Powell: Fed Will ‘Proceed Carefully’ on Any Rate Rises

Federal Reserve Chair Jerome Powell argued for holding interest rates steady for now, but he kept the door open to raising them later this year if the economy doesn’t slow enough to keep inflation declining. (…)

Powell twice said the Fed would “proceed carefully” in any further move, signaling he saw little urgency to raise rates at the central bank’s next policy meeting in September.

“Given how far we have come, at coming meetings we are in a position to proceed carefully,” as officials “decide whether to tighten further or, instead, to hold the policy rate constant and await further data,” he said in delicately scripted remarks.

Powell noted recent signs the economy might not be slowing as officials expect. (…)

Powell said additional evidence that the economy might instead grow above that trend rate “could put further progress on inflation at risk and could warrant further tightening of monetary policy.”

In June, most officials thought they would raise rates to a range between 5.5% and 5.75% this year, implying one more quarter-point increase later this year.

Some officials are uneasy about raising rates further because they expect past increases will continue to weaken the economy by making it more expensive and harder for companies and individuals to borrow. Others worry that strong economic growth could cause inflation to decline more slowly than anticipated if the Fed doesn’t respond by raising rates again.

Powell nodded to both concerns in his remarks. Financial conditions, including lending standards and borrowing rates, have tightened broadly in a way that typically slows down economic activity. Labor market imbalances have eased.

Powell sounded “like a man who thinks he is probably done raising rates and sees a stern tone as providing hawkish air cover for shifting gradually” to a strategy of holding rates at current levels as inflation declines, said Krishna Guha, vice chairman of Evercore ISI.

At the same time, Powell indicated “he is serious about not giving up the extra hike option now given the growth bounce,” he said. (…)

After this speech, investors in interest-rate futures markets saw a nearly 20% chance that the Fed would raise rates at its next meeting, but the probability of an increase in either of the central bank’s decisions in November and December edged up to around 50%, according to CME Group. (…)

“Two months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal,” Powell said. “There is substantial further ground to cover.” (…)

He explicitly rejected any idea that the Fed would change its 2% inflation target.

Christine Lagarde, president of the European Central Bank, similarly repudiated any talk of changing its inflation target during a discussion Friday afternoon. (…)

Powell acknowledged uncertainty about just how high rates needed to rise to provide enough economic restraint. Inflation-adjusted interest rates have risen to historically high levels, putting them “well above mainstream estimates” of the so-called neutral rate that neither spurs nor slows economic activity, Powell said.

“But we cannot identify with certainty the neutral rate of interest, and thus there is always uncertainty about the precise level of monetary policy restraint,” he said. (…)

Goldman Sachs explains “careful”:

After avoiding the language in the July press conference, Powell once again argued that the FOMC should “proceed carefully” when deciding whether to hike or hold the policy rate constant at future meetings. When “careful” was introduced at the June meeting, it was widely taken to mean that the FOMC envisioned hiking at an every-other-meeting pace, and we take its revival today to mean that the FOMC does not intend to hike at the September meeting.

Some FOMC members worry that “past increases will continue to weaken the economy” (the “lags”), but Mr. Powell, still very focused on winning the inflation battle, errs on being careful about inflation vs about the economy, noting that

- The FOMC is “attentive to signs that the economy may not be cooling as expected.”

- “The housing sector is showing signs of picking back up.”

- “Evidence that the tightness in the labor market is no longer easing could also call for a monetary policy response.”

- “Additional evidence of persistently above-trend growth could put further progress on inflation at risk and could warrant further tightening of monetary policy.”

- “Although inflation has moved down from its peak—a welcome development—it remains too high,”

- “We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

- “Two percent is and will remain our inflation target.”

Ed Yardeni sums it up nicely: Powell “said that the policy options were either high-for-longer or higher-for-longer interest rates.”

About those increasingly lagging lags, the Fed’s staff published a piece on June 30, A New Index to Measure U.S. Financial Conditions (my emphasis):

While existing FCIs typically measure whether financial conditions are tight or loose relative to their historical distributions, the new index assesses the extent to which financial conditions pose headwinds or tailwinds to economic activity. Another important difference of this new index, compared with other commonly used FCIs, is its explicit consideration of the lags through which changes in financial variables are estimated to affect future economic activity. In the models used to construct the FCI-G, past changes typically receive decreasing weights, reflecting the diminishing effects that changes in financial variables have on economic activity over time.

