US stimulus plan shrinks to $748bn but wins crucial backer Bipartisan group of lawmakers strip out contentious provisions in bid for compromise

SURVEY SAYS!

In its November Survey of Consumer Expectations, the central bank found households reporting the highest level of expected spending growth since July 2016, at a predicted 3.7% rise for a year down the road, up from 3.1% in October. The increase was driven by households earning under $50,000 a year.

The spending forecast comes against a backdrop of expected household income gain holding steady at 2.1%,which the New York Fed noted was below the long-run average of an expected 2.8% increase in income.

Despite the expected rise in spending, “respondents were more pessimistic about their households’ financial situations in the year ahead, with more respondents expecting their financial situation to deteriorate, and fewer respondents expecting an improvement in their financial situation,” the report said. (…)

- ZeroHedge looked at the latest aggregated credit and debit card data reported by BofA, one of the largest card issuers in the US:

(…) contrary to gloomy expectations, found that consumer demand normalized with total card spending increasing by 5.4% yoy for the 7-days ending December 5th after a large yoy swing the prior two weeks. Importantly, BofA’s measure of holiday sales, defined as core control retail sales ex-groceries, has moved back in line with last year’s trend and on a cumulative basis is up a whopping 19% yoy, reflecting very strong demand for goods items during the holiday season.

My more cautious reading is that core retail sales trended in line with 2019 in November after a strong October. Many suspect that consumers shopped earlier than normal this year, fearing lockdowns and taking advantage of early promotions (e.g. Prime Day). Recall that this only covers spending on goods. ZH continues:

And although the % mom may indeed be on the cusp of a contraction, BofA’s Michelle Meyer notes that it doesn’t reverse the exceptional growth previously and leaves the November growth rate at a stellar 9.8% Y/Y, hardly the stuff of imminent recessions.

It is rather interesting to note that people are going debit and not credit. Seems cautious to me. November U.S. retail sales data are out tomorrow.

-

Consumer Sentiment Rose in Recent Weeks U.S. consumers grew more confident in the economy in late November and early December, with many expecting the economic conditions to improve when the country begins to exit from the pandemic.

The University of Michigan said Friday its index of consumer sentiment climbed to 81.4 in the two weeks ended Dec. 9, from 76.9 in November. Economists surveyed by The Wall Street Journal expected a reading of 75.5.

Rosier expectations for the economy drove the index’s rebound, though respondents’ views on current economic conditions improved as well.

“Most of the early December gain was due to a more favorable long-term outlook for the economy, while year-ahead prospects for the economy as well as personal finances remained unchanged,” said Richard Curtin, the survey’s chief economist.

A partisan skew in views was responsible for much of the upward shift in sentiment, Mr. Curtin said, with Democrats becoming more optimistic about the economy and Republicans more pessimistic, following President-elect Joe Biden’s victory in the presidential election. (…)

- The Investor’s Business Daily/TIPP poll dropped from 55.2 in October to 50.0 in November and to 49.0 in December. The 6-m outlook was 46.3 in December, down from its February peak of 57.0.

There are other types of surveys:

In the first week of December, the proportion of mortgage borrowers that started seeking forbearance relief rose to its highest level since August, according to the Mortgage Bankers Association. And call volume at the companies that collect payments rose to the highest level since April, a sign of growing distress among homeowners, the trade group said Monday. (…)

The total percentage of loans that are in forbearance edged lower to 5.48% in the week ended Dec. 6, from 5.54% the week before. Yet the number of borrowers looking to enter forbearance rose to 0.12% of all the loans mortgage servicers collect payments for, the most since August, the MBA said. (…)

As the pandemic drags on, time is running out for some borrowers. Consumers whose loans are in forbearance have to resume making payments next year, in some cases as soon as the end of March. When that happens, many homeowners will face a difficult choice: either pay their mortgage, convince their lender to somehow ease the terms of their loan, or default. (…)

Even with the forbearance program, delinquencies have been rising, in part because some borrowers may not know they’re eligible for relief. At the end of the third quarter, about 7.7% of loans were delinquent, according to the MBA, about twice the percentage at the end of 2019. Delinquencies are still below their financial crisis peak of around 10%. (…)

Bloomberg’s Shawn Donnan suspects that many businesses are in a state of suspended animation that might hit the economy in 2021.

