if stock returns were poor, the VIX “fear gauge” almost always spiked 1 month after these events. The only case in which VIX did not spike was last December, after VIX had already surged. Today, volatility has been subdued for a long time.

Meanwhile, there are other noteworthy signs:

-

Leveraged-Loan Downgrades Signal Financial Cracks Downgrades on U.S. leveraged loans in sectors including health care are picking up, a sign of fragility in the booming corporate debt market.

The ratio of downgrades to upgrades in the S&P/LSTA Leveraged Loan Index rose in the 12 months through September to nearly 3 to 1—the highest reading since 2009. A total of 282 issuers were downgraded from the beginning of January through Oct. 11, up from 244 in all of 2018 and 33 in 2017, according to LCD, a unit of S&P Global Market Intelligence. (…)

A recent report by the Financial Stability Board, an international watchdog, warned of risks to the global financial system posed by leveraged loans, citing the lower quality of corporate debt and changes in loan documentation.

The Financial Stability Board, whose chairman is Federal Reserve Vice Chairman Randal K. Quarles, said that such changes in documentation, which weaken creditor protection, isn’t fully priced in by investors and could increase default rates, reverberating through credit markets.

-

Investors Push Tech Startups for Profits, Not Just Customers The discounts and freebies many tech startups have used to lure customers have fallen out of favor as investors lose patience with failure to turn a profit.

(…) Following a year of dismal performances from companies that were heavily subsidized by venture capital, investors and board members are pressuring companies to figure out a more profitable business model, tech deal makers and startup founders say.

Investors want startups to become less dependent on raised capital to cover the cost of customer discounts, such as e-commerce startup Brandless Inc. selling home and beauty products for a fraction of the cost of shipping, ride-hailing companies Uber Technologies Inc. and Lyft Inc. discounting the cost of their rides, and meal-delivery service Postmates Inc. offering coupons for $100 off delivery fees. (…)

Many companies in the transportation and delivery sectors used billions of dollars in venture capital to subsidize their businesses. They now face pressure to prove their business model is profitable and can survive without the help of outside investment. (…)

Adding more customers to an already-unprofitable business model doesn’t mean profit suddenly appears. (…)