CONSUMER WATCH

Busy week with the U.S. CPI Tuesday, retail sales Thursday and housing starts Friday.

JP Morgan Chase’s “Consumer Card Spending Tracker” offers a preview of Thursday’s retail sales report. Terrific or scary, depending on your book, or in which of the pent-up or spent-up camp you reside:

During the 7-days ending April 3rd, total card spending increased 67% YoY and 20% on a 2-year change. Never mind the YoY base effect, the 2-year change is huge, steady compared to the previous week and roughly double the growth rate prior to the stimmies.

It’s not only pent-up services demand that is strong, spending on goods remains very solid:

Also interesting is that total card spending was up 33% YoY over a 2-year period for stimulus recipients compared with a 14% gain for non-recipients (defined as those who did not receive the stimulus payment through direct deposit on Mach 17). Fourteen percent over 2 years is strong (CPI +4%), however you slice it.

McKinsey’s February 2021 survey:

When comparing those who are vaccinated already to those who say they are likely to get vaccinated, vaccination drives more out-of-home activity (with 33 percent engaging out of home versus 22 percent among those who intend to be vaccinated) and drives higher spend intent, particularly for out-of-home activities (such as restaurants, out-of-home entertainment, and travel).

Greater spend and out-of-home activity will continue to pick up as younger consumers receive the vaccine. That’s because the currently vaccinated group is comprised largely of baby boomers, who indicate a lower propensity to spend, and because younger consumers have a greater desire to spend and greater opportunity for activity.

Meanwhile, about half of those who say they are unlikely to be vaccinated are already engaging in regular out-of-home activity, however have similar spend intent to the non-vaccinated population at large.

Consumers intend to continue with many digital behaviors even after COVID-19 subsides, including restaurant curbside pickup (about 30 percent penetration, with about half intending to continue post-COVID-19) or use of digital health-and-wellness tools (over 10 percent penetration with 70 to 80 percent intent to continue post-COVID-19).

Consumers have made structural changes to their homes which will create lasting change (28 percent renovated their homes, or set up a gym or a workspace; 19 percent have changed their living situation); and people are still investing in their homes (30 percent plan to splurge on items for their home after the pandemic).

However, consumers are also excited to spend more time and money outside of their homes post-COVID-19: about 30 percent of consumers say they will spend more on in-person restaurant dining, out-of-home entertainment, and travel.

- Freight traffic posted biggest annual gain ever in March (Axios)

Freight train traffic, an important gauge of U.S. economic health, showed a major pickup in March, increasing year over year for the first time since January 2019, data from the Association of American Railroads (AAR) showed.

Intermodal train traffic — a measure of shipping containers and truck trailers moved on rail cars — jumped 24% last month.

- “That’s the biggest monthly gain ever for intermodal; it includes a 28% increase in the last two weeks of March,” AAR noted in its latest Rail Time Indicators report.

- “March’s intermodal gains are not solely a function of easy comparisons, though: March 2021 was the highest-volume March ever for intermodal and the sixth-best intermodal month overall.”

Thanks to big gains last month, overall intermodal train traffic is up 13.2% from 2020’s levels, and ahead of intermodal traffic through March in 2019 and 2018.

- Powell Sees Pickup in Economic Growth Ahead Fed chairman says job gains, economic output are about to start increasing ‘much more quickly’

(…) “We feel like we’re at a place where the economy’s about to start growing much more quickly and job creation coming much more quickly,” Mr. Powell said in an interview to be broadcast Sunday evening on CBS’s “60 Minutes.” He said the Fed’s forecast is that the economy could produce close to one million jobs a month for “a string of months.” (…)

Mr. Powell reiterated that the Fed plans to wait until the economy’s recovery is complete before it raises interest rates.

“It’ll be a while until we get to that place,” Mr. Powell said, according to a transcript of the interview, which took place on Wednesday. Asked whether a rate increase might happen this year, Mr. Powell said it is “highly unlikely.” (…)

Bloomberg adds (my emphasis):

“The Fed will do everything we can to support the economy for as long as it takes to complete the recovery,” he said, noting many Americans have left the workforce during the pandemic — which means they are not included in the unemployment rate — and “we need to see those people coming back into the labor force.”