As changes in financial variables work their way through the economy with lags, we use a lookback window—the length of the period over which past changes in financial variables are included in the calculation of the index—of either one or three years. Depending on the lookback window, more distant changes in financial variables drop out from the computation of the index after either one or three years.

This chart shows the FCI-G (black line), a headwind to growth since August 22 as rising interest rates more than offset rising house and equity values.

Financial Conditions Impulse on Growth Components

Source: Haver Analytics; Authors’ calculations

I do not have the time nor the capabilities to fully analyse the FCI-G but I humbly offer the following observations:

- The FCI-G currently shows that the wealth effect (housing, equities) remains positive (even more so since May) but is graphically overwhelmed by rising interest rates (also even more so since May).

- Much uncertainty lies in the relative weight/impact of wealth vs the various costs of funds on the economy at any point in time. One can argue that relatively less leveraged individuals and corporates can make higher financing costs relatively less potent.

- The current cycle is arguably atypical following a decade of Fed QEs with zero interest rates. As a result, rising rates did not have their “normal” effects on the housing/construction markets, quite the opposite.

- Furthermore, I can argue that the wealth effect from rising housing values actually increases along with interest rates since more of the 90% of homeowners with mortgages below 5% (71% below 4%) will elect to stay put the higher mortgage rates are. Because of these “mortgage handcuffs”, existing home inventory keeps falling (it is down 14.6% YoY in July), supporting prices and boosting the new housing market. Nineteen months of rising mortgage rates (+4.2% to 7.2%) did not prevent new one-family house sales to jump 31% in the past year, back to their pre-pandemic level.

- “Excess savings”, a measure of wealth, should be factored in. The FCI-G would have been lower, perhaps much lower, during the past 12 months.

This new Fed measure of monetary policy potency could prove an illusion as the side effects of a decade of QE experiments (conveniently dubbed “lags”) materialize and prevent overall demand from declining as much as needed to contain inflation.