(…) This state of suspended animation applies as well to corporate America, which has benefited from the Federal Reserve’s dramatic cuts in interest rates and moves to support credit markets. A Bloomberg analysis of financial data for 3,000 of the country’s largest publicly traded companies found that 1 in 5 were not earning enough to cover the cost of servicing the interest on their debt, rendering them financial zombies. Collectively those companies—among them Boeing, Delta Air Lines, Exxon Mobil, and Macy’s—have added almost $1 trillion in debt to their balance sheets since the beginning of the pandemic. (…)

As the economy comes back to life and government support eventually is withdrawn, one effect is likely to be a surge in bankruptcies and evictions, he says. Even if vaccinations reach a meaningful number of Americans, it may be too late for many businesses.

Oil consumption will be ‘lower for longer than expected’, warns IEA Body cautions against premature ‘euphoria’ that vaccines will swiftly boost air travel

Covid19

-

Jump in London Covid cases raises fears over Christmas gatherings Case numbers surge in capital and South East but cause of new outbreak is not fully known

-

UK warns of threat from new Covid-19 variant Mutation may be responsible for rise in infections but no evidence of more severe symptoms

-

Germany braced as hard lockdown set to trigger double-dip recession

China Recovery Continues Despite Covid Surge Elsewhere Industrial output, investment and consumer spending all grew at faster paces in November

(…) China’s industrial output rose 7.0% in November from a year earlier—its highest level in more than two years, China’s official National Bureau of Statistics said. The result was a tick up from 6.9% in October, and beat the 6.8% increase expected by economists polled by The Wall Street Journal. (…)

China’s fixed-asset investment, which includes spending on manufacturing, property and infrastructure projects, rose 2.6% in the January-November period compared with last year, according to data from the statistics bureau. That was faster than the 1.8% pace recorded in the first 10 months of the year, and beat economists’ expectations of 2.5%.

China’s urban jobless rate fell for the fourth straight month to 5.2% in November, compared with 5.3% in October, said the statistics bureau. (…)

China’s retail sales, a key gauge of consumer spending, rose 5.0% year over year in November, up from 4.3% in October. Still, it was lower than the 5.5% increase expected by surveyed economists, suggesting China has work to do to shore up growth longer term. (…)

FYI: China’s 10Y yields are up 80bps (+32%) back to their late 2019 range.

China suspends top credit rating agency as defaults hit market Regulator says Golden Credit failed to justify some of its ratings and upgrades

SENTIMENT WATCH

- Bank of America says says investor bullishness is rising, but is not yet euphoric. BofA’s Sell Side Indicator rose to 57.8%, the highest level of bullishness in 18 months. The indicator is now closer to a “sell” signal than it has been since the onset of the Greet Financial Crisis. But this doesn’t mean that it’s time to sell stocks just yet. In fact, the strategists said this signal indicates a 10% total return in the benchmark S&P 500 over the next 12 months. In other words, investor sentiment is rising, but it’s not yet at the euphoric level that is typically seen at the conclusion of bull markets. a reading of 61.9 represents high bullishness and thus triggers a “sell” signal.

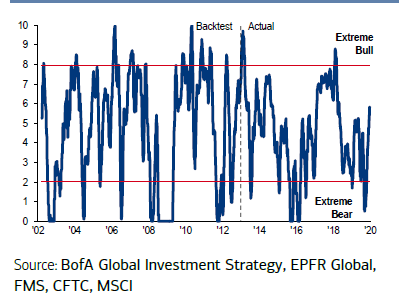

- BofA Bull & Bear Indicator is “accelerating toward extreme bullish”. It now stands at 5.8, up from 4.7; on a scale from 0 to 10. In concert with that indicator, the bank said fund managers’ cash was at 4.1 per cent of their holdings, which is close to a “sell signal”.

- The IPO frenzy is almost where it was during the dot.com era (The Daily Shot).

