Posted yesterday: “OPEN SESAME!†MOMENTS

U.S. Leading Economic Indicators Strengthen

The Conference Board’s Composite Index of Leading Economic Indicators increased 0.5% (1.6% y/y) during July following a 0.1% June decline, revised from -0.3%. It was the largest rise since September 2018. (…)

Performance amongst the components of the Leading Indicator index was mixed. Contributing positively to the index were the readings for building permits, initial unemployment insurance claims, stock prices, consumer expectations for business/ economic conditions and the leading credit index. Offsetting these increases were declines in the average workweek, the ISM new orders index, factory orders for nondefense capital goods excluding aircraft and the yield spread between 10-year Treasuries and Fed Funds. Factory orders for consumer goods & materials held steady.

Three-month growth in the leading index rebounded m/m to 1.4% (AR) but remained below the high of 9.1% in December 2017.

The Index of Coincident Economic Indicators increased 0.2% (1.8% y/y), the same as in June which was revised from 0.1%. (…) Three-month growth in the coincident index improved to 1.9% (AR), its strongest since February.

The Index of Lagging Economic Indicators increased 0.6% last month (3.5% y/y) after a 0.5% June rise, revised from 0.6%. (…) Three-month growth in the lagging index strengthened to 4.2%, its quickest since February.

The ratio of coincident-to-lagging economic indicators is sometimes considered a leading indicator of economic activity. It declined to nearly the lowest level since early-1975.

A pretty timely uptick (charts below from Advisor Perspectives):

These charts are from Ed Yardeni:

A look at trends in each of the LEI components doesn’t lead to a great sense of safety, does it?

U.S. Initial Unemployment Insurance Claims Decline Sharply

Initial unemployment insurance claims fell to 209,000 (-2.1% y/y) during the week ended August 17 from the prior week’s 221,000, revised from 220,000. (…) The four-week moving average of initial claims of 214,500 compared to 214,000 in the prior week. It remained above the 50-year low of 201,500 reached in April.

The latest initial claims figure covers the survey week for August nonfarm payrolls. Claims fell 7,000 (-3.2%) from the July period. During the last twenty years, there has been a 69% correlation between the level of initial jobless claims and the m/m change in payroll employment. (…)

Claims are still well within the channel.

But, but, yesterday’s U.S. Flash PMI from Markit should curb your enthusiasm, if any: Services have kept the economy humming so far but:

At 50.9 in August, down from 53.0 in July [and 56 in February], the IHS Markit Flash U.S. Services PMI™ Business Activity Index eased to a three-month low and pointed to only a marginal rate of expansion. Subdued demand conditions continued to act as a brake on growth, with the latest rise in new work the slowest since March 2016. This contributed to a decline in backlogs of work for the first time in 2019 to date. Meanwhile, business expectations among service providers for the next 12 months eased in August and were the lowest since this index began nearly a decade ago. (…)

August’s survey data provides a clear signal that economic growth has continued to soften in the third quarter. The PMIs for manufacturing and services remain much weaker than at the beginning of 2019 and collectively point to annualized GDP growth of around 1.5%.

The most concerning aspect of the latest data is a slowdown in new business growth to its weakest in a decade, driven by a sharp loss of momentum across the service sector. Survey respondents commented on a headwind from subdued corporate spending as softer growth expectations at home and internationally encouraged tighter budget setting. (…)

Business expectations for the year ahead became more gloomy in August and remain the lowest since comparable data were first available in 2012. The continued slide in corporate growth projections suggests that firms may exert greater caution in relation to spending, investment and staff hiring during the coming months.

World wide from the CPB:

- World trade volume decreased 1.4% month-on-month (growth was 0.6% in May, initial estimate 0.3%) and growth was -0.7% in 2019Q2 (-0.3% in 2019Q1).

- World trade momentum was -0.7% (non-annualised; 0.1% in May, initial estimate 0.0%).

- World industrial production decreased 0.5% month-on-month (0.2% in May, unchanged from initial estimate) and growth was -0.1% in 2019Q2 (0.2% in 2019Q1).