The U.S. labor force declined by 3.9 million people during the pandemic but the number of Americans “not in labor force but available to work now” is 1.8 million, up from 1.2 million before the pandemic. It thus seems that many dropouts don’t even want to re-enter. As I showed last week, the Participation Rate for 65+ year-olds declined from 26% to 23%, its 2014 level with no signs so far of a rebound.

Eurozone retail sales improve modestly but the big surge is yet to come Despite the improvement in Eurozone retail sales, the big rebound is yet to come in the months ahead, as non-essential retail stores are still closed in many countries. As consumers show decreasing signs of caution, consumption seems set for a reopening rebound

The February increase in Eurozone retail sales was seen in most countries but driven by boosts thanks to easing relief measures. However, they are still below the 6% level seen in October 2020. (…)

Overall, levels of sales remain subdued at the moment, but this is mainly because substantial restrictions are still in place.

The big question is whether eurozone consumers are eager to consume when the economy reopens. With involuntary savings built up substantially over the course of last year, there is significant potential for a rebound. As we inch closer to the easing of restrictive measures, things are looking good for a consumption recovery. The immediate positive response in sales to the easing of mobility measures is a positive sign, which is also confirmed by survey data.

U.S. PPI Posts Broad-Based Strength in March

The Producer Price Index for final demand jumped 1.0% (4.2% y/y) during March following a 0.5% February improvement. The index has risen at an 11.9% annual rate during the last three months. A 0.5% rise had been expected in the Action Economics Forecast Survey. The PPI excluding food & energy strengthened 0.7% (3.1% y/y) after increasing 0.2% in February. The index rose at an 8.3% annual rate during the last three months. A 0.2% rise had been expected. The PPI less food, energy & trade services rose 0.6% (3.1% y/y) after increasing 0.2% in February. (…)

The 0.7% strengthening in the core PPI reflected 0.9% rise (3.6% y/y) in goods prices less food & energy. Core government goods prices increased 1.0% (2.8% y/y). Core consumer goods prices rose 0.5% (2.2% y/y) following a 0.1% uptick. The cost of core nondurable consumer goods increased 0.5% (1.9% y/y) while durable consumer goods prices improved 0.3% (2.7% y/y). Private capital equipment prices edged 0.1% higher (1.6% y/y).

Services prices increased 0.7% (3.0%) in March following a 0.1% uptick. Trade services strengthened 1.0% (3.3% y/y) after a 0.1% improvement. The price of transportation & warehousing of finished goods for final demand surged 1.6% (6.0% y/y) following a 0.2% rise.

Construction costs rose 0.5% (1.5% y/y) following a 0.3% rise.

Intermediate goods prices surged 4.0% in March (12.5% y/y) following a 2.7% rise. These gains were bolstered by the strength in energy prices.

Hoisington Sees Treasuries Escaping ‘Inflationary Psychosis’

(…) “Contrary to the conventional wisdom, disinflation is more likely than accelerating inflation,” according to latest quarterly report from the firm, which manages about $5 billion in Treasuries. After moving higher in the second quarter, the annual inflation rate “will moderate lower by year end and will undershoot the Fed Reserve’s target of 2%,” and “the inflationary psychosis that has gripped the bond market will fade away.” (…)

While U.S. GDP is likely to grow in 2021 at the fastest pace since 1984 — and possibly since 1950 — several factors will restrain inflation, Hoisington said. They include:

- Inflation is a lagging indicator, reaching lows an average of 15 quarters after recessions end

- Productivity tends to rebound vigorously after recessions

- Supply-chain restoration will be disinflationary

- Pandemic has accelerated technological advancements

- Growth numbers don’t reflect reflect the costs of rampant business failures

As inflation “is the key determinant for the level and direction of long term Treasury yields,” yields also tend to reach cyclical lows long after the start of recessions, with an average lag of 76 months since 1990, Hoisington said. “While no two cycles are ever alike, the trend in long bond yields remains downward.”

