The Economy Just Keeps Going Gross domestic product finished out last year on a solid note and is poised to continue growing

The Commerce Department on Thursday reported that gross domestic product grew at a 3.3% annual rate, adjusted for inflation, in the fourth quarter—better than the still respectable 2% economists were looking for—after growing at a 4.9% rate in the third quarter.

It caps off a year in which the economy defied expectations that it would plunge into recession. Instead, GDP accelerated: It was 3.1% higher in the fourth quarter than a year earlier compared with a 0.7% on-the-year gain in the fourth quarter of 2022. Economists polled by The Wall Street Journal last January had forecast that fourth-quarter 2023 GDP would be up just 0.2% on the year. (…)

Consumer spending—the economy’s workhorse—grew at a 2.8% annual rate. That indicates, in line with the retail sales figures, that spending growth accelerated through the end of the quarter. As a result, spending in December was significantly higher than the average spending level during the quarter, effectively creating a ramp into the first quarter.

As a result, it looks as though, even if spending didn’t budge from December’s level in the first quarter, first-quarter spending would still be an annualized 1.9% higher than in the fourth quarter. Friday’s report on December personal income and spending, due out on Friday, will provide more information.

The report showed that capital spending picked up, with nonresidential investment growing at a 1.9% annual rate in the fourth quarter after growing 1.4% in the third quarter. Residential investment also eked out a slight gain, a reflection of how—even though the housing market is a complete and utter mess—home-construction activity is growing again. A narrowing trade deficit also helped bump up GDP. (…)

The Commerce Department’s gauge of consumer prices—the Federal Reserve’s favored inflation metric—rose at a 1.7% annual rate in the fourth quarter from the previous quarter after rising by 2.6% in the third quarter. The so-called core, which excludes food and energy prices in an effort to better capture inflation’s trend, rose at a 2% rate, matching the third quarter’s increase. Monthly data, which will be included in Friday’s income and spending report, looks likely to show that core inflation’s recent trend is below 2%. (…)

- Lagging lags:

US real GDP level versus pre-Covid trend

Source: Macrobond, ING

(…) Indeed, economic growth has been boosted recently by better-than-expected productivity growth at 3.1% and 5.1% during Q2 and Q3 of 2023. During Q4, aggregate hours worked edged up by just 0.4% suggesting that productivity growth was close to 3% during Q4. That is helping to bring inflation down and to boost real wages, providing consumers with more purchasing power. Consumer spending in real GDP was up 2.8% during Q4.

Helping to boost the economy has been onshoring. Capital spending on structures in real GDP rose 12.7% last year. Leading the way has been construction of manufacturing facilities.

That’s boosting spending on capital equipment and increasing the demand for labor. Nondefense capital goods orders rose to a record high during December.

Inflation has moderated significantly according to the GDP price deflator. It rose 3.4% in 2023, down from 6.8% in 2022. So 2023 was a good year for the economy, which is why stock prices rallied. 2024 should be another good year for the economy.

If you missed yesterday’s January Flash PMI:

- At 52.3, the headline S&P Global Flash US PMI Composite Output Index was up from 50.9 in December and signalled the fastest rise in business activity since June 2023. The expansion in output indicated a notable uptick in performance at the start of the year.

- New business expanded for the third successive month at US companies in January, with the rate of growth quickening to the sharpest since June 2023. The upturn in new orders was broad-based, as manufacturers registered the first rise in new sales since October 2023, and the fastest uptick since May 2022. Service providers reported the strongest gain for seven months.

This preview of month-end PMIs indicates:

- Broadly accelerating demand (new orders) overall, including goods, suggesting that the inventory cycle might be complete after the strong year-end retail sales.

- Soft but growing employment, potentially easing wage demand/offers.

- Slowing inflation overall, the “smallest monthly rise since May 2020”. Remember the spring of 2020?

#Supplychain disruptions are squarely back. Container prices shipping goods from #China to the US have more than doubled YTD!!! (@RBAdvisors)

While on inflation/shrinkflation:

Existing home prices have historically run lower than new home prices, but inverse price trends have allowed new home prices to close the gap. The “premium” home buyers paid for a new home was just $26,200 in December.

An additional factor that may be contributing to lower new home prices is the shrinking floor area of new construction. According to data from the Census’ Quarterly Starts and Completions by Purpose and Design, the median floor space of a newly completed single-family home was 2,218 square feet in Q3-2023. The median single-family home size has fallen for the past three quarters and is now nearly 100 square feet smaller than the size of a newly built home in Q4-2022. (Wells Fargo)

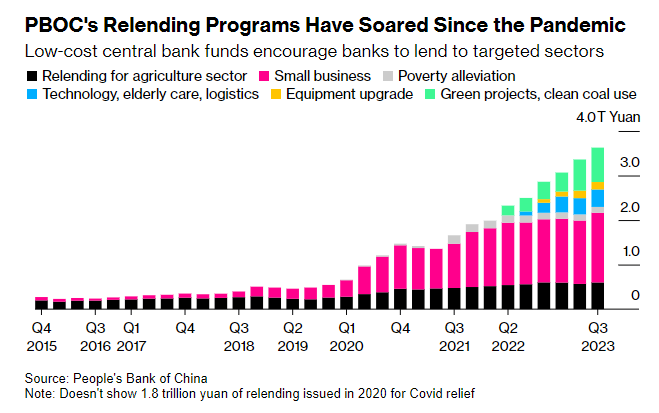

China Signals More Targeted Stimulus to Come PBOC earmarks plan to target specific areas of economy

The People’s Bank of China surprised investors on Wednesday by revealing a bigger-than-expected RRR cut weeks in advance, providing markets with a much-needed boost. Economists see the central bank following up that move by steering credit into select areas, along with a handful of trims to the amount of cash banks must hold in reserve and modest policy-rate cuts. (…)

The PBOC already increased funding via such tools by 7% last quarter from the previous period, reaching 7.5 trillion yuan ($1 trillion) overall, data published by the central bank Friday showed. (…)

The PBOC will set up a new credit market department to promote financing to technology, green and other sectors, he said. It’s also cutting the interest rate on more than 2 trillion yuan ($279 billion) of low-cost funds for banks — a move intended to encourage more lending to agriculture and small firms. (…)

The real estate industry “has an important impact on the national economy and is closely related to the lives of the people,” Xiao Yuanqi, deputy head of the National Administration of Financial Regulation, said during a press briefing this week. “The financial industry has an unshirkable responsibility and must vigorously support it.” (…)

The central bank has listed small businesses, the digital economy and elderly care as other favored sectors. (…)