- World industrial production momentum was -0.1% (non-annualised; 0.6% in May, initial estimate 0.7%).

It can get worse as Ed Yardeni illustrates:

Confused? Read on, you have company!

-

Powell Faces Challenge Defining Doctrine Around When to Cut Rates Fed Chairman Jerome Powell’s challenge in the weeks ahead is to articulate clearly why the central bank is likely to continue reducing rates absent obvious signs of economic deterioration

-

Seeking clarity from Fed’s Powell? Good luck with that

Three Fed Officials Offer Diverging Views on Rate Cuts in TV Interviews Three Fed officials offered diverging views on the path for monetary policy in television interviews, with two skeptical over the need for lower rates and a third open to a further cut by the central bank.

Big Banks Struggled With Fed Communications Ahead of July FOMC As the Federal Reserve prepared to implement its first interest rate cut in over a decade, many of Wall Street’s biggest banks weren’t happy with the story officials were telling markets.

A majority of primary dealer banks told the New York Fed in a survey done ahead of the July 30-31 Federal Open Market Committee that central bank communications were on the ineffective side.

The survey, conducted July 17-22, found that 15 of 24 banks rated Fed communications as “ineffective†or close to that level, compared with eight who rated the communications effectiveness at the midpoint between ineffective and effective. The survey was released Thursday.

“Several dealers indicated that they found communication confusing, and several characterized communication from various Fed officials as inconsistent,†the New York Fed report said.

Primary dealers underwrite Treasury debt auctions and serve as counterparties to central bank monetary policy operations. A similar New York Fed survey of market participants, also done ahead of the July Fed meeting, saw the Fed getting better grades from money managers, although 14 out of 28 also gave low grades for communications effectiveness. (…)

Today’s Powell Jackson Hole speech “may mark the last market sensitive event of what Bank of America Merrill Lynch refers to as “the summer of bonds†where bonds flew off the shelves as investors sought safety from the threat of global recession. The bank notes investors poured a record three-month $155 billion into bond funds, versus $98 billion that drained out in January 2019 (WSJ)

BlackRock’s views: Dealing with the next downturn: From unconventional monetary policy to unprecedented policy coordination

And at the WH:

Trump Adviser Says Tax Cuts Could Be Proposed Before 2020 Election Lawrence Kudlow, the president’s top economic adviser, said a middle-class tax-cut proposal could be unveiled during the 2020 presidential campaign, adding a new layer to conflicting messages from the administration.

(…) “You very may well see a new rollout of additional, additional middle-class tax relief and small-business tax relief,†Lawrence Kudlow, the White House National Economic Council director, said Thursday evening on Fox Business Network.

President Trump said Wednesday tax-cut proposals weren’t being considered, contradicting remarks he had made a day earlier amid reports of a slowing economy. (…)

“There is nothing in the near term, that’s what the president was getting at,†Mr. Kudlow said. “We believe the economy is quite healthy, we expect some relief on short-term interest rates coming up from the Fed and so forth. But longer run, why not?†(…)

The message: We don’t want anybody to think we may be thinking a recession is coming. But we’ll be ready if a recession…or polls threaten.