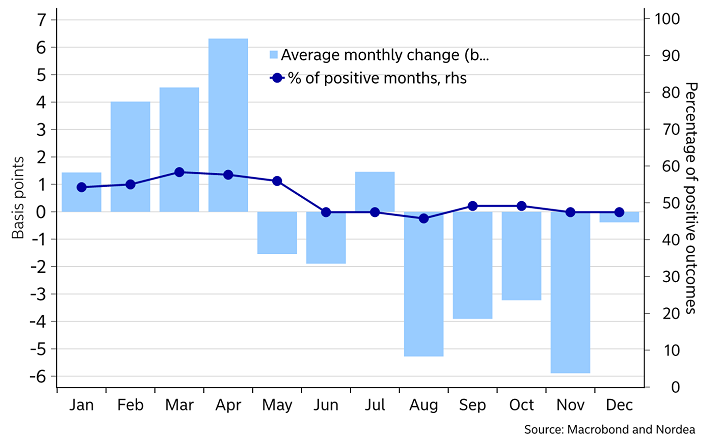

I had never seen a seasonality chart on U.S. 10Y yields which, according to this Nordea chart, “tend to drop in the period from May to November, in contrast to yields tending to rise from January to April.” Nordea does not specify the observed period but my casual check shows that using this seasonality would not have been profitable since 2016.

US Treasuries –seasonality turning positive

Who’s Afraid Of The Big Bond Wolf?

Gavekal’s Anatole Kaletsky:

(…) Equities have continued to hit new records despite rising US bond yields—or because of them. This makes sense, because what is pushing up bond yields is the prospect of strong economic growth in the next two years, combined with a once-in-a-generation regime change in global economic policy. While these two developments are bad news for bond investors, they bode well for corporate activity and profits in the years ahead. With central banks everywhere anchoring the short end of their yield curves at zero, it makes sense for stock prices to keep rising at least until valuations exceed the peak multiples of previous bull markets—and certainly until equities are more expensive than they are at present relative to bonds. (…)

I say this in full knowledge that bond yields are still “far too low,” even after the recent doubling. I have long argued that the global bond bubble, with more than US$13trn worth of global bonds trading on negative yields, is by far the biggest and most extreme speculative bubble the world has ever seen. Despite this, there are two reasons why bond yields will rise only very slowly, with a return to “fair value” likely to take a decade or more.

The first is that governments and central banks have strong means and even stronger motivations to ensure that the bond bubble deflates slowly, instead of bursting suddenly. The motivations are the need to limit debt servicing costs, to keep economies growing and to avoid financial instability, or at least to postpone it for as long as possible. The means are quantitative easing plus various forms of financial repression whereby regulators can force financial institutions and banks to buy “risk-free”

bonds even when these investors are guaranteed to lose money.The second reason for confidence that the bond bubble will deflate slowly instead is that the most active participants in government markets do not give a damn about the negative returns guaranteed to long-term bond investors, since they buy bonds for short-term trading profits and yield-curve carry. Because of the interaction between these short-term players and carry traders with central banks indifferent to “fair value” losses, and pension and insurance funds that can pass on to customers the negative returns on their “liability-driven investments”, bond yields are relatively easy for governments to manage and control.

The upshot is that bonds are likely to stabilize for a considerable period in a new trading range that will remain much lower than would seem to be dictated by fundamentals,” despite the fact that almost every economist and financial analyst believes (rightly) that bond yields must ultimately move much higher. Last month, I thought (wrongly) that the top of this trading range might be around 1.5%.

Now it looks as if the ceiling may be 1.75%. But perhaps it will be as high as 2%, or even 2.25%. Whatever turns out to be the top of the new trading range, if US 10-year yields stay below the ceiling of 3% that has held since 2011, they will not be a major hurdle to higher equity prices. When the bull market dies, as it surely will someday, it will be killed by a turn in the economic cycle or a crazy upsurge in equity valuations, not by the yield on US bonds. (…)

So, equities are very expensive, but not relative to bond yields which, themselves, remain “far too low”. The step down, when it happens, could be pretty steep…

EARNINGS WATCH

Entering the Q1’20 earnings season, we already have 21 early reporters boasting an 81% beat rate and a +5.9% surprise factor, resulting in an 11.3% earnings growth rate (revenues up 8.1%) in Q1 for these companies, 13 of which are consumer-related and 5 in Technology.