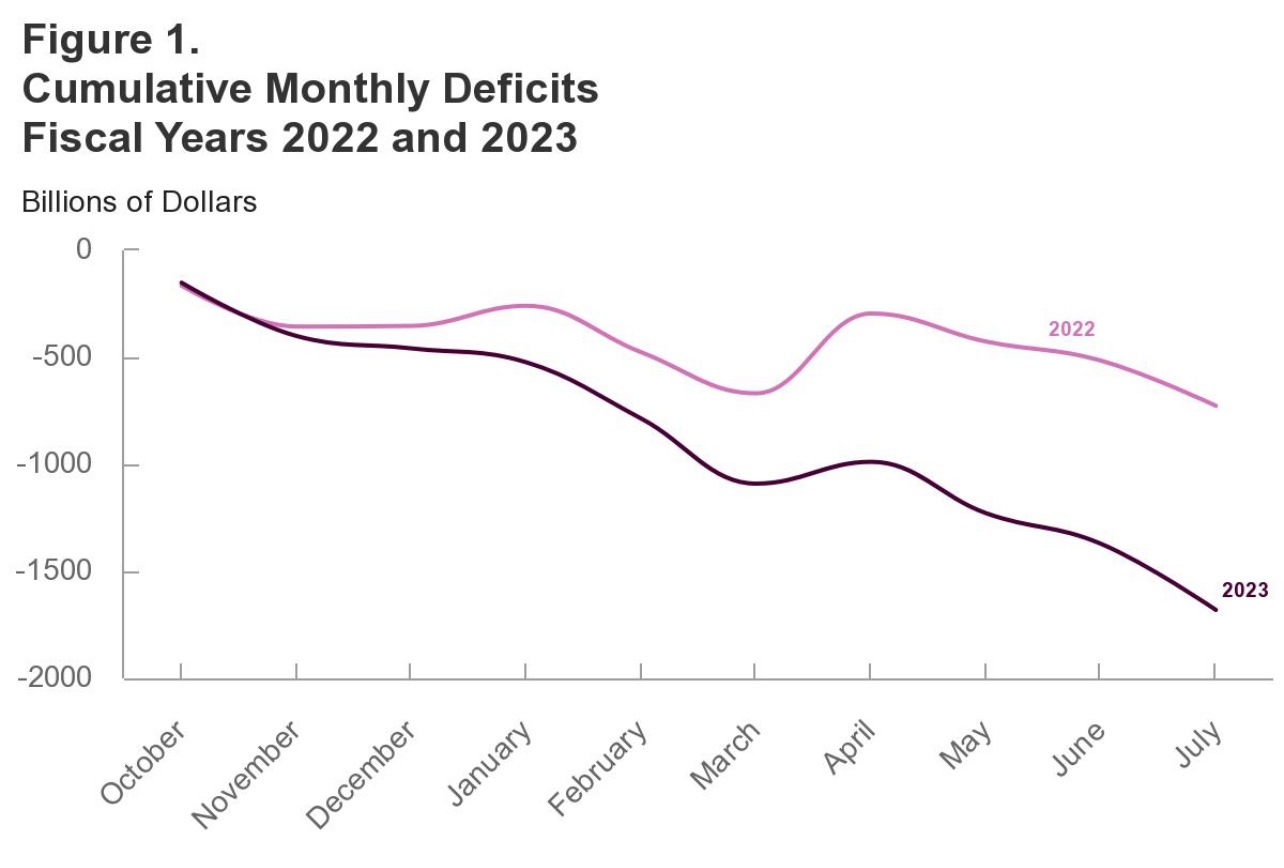

Insert other demand boosters such as enormous budget deficits and world-wide environmental investments and one must hope that the immaculate disinflation continues (btw, oil prices were down 43% during the 12 months to June, they’re up 21% since) or that productivity rises sustainably. That would allow the FOMC to tolerate the ever lagging lags.

Source: @USCBO monthly budget review (@paulwinfree)

(…) “My best guess would be that we’re going to need more interest-rate increasing” by the Fed, Summers said on Bloomberg Television’s Wall Street Week with David Westin. There’s not much economic slowing “in the pipeline” at this point, with some estimates suggesting a growth rate in excess of 5% this quarter, he said. (…)

He added that Powell’s remarks suggest the Fed is open to the possibility that the neutral interest rate — the level that neither stimulates nor restricts the economy — could be higher than it’s been. (…)

While not explicitly recognizing the neutral rate is higher, Powell “noted that growth was much faster than many people expected, given how high interest rates have been pushed,” said Summers, a Harvard University professor and paid contributor to Bloomberg TV. “I think it will reinforce the growing sense in markets” that the Fed is now regaining its inflation-fighting credibility, he said. (…)

“My guess is that you may see the fed funds rate have to go up once, or even more than that, over the next few few months,” Summers said, referring to the Fed’s benchmark rate.

Summers also said he would have preferred to see Powell do more to recognize the implications of “the nation’s problematic fiscal posture” for monetary policy.

“Substantially enlarged government budget deficits mean substantially more absorption of saving” and a boost to demand, he said. “And all of that means that the neutral interest rate is increased — and is increased now, and in the future.”

The US Treasury said earlier this month it expects to borrow a net $1 trillion this quarter, with prospects for increasing issuance of longer-dated securities in coming quarters.

Summers highlighted that this increase in supply is occurring alongside the Fed’s continuing shrinkage of its own holdings of Treasuries, via its so-called quantitative tightening program. Another factor is the potential for diminished foreign demand for US government debt, he said, especially from Japan, which is now considering its own potential shift away from monetary easing.

The former Treasury chief reiterated his view that “I’d expect the 10-year rate to settle someplace above its current level over the next few years.”

- Big Deficits Risk Mounting Treasuries Stress: Jackson Hole Paper Finds Stanford expert urges moves to boost market resilience

(…) The main challenge is that the capacity of the primary dealers in US Treasuries to serve as intermediaries between buyers and sellers hasn’t grown in step with the size of the overall market. In times of extreme stress, such as in March 2020, that leaves the market in danger of freezing up. (…)

“The quantity of Treasury securities that investors may wish to liquidate in a crisis is growing far more rapidly than the size of dealer balance sheets,” Duffie warned. Risks stemming from dealers’ limited intermediation capacity include “losses of market efficiency, higher costs for financing US deficits, potential losses of financial stability, and reduced save-haven services to investors,” he wrote. (…)

One continuing constraint on dealers, which include the nation’s largest banks, is the so-called supplementary leverage ratio rule — which compels financial institutions to hold capital against their portfolios, including inventories of Treasuries.