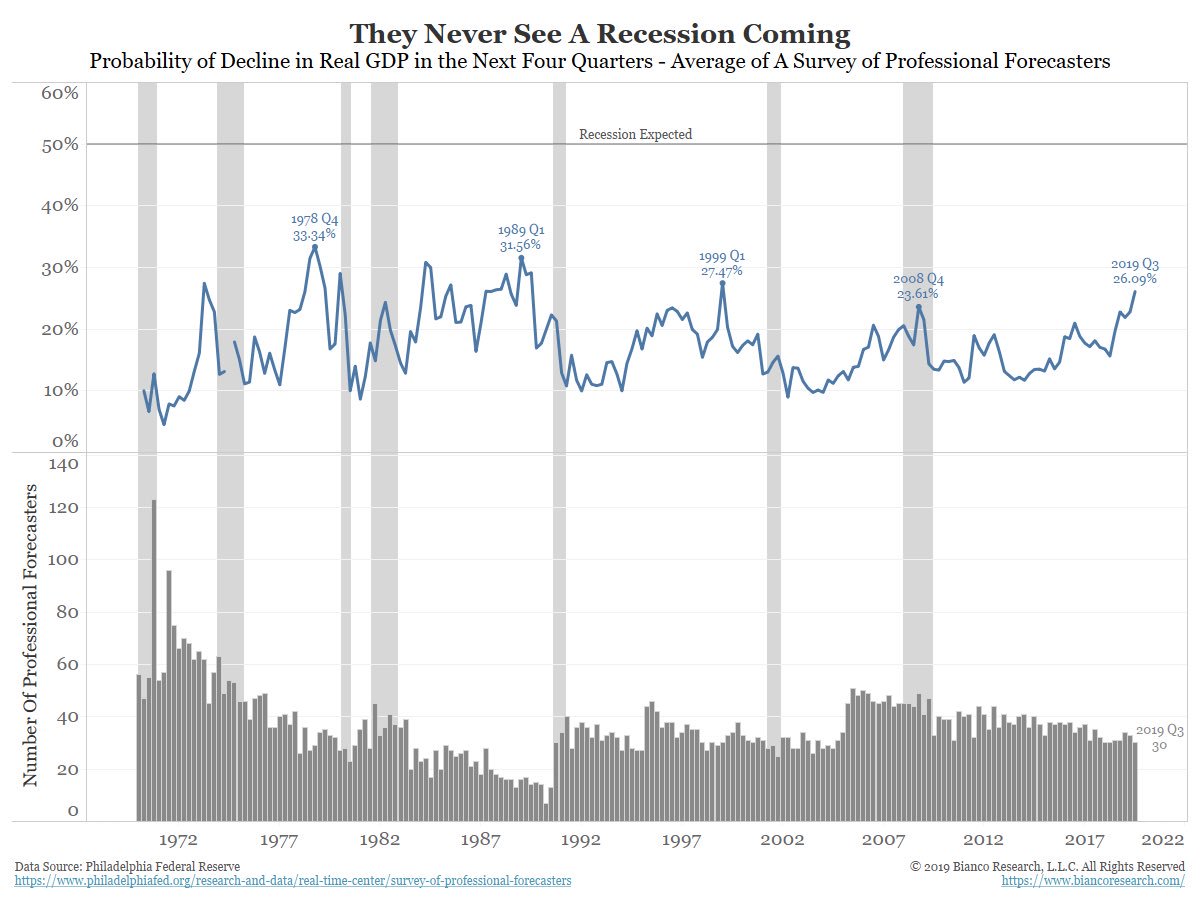

Just in case you want to rely on economists to timely warn you of a recession, Bianco Research shows that professional forecasters never put odds of a decline in GDP over subsequent 4 quarters much above 30%.

Huawei Puts a Price on Trump’s Aggression

(…) China’s largest technology company is seeking ways to replace key U.S. suppliers such as Cadence Design Systems Inc. and Synopsys Inc., Deputy Chairman Eric Xu said Friday. The overall damage to the company will be a “little less†than billionaire founder Ren Zhengfei’s initial estimate, Xu added.

Huawei is seeking to develop alternatives after coming under intense pressure from the Trump Administration, which has argued its technology represents a security threat. On Friday, it introduced its most powerful artificial intelligence chipset, the Ascend 910, which is poised to rival some of the best offerings from Qualcomm Inc. and Nvidia Corp. Earlier this month, it offered the first glimpse of an in-house software — HarmonyOS — that may someday replace Google’s Android.