Expectations are for earnings to jump 25% YoY in Q1 (26% ex-Energy) on revenues rising 8.8% (10.3% ex-E).

In light of the sharp rise in cost pressures in recent months, investors are eager to listen to earnings calls for reassurance on profit margins going forward. Pre-announcements did not worsen materially in the past month.

Analysts remain upbeat with earnings growth of 54.9% in Q2, 20.2% in Q3 and 14.1% in Q4.

Trailing EPS are now $149.37, on their way to an estimated $176.51 for the year and $203.10 for 2022. Obviously, analysts have not started to factor in any corporate tax increases.

The U.S Treasury released its “Made in America Tax Plan” last week, detailing the White House tax proposal. The Senate will no doubt table its own versions. For now, the CBO projects corporate profits totaling $29.3 trillion over the next ten years. A $2 trillion rise in gross corporate taxes would represent a 7% increase off of that base, impacting foreign profits (multinationals) more than domestic profits.

Using trailing EPS of $149.37 and a 1.3% inflation rate, the Rule of 20 P/E is 28.8. “Normalizing” EPS with the 2021 estimate of $176, the R20 P/E becomes 24.7 while the actual P/E is 23.4. Using the 2022 estimate, before any tax increase, brings the R20 P/E to 21.6 and the actual P/E to 20.3.

Note that the coming rise in inflation will negatively impact the R20 P/E, however transitory it will be. Not only will we need to normalize earnings, we will also need to normalize inflation.

Assuming the market is adequately normalizing inflation with the current 2.1% 5-year inflation rate, the “fully normalized” R20 P/E is 22.4 using profits of $203 and 23.9 using a “further normalized” EPS of $189 assuming a 7% tax bite.

The next 2 charts reflect “fully, fully normalized” EPS and inflation numbers:

Steve Blumenthal posts this interesting NDR chart valuing equity markets against trend-lined GDI (the U.S. collective income). Given that there is a strong likelihood that both corporate and individual taxes will rise in coming years, “normalizing” the denominator would make the reading even scarier.

(…) Goldman strategists including David Kostin estimate that in the unlikely scenario that no tax reforms are adopted, the S&P 500’s annual earnings per share will grow by 12% to $203 next year. However, full adoption of the Biden proposals would cut growth to just 5% or $190.

“Legislation will be heavily negotiated,” the strategists write, adding their current estimate for a 9% earnings per share growth assumes that taxes will rise. (…)

Meanwhile, in the Eurozone

Brussels faces battle on new pan-EU revenue sources European Commission aims to raise at least €13bn a year to service post-pandemic borrowing

- Germany’s highest court blocks ratification of EU recovery fund

- Italy crisis raises concerns about EU recovery spending

- Wolfgang Schäuble issues warning on EU recovery fund

TECHNICALS WATCH

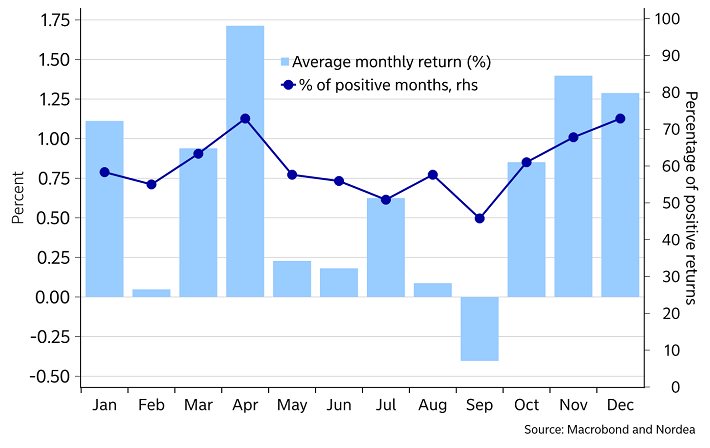

Nordea also warns us on stock seasonality, also not very useful recently…

S&P500 – worse seasonality approaching

My favorite technical analysis firm remains positive even while noticing weaker short-term momentum and pretty soft volume in recent weeks, underscoring investor uncertainty, possibly due to inflation/interest rates angst and/or taxation. Another area with diminishing participation.