“The resilience of the US Treasury market is limited by dealer balance sheets that are not sufficiently large and flexible to effectively intermediate this market in a ‘dash for cash,’ as when Covid” hit in spring 2020, he wrote. “The total amount of Treasuries outstanding will continue to grow significantly relative to the intermediation capacity of the market because of large US fiscal deficits and limited dealer balance-sheet flexibility” unless changes are made, Duffie said.

Having more Treasury trades centrally cleared would ensure buyers and sellers would no longer be “exposed” to each other, a change that could improve financial stability. The approach also helps dealers use their balance sheets more efficiently, Duffie wrote. (…)

Auto Union Boss Wants 46% Raise, 32-Hour Work Week in ‘War’ Against Detroit Carmakers The days of settling for lesser contracts ‘are over,’ he says.

U.S. Consumers Are Showing Signs of Stress, Retailers Say Consumer spending remains resilient, but retailers’ latest earnings offered a glimpse into worrying shifts in shopping habits

(…) “It is clear that the lower-income shopper, our core customer, is still under significant economic pressure,” Michael O’Sullivan, the chief executive of the off-price retailer Burlington Stores, said in a statement on Thursday. (…)

In calls with Wall Street analysts this week, retail executives also flagged rising credit card delinquencies and higher rates of retail theft, ominous signs that consumers could be more strapped for cash.

Jeff Gennette, the chief executive of Macy’s, the largest department store in the United States, said shoppers had “more aggressively pulled back” on spending in the discretionary categories, resulting in an overall decline in sales last quarter. Half of Macy’s shoppers make $75,000 or less. (…)

“Probably the most important thing people are spending money on is general merchandise,” said Max Levchin, the chief executive of Affirm, which extends credit to shoppers at checkout via a so-called buy-now, pay-later model. “People are looking for more value for less money, or simpler functionality and lower price,” he said.

The company reported an 18 percent rise in active customers from a year earlier.

(…) Foot Locker reported a sales decline of nearly 10 percent for the quarter, it also cut its forecast for 2023 earnings for the second time this year, citing “ongoing consumer softness.” (…)

If you are a large bank, your delinquency rate on CC has just gone above its pre-pandemic level but is still 45% lower than in 2007. But if you are a small bank, you are clearly in trouble…

… even more so since your CC loan balances are 25% above 2019 vs 17% for larger banks. Small banks represent only 19% of all CC loans but they are already bleeding with charge off rates, 8.5% in Q2, above previous recessionary levels.

Large banks charged off 3.0% of their CC loans in Q2, below 2019 (3.7%) and below 2007 (4.3%).

China’s Worsening Economic Slowdown Is Rippling Across the Globe Asian economies are taking biggest hit to trade so far

(…) Caterpillar Inc. says Chinese demand for machines used on building sites is worse than previously thought. (…)

Asian economies are taking the biggest hit to their trade so far, along with countries in Africa. Japan reported its first drop in exports in more than two years in July after China cut back on purchases of cars and chips. Central bankers from South Korea and Thailand last week cited China’s weak recovery for downgrades to their growth forecasts. (…)

China’s slowdown will drag down global oil prices, and deflation in the country means the prices of goods being shipped around the world are falling. That’s a benefit to countries like the US and UK still battling high inflation. (…)

An analysis from the International Monetary Fund shows how much is at stake: when China’s growth rate rises by 1 percentage point, global expansion is boosted by about 0.3 percentage points. (…)

The value of Chinese imports has fallen for nine of the last 10 months as demand retreats from the record highs set during the pandemic. The value of shipments from Africa, Asia and North America were all lower in July than they were a year ago.

Africa and Asia have been the hardest hit, with the value of imports down more than 14% in the first seven months this year. Part of that is due to a drop in demand for electronics parts from South Korea and Taiwan, while falling prices of commodities such as fossil fuels are also hitting the value of goods shipped to China.