The company is also researching ways to replace chip-design software tools offered by Cadence and Synopsys, Xu told a news briefing in Shenzhen without elaborating. “There were no chip design tools 10 years ago, but the industry still developed chips,†said Xu, who argued that Cadence and Synopsys were not must-haves for design. “Intel started to develop chips in the 1970s, when those companies didn’t exist.†(…)

One area in which the Chinese company is rapidly developing in-house expertise is semiconductors, propelling Beijing’s ambitions of weaning itself off foreign chips. HiSilicon — Huawei’s chip design subsidiary — has been developing its capabilities for a long time, and it’s recently grown into the second largest customer (after Apple Inc.) for the world’s biggest chip manufacturing contractor Taiwan Semiconductor Manufacturing Co.Huawei has also elevated the presence of home-grown technologies throughout its product line — from base stations to smartphones and servers — as a key step to limiting the damage of the U.S. ban.

The Ascend 910 processor unveiled Friday is a show of technological prowess. It will be used for AI model training, and Huawei says it outperforms all existing competition. Xu proclaimed that “without a doubt, it has more computing power than any other AI processor in the world.†The company also unveiled MindSpore, an AI computing framework that — along with the 910 — is supposedly twice as fast as Google’s TensorFlow.

- Totally related: “OPEN SESAME!†MOMENTS

Facebook’s Libra backers distance themselves from project Some early supporters of cryptocurrency consider cutting ties amid regulatory scrutiny

(…) Two of the project’s founding backers told the FT they were concerned about the regulatory spotlight and were considering cutting ties. Another backer said they were worried about publicly supporting Libra for fear of attracting the attention of agencies who oversee their own businesses. (…)

FYI: From Robert Eisenbeis, Ph.D., Vice Chairman & Chief Monetary Economist, Cumberland Advisors

Bitcoin and similar cryptocurrencies: While Bitcoin gets a lot of attention, there are now over 1600 so-called cryptocurrencies trading on at least 500 different exchanges.[1] Given the number and complexity of arrangements, only general observations are offered here.[2] While these systems offer varying degrees of real-time clearing and settlement, the exchanges are not interconnected; and not all currencies are available on each. In fact, some are single-currency exchanges. In many respects, attempting to convert one cryptocurrency into another is the same as engaging in a foreign-exchange conversion; but with so many currencies the number of pairs of exchange rates is very large, and it is made even more cumbersome because exchange rates may also vary from exchange to exchange. Finally, it is important to note that there are often significant transactions costs, and the delay in conversion back to a home currency may take anywhere from two to five days before the seller receives good funds. So these are not real-time transfer systems as envisioned in the Payment Modernization Act. Indeed, the cryptocurrency environment is quite similar to the Wildcat banking period in the US in the 1800s when individual banks issued their own currencies, usually backed by a promise to redeem in gold. These currencies did not trade at par with each other, and there were books printed to help users identify issuing banks and their associated currencies.

Despite all the positive hype, there have been some significant problems with hacking and loss of funds by cryptocurrency holders. A recent study revealed some interesting facts.[3] Considering just Bitcoin alone, it was determined that one quarter of Bitcoin users and about half the transactions were associated with illicit activities, amounting to an estimated $72 billion per year in that one currency alone. In addition, there have been numerous exchange failures, one of the most famous being the 2014 failure of Japan’s Mt. Gox, one of the largest in terms of volume of transactions. About 650,000 bitcoins were lost due to hacking, and the exchange’s creditors were said to have lost $2.4 trillion.[4]

A supposed desirable feature of cryptocurrencies is their anonymity, in that transactions are said not to be traceable. Whether that is true or not, it is interesting that the Mueller investigation of Russian interference in our 2016 election resulted in indictments of 12 Russian security agents; and the investigation revealed that the use and tracking of Bitcoin payments was an important piece of evidence. So, these transactions may not be as hidden as most think.

The proposed Libra/Calibra payments system put forward by Facebook is a closed system variant of blockchain cryptocurrencies. The key distinctions are that the currency-value is to be backed by a basket of currencies, the system is not truly anonymous, the user receives no return on the purchase of a Libra and it is unclear how and under what terms a user can convert a Libra back into the home currency. All of these are details that are yet to be resolved. Indeed, some have argued that Libra is more like an ETF than an actual cryptocurrency.[5]