Asset Class returns over the last 10 years

@charliebilello

@charliebilello

COVID-19

- Recent Rise in Covid-19 Cases Driven by Younger People Epidemiologists, public-health authorities point to school sports as major source of transmission

Five states—Michigan, New York, Florida, Pennsylvania and New Jersey—account for some 42% of newly reported cases. In Michigan, adults aged 20 to 39 have the highest daily case rates, new data show. Case rates for children aged 19 and under are at a record, more than quadruple from a month ago. There were 301 reported school outbreaks as of early last week, up from 248 the week prior, according to state data.

Epidemiologists and public-health authorities have pointed to school sports as a major source of Covid-19 transmission. Since January, K-12 sports transmission in Michigan has been highest in basketball, with 376 cases and 100 clusters; in hockey, with 256 cases and 52 clusters; and in wrestling, with 190 cases and 55 clusters. Overall, cases and clusters have occurred in over 15 sport settings, data from the state shows. (…)

Across the U.S., more than half of the new cases are among people aged 18 to 54, CDC data shows. (…)

(Raymond James)

Concern over the efficacy of China’s Covid-19 vaccines is rising after a senior health official acknowledged the level of protection they provide is not high, before backtracking on the comments, and a key shot was confirmed to be less potent than other immunizations.

George Fu Gao, head of the Chinese Center for Disease Prevention and Control, said at a forum on Saturday that something needed to be done to address the low protection rate of the Chinese shots, according to local news outlet the Paper.

The rare admission by a senior Chinese official appeared to go viral on social media over the weekend, but posts and media reports about Gao’s comments were quickly censored or taken down. Gao told state-backed newspaper the Global Times on Sunday that his remarks were misinterpreted, and were only meant to suggest ways to improve the efficacy of vaccines.

Meanwhile, a study published over the weekend on late-stage testing of Sinovac Biotech Ltd.’s vaccine in Brazil confirmed readouts from late last year that showed its efficacy at slightly above 50%, a level that barely crosses the mark of minimum protection required for Covid vaccines by leading drug regulators.

Other coronavirus shots developed by Chinese companies have reported efficacy of anywhere between 66% to 79% in preventing symptomatic Covid — all below the more than 90% protection rate found in the mRNA vaccines developed by Pfizer Inc. and Moderna Inc.

The public, high-profile recognition that China’s vaccines may be less effective may fuel already-widespread vaccine hesitancy among the Chinese population, many of whom now see Covid as a distant threat and also harbor concerns about locally developed shots. China is aiming to vaccinate 40% of its population — or 560 million people — by the end of June, an ambitious effort that will require it to move at twice the pace of the U.S. (…)

China Hits Alibaba With $2.8 Billion Antitrust Fine In recent months, the business empire of Alibaba founder Jack Ma has come under increasing regulatory scrutiny.

China’s State Administration for Market Regulation said Saturday in Beijing that Alibaba punished certain merchants who sold goods both on Alibaba and on rival platforms, a practice that it dubbed “er xuan yi”—literally, “choose one out of two.” (…)

The 18.2 billion yuan fine is equivalent to 4% of the company’s domestic annual sales, the regulator added. Under Chinese rules, antitrust fines are capped at 10% of a company’s annual sales.

Alibaba’s business practices limited competition, affected innovation, infringed on the rights of merchants and harmed the interests of consumers, the regulator said. (…)

While the fine is large, the government’s treatment of Alibaba contrasts with that of Ant Group, which has been ordered to transform itself into a financial holding company overseen by China’s central bank. The restructuring could significantly cut into revenue and profit growth at Ant. Its IPO had been expected to be the world’s largest before it was canceled.