So far, the actual volume of commodities such as iron or copper ore sent to China has held up. But if the slowdown continues, shipments could be impacted, which would affect miners in Australia, South America and elsewhere around the world. (…)

Economists at Wells Fargo & Co. estimate that a ‘hard landing’ in China — which they define as a 12.5% divergence from its trend growth — would cut the baseline forecast for US consumer inflation in 2025 by 0.7 percentage points to 1.4%. (..)

The pandemic and weak economy have curbed incomes in China, while the years-long housing market slump means homeowners feel less wealthy than before. That suggests it may take a long time for overseas travel to rebound to the levels they were at before the pandemic, hitting tourism-dependent nations in Southeast Asia such as Thailand.

China’s economic woes have pushed the currency down more than 5% against the dollar this year, with the yuan close to breaching the 7.3 mark this month. (…)

The depreciation in the offshore yuan is having a greater impact on its peers in Asia, Latin America and the Central and Eastern Europe bloc, Bloomberg data show, with the correlation of the Chinese currency to some others rising.

The weak sentiment spillover may weigh on currencies like the Singapore dollar, Thai baht, and Mexican peso as correlations rise, according to Barclays Bank Plc. (…)

The Australian dollar, which often trades as a proxy for China, has lost more than 3% this quarter, the worst performer in the Group-of-10 basket. (…)

Companies from Nike Inc. to Caterpillar have reported a hit to their earnings from China’s slowdown. An MSCI index that tracks global companies with the biggest exposure to China has retreated 9.3% this month, nearly double the decline in the broader gauge of world stocks. (…

Luxury goods firms such as Louis Vuitton bags-maker LVMH, Gucci-owner Kering SA and Hermes International are particularly vulnerable to any wobbles in Chinese demand.

But its the domestic demand that currently matters most:

INFLATION WATCH

(…) So when dozens of container ships began backing up outside the canal recently, the result of a drought so fierce that water levels have plunged to dangerously low levels, it got the attention of traders on Wall Street. (…)

“The problem is that there’s no short-term solution — unless mother nature helps, and water levels rise,” said Fernando Losada, a managing director for fixed income at Oppenheimer & Co. “They can fix it with investment and infrastructure but it’s going to take time and it will weigh on the economy in the meantime.” (…)

The lake has long been suffering with erratic rainfall in what is normally one of the world’s wettest countries. Now, an El Nino weather pattern threatens to further reduce water levels.

The canal authority has restricted the number of ships that can cross to about 32 and forced those that are allowed to enter to reduce their drafts, meaning they take less cargo. Typically about 38 vessels navigate it daily, according to the canal authority. (…)

Delayed shipments = goods shortages, higher costs, higher prices.