- If you can’t buy the IPO directly because your a “financial nobody”, you can feed the beast that buys IPOs at and after issue:

The beast is feeding on pretty fatty meals these days as Jay Ritter’s data shows:

Wolf Street (via the Daily Shot) adds that

not only are investors willing to buy unproven companies, they’re willing to buy things that aren’t really companies at all, just concepts. There has never been a time when investors were so willing to fund blank-check companies in hopes of striking it rich with an undiscovered gem – even though these things are much more likely to give riches to their founders.

This paper analyzes the structure of SPACs and the costs built into their structure. We find that costs built into the SPAC structure are subtle, opaque, and far higher than has been previously recognized. Although SPACs raise $10 per share from investors in their IPOs, by the time the median SPAC merges with a target, it holds just $6.67 in cash for each outstanding share. We find, first, that for a large majority of SPACs, post-merger share prices fall, and second, that these price drops are highly correlated with the extent of dilution, or cash shortfall, in a SPAC. This implies that SPAC investors are bearing the cost of the dilution built into the SPAC structure, and in effect subsidizing the companies they bring public. We question whether this is a sustainable situation. We nonetheless propose regulatory measures that would eliminate preferences SPACs enjoy and make them more transparent, and we suggest alternative means by which companies can go public that retain the benefits of SPACs without the costs.

U.S. tech giants face 6-10% fines as EU set rules to curb their power Amazon, Apple, Facebook and Alphabet unit Google may have to change their business practices in Europe or face hefty fines between 6-10% under new draft EU rules to be announced on Tuesday.

(…) One set of rules called the Digital Markets Act calls for fines up to 10% of annual turnover for online gatekeepers found breaching the new rules, a person familiar with the matter told Reuters.

It also sets out a list of dos and don’ts for gatekeepers, which will be classified according to criteria such as number of users, revenues and the number of markets in which they are active, other sources said.

The second set of rules known as the Digital Services Act also targets very large online platforms as those with more than 45 million users.

They will be required to do more to tackle illegal content on their platforms, misuse of their platforms that infringe fundamental rights and intentional manipulation of platforms to influence elections and public health, among others. (…)

The draft rules need to reconcile with the demands of EU countries and EU lawmakers, some of which have pushed for tougher laws while others are concerned about regulatory over-reach and the impact on innovation.

Tech companies, which have called for proportionate and balanced laws, are expected to take advantage of this split to lobby for weaker rules, with the final draft expected in the coming months or even years.

- The FT adds today:

EU warns that it may break up Big Tech companies Repeat offences under new rules will trigger action to force divestments, Brussels will warn

U.S. Homeland Security, thousands of businesses scramble after suspected Russian hack The U.S. Department of Homeland Security and thousands of businesses scrambled Monday to investigate and respond to a sweeping hacking campaign that officials suspect was directed by the Russian government.

(…) The attacks, first revealed by Reuters Sunday, also hit the U.S. departments of Treasury and Commerce. Parts of the Defense Department were breached, the New York Times reported late Monday night, while the Washington Post reported that the State Department and National Institutes of Health were hacked. (…)

Technology company SolarWinds, which was the key steppingstone used by the hackers, said up to 18,000 of its customers had downloaded a compromised software update that allowed hackers to spy unnoticed on businesses and agencies for almost nine months. (…)

SolarWinds boasts 300,000 customers globally, including the majority of the United States’ Fortune 500 companies and some of the most sensitive parts of the U.S. and British governments – such as the White House, defence departments and both countries’ signals intelligence agencies.

Because the attackers could use SolarWinds to get inside a network and then create a new backdoor, merely disconnecting the network management program is not enough to boot the hackers out, experts said.

For that reason, thousands of customers are looking for signs of the hackers’ presence and trying to hunt down and disable those extra tools.

Investigators around the world are now scrambling to find out who was hit. (…)

FireEye, a prominent cybersecurity company that was breached in connection with the incident, said in a blog post that other targets included “government, consulting, technology, telecom and extractive entities in North America, Europe, Asia and the Middle East.”

“If it is cyber espionage, then it is one of the most effective cyber espionage campaigns we’ve seen in quite some time,” said John Hultquist, FireEye’s director of intelligence analysis.

BTW: Putin Finally Congratulates Biden on Winning U.S. Presidency

Correlation is not causation:

Correlation is not causation:

Joe Weisenthal, an editor at Bloomberg.