Chinese officials said Beijing was reluctant to come down too severely on Alibaba, a pillar of the Chinese tech sector that is immensely popular among consumers, but wanted it to dissociate from Mr. Ma, The Wall Street Journal previously reported. (…)

- China reportedly halting enrolment at business school backed by Alibaba founder Jack Ma The clampdown on the school, founded in 2015 by Ma to train China’s next generation of entrepreneurs, comes as his business empire faces government scrutiny.

- Ant was told to become a financial holding company by China’s central bank, meaning it may be regulated more like a bank. (Bloomberg)

Blinken Warns China on Taiwan Encroachment, Russia on Ukraine

U.S. Secretary of State Antony Blinken warned China against encroaching on Taiwan, and blamed secrecy by the government in Beijing for helping to hasten the spread of Covid-19.

In an interview with NBC News, Blinken voiced concern about tension fomented by Chinese “aggressive actions” in the Taiwan Strait and said the U.S. stands by its commitments to ensure the island’s self-defense.

“It would be a serious mistake for anyone to try to change the existing status quo by force,” Blinken said on “Meet the Press” on Sunday, adding that he wouldn’t speculate about possible U.S. responses. (…)

Endless U.S.-China Contest Risks ‘Catastrophic’ Conflict, Henry Kissinger Warns

Speaking with former British Foreign Minister Jeremy Hunt in a Chatham House webinar on Thursday, Kissinger said that “endless” competition between the world’s two largest economies risks unforeseen escalation and subsequent conflict, a situation made more dangerous by artificial intelligence and futuristic weaponry. (…)

Beijing is not “determined to achieve a world domination,” Kissinger said Thursday, but rather “they’re trying to develop the maximum capability of which their society is able.”

China’s rise is challenging U.S. hegemony, prompting nerves in Washington, D.C. and among American allies in Europe and elsewhere. China’s economy is on course to eclipse America’s within the coming decades, and Chinese military investment, nuclear arms, and technological advances have set it firmly on the path to superpower status. (…)

In Washington, there is now bilateral agreement that China presents a challenge to be addressed rather than a commercial opportunity to be exploited.

President Joe Biden has vowed to be tough on China, following on from four years of U.S.-China simmering conflict under former President Donald Trump. Biden’s team have framed their strategy as competition rather than conflict, seeking to challenge Beijing from a position of strength and with the support of American allies.

(…) Kissinger said Thursday that Washington and Beijing must learn to live with each other to maintain peace.

“Is it necessary to have a coherent view of governance in order to have a peaceful order?” Kissinger asked. “Or is it possible to work out an international order in which the fundamental domestic principles vary to some extent, but there’s an agreement on what is needed to prevent a breakdown of the international order?”

Kissinger continued: “And if you add to it the element of technology, of…the revolutionary explosion of democracy, the development of artificial intelligence, of cyber and so many other technologies.

“And if you imagine that the world commits itself to an endless competition based on the dominance of whoever is superior at the moment, then a breakdown of the order is inevitable.

“And the consequences of a breakdown would be catastrophic,” Kissinger added.

America now, for the first time, has to decide “whether it is possible to deal with a country of comparable magnitude—and maybe in some respects marginally ahead—from a position that first analyzes the balance that exists,” Kissinger said.

The U.S. must also remember, he said, that international problems do not have “final solutions,” and that each apparent solution “opens the door to another set of problems.”

“Is it possible for us to develop a foreign policy thinking together with allies and understood by other countries that looks for world order at the basis of that sort of analysis?” Kissinger asked.

“if we don’t get to that point and if we don’t get to an understanding with China on that point, then we will be in a pre-World War One-type situation,” he warned, “in which there are perennial conflicts that get solved on a immediate basis but one of them gets out of control at some point.”

The situation now is “infinitely more dangerous,” Kissinger said, given the advanced weapons available to both the U.S. and China.

“A conflict between countries possessing high technology with weapons that can target themselves and that can start the conflict by themselves without some agreement of some kind of restraint cannot end well,” Kissinger warned. “And that’s an understatement.”