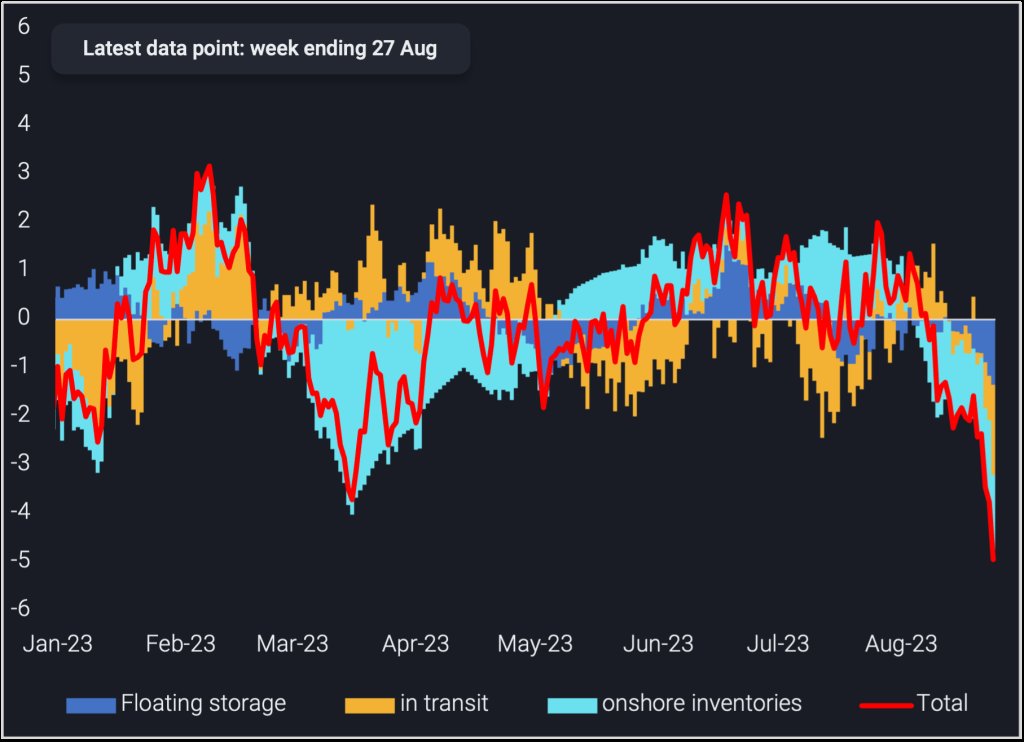

- On- and offshore crude oil inventory drop reflects fundamental market tightening (@staunovo)

As of August the implied crude shortfall has really accelerated with the latest 4-week average showing draws of close to 5mbd. About 2mbd come from onshore tanks, with China having shifted from a stockbuilding to a stockdrawing pattern. And an even bigger figure is emerging for crude oil at sea.

(vortexa.com)

- Apple’s iPhone Supply Chain Splinters Under US-China Tensions The shift beyond China threatens to push up prices for consumers.

(…) It’s a splintering of the global supply chain that threatens to push up prices for Apple’s vast consumer base, as producers, shippers and brands grapple with manufacturing in less established locales and managing multiple entry and exit points. High-end models are the most likely to become more expensive to make.

Data compiled by Bloomberg on more than 370 suppliers and their factory locations reveals which of Apple’s manufacturing partners are building new capacity and where. The result is the clearest picture yet of all the ways the Cupertino, California-based company’s network of producers increasingly crisscrosses the developing world.

Vietnam and India are the biggest winners, with smaller production hot spots appearing elsewhere in Asia. Producers from the US and Japan have reduced their footprint in China, even as Chinese firms join the supplier list at a rapid clip. China still houses the majority of Apple’s device-making factories, and will remain an integral part of the company’s supply chain. But the shift to a more diffuse production network is undeniable and accelerating. (…)

But scattering production across several countries — some of which lag China by far in terms of infrastructure, labor availability and general supply chain expertise — raises the risk of shipping delays and inflated costs. (…)

In the rice fields of Bac Giang [Vietnam], a billion-dollar Foxconn complex expected to eventually churn out MacBooks is rising up on a plot the size of 93 American football fields. Such big investments create an economic ripple effect: Apple’s list includes 25 suppliers in the country, but more than 300 subcontractors have also opened factories in Bac Giang alone, according to Dao Xuan Cuong, who oversees the province’s industrial parks. (…

[India] now manufactures roughly 7% of all iPhones, tripling production in the last fiscal year. Overall, Indian electronics exports have quadrupled since 2018 to $24 billion last year. (…)

EARNINGS WATCH

The Q2 earnings season is almost over.

79% of the 485 S&P 500 companies that have reported beat estimates by a +8.0% factor, broadly distributed.

Q2 EPS are nonetheless down 3.0% (+3.4% ex-Energy), vs -5.7% expected, on a +0.5% revenue gain (+4.4% ex-E) vs -0.6% expected.

Trailing EPS are now $216.79. Full year 2023: $221.01e. Forward EPS: $232.80e. Full year 2024: $247.09e.

Interestingly, 132 companies have pre-announced, 37% more than at the same time during Q2 and 50% more than one year ago.

Of the 36 additional pre-announcements, 18 are positive and 19 negative.

But of the 22 pre-announcements of the past 2 weeks, 16 were positive and 6 negative.

FYI:

- Surging interest in AI will add further strain to global electricity grids with the potential to rival the massive energy consumption of Bitcoin, Tim Culpan writes. Thankfully, crypto has also shown a way forward. Expect to see AI providers tapping cold climates with plenty of renewable energy and Chinese hydroelectric power stations, previously exploited for mining tokens.