The Conference Board’s Composite Index of Leading Economic Indicators edged 0.1% higher (5.9% y/y) during October following a 0.6% September gain, revised from 0.5%. It was the smallest rise since May. (…)

Three-month growth in the leading index declined to 4.8% (AR), the weakest growth since June. (…)

Three-month growth in the coincident index held steady at 2.3% (AR). It remained improved from 1.6% growth early in the year, but below its 3.6% peak as of December. (…)

The three-month growth in the lagging index jumped to 1.9%, the quickest growth since June. (…)

Still no sign of recession from this indicator, however we look at it:

-

Drop in Durable-Goods Orders Signals Slowing Momentum Long-lasting factory goods orders have declined in three of the last four months

Orders for durable goods—products designed to last at least three years, such as computers and machinery—decreased 4.4% from the prior month in October, the Commerce Department said Wednesday. That was the biggest monthly decline in new orders since July 2017, and it was much steeper than the 2.6% drop Wall Street analysts had expected. (…)

Orders for September were reduced to a 0.1% decline from a previous estimate of a 0.7% increase.

The report showed orders in the volatile civilian aircraft category declined 21.4% in October. Still, a closely watched proxy for business investment—new orders for nondefense capital goods excluding aircraft—was flat in October after declining 0.5% in September and 0.2% in August. (…)

This chart plots actual new orders, peaking at the same level since 2000. But are we at a peak?

-

Home Sales Post Biggest Annual Drop in 4 Years Sales fell on an annual basis in October, as higher mortgage rates reduce home affordability

Existing-home sales edged up 1.4% in October from the previous month to a seasonally adjusted annual rate of 5.22 million, the National Association of Realtors said Wednesday. That broke a six-month streak when sales declined compared with a month earlier.

Sales, however, posted a sharp 5.1% drop compared with a year earlier, indicating the market is likely to end the year on a sluggish note. (…)

The rate for a 30-year fixed rate mortgage averaged 4.81% this week, down from 4.94% a week earlier, according to data released byFreddie Mac on Wednesday. Rates are still up significantly from a year ago, when they averaged 3.92%.

The median sale price for an existing home in October was $255,400, up 3.8% from a year earlier. That shows a cooling from a year ago, when prices rose about 5.5%. (…)

WHERE’S THE BEEF?

So, no signs of recession. But, look Ma:

- No housing! Last 3 quarters: -0.35%, contributed -3% to GDP growth.

- No agriculturing! Gross output down 13% in last 4 years.

- No trading! Last 4 quarters: –1.5%, contributed –12% to GDP growth.

- Little governmenting! Last 4 quarters: +1.67%, contributed 14% to GDP growth.

- Some manufacturing recently although real output up only 4.1% in last 4 years.

- Slowing investing! Last 4 quarters: +3.37%, contributed 28% to GDP growth. But negative in last 3 months.

Q3 GDP grew 3.5% but inventory accumulation (likely tariffs induced) contributed 2.1%. Real final sales were up only 1.4%. In Q2, a rush to beat tariffs boosted soybean exports and GDP. Trump’s trade “initiatives” have thus positively contributed to GDP in 2018 but much of it was front loading. Growth in real final sales to domestic purchasers has indeed accelerated from its 2.4% average of 2016-17 to 2.9% so far in 2018 but given the magnitude of the tax cuts and federal spending, the incremental economic boost is actually pretty light.

The reality is that all that’s really supporting this economy is the consumer. Last 4 quarters: +8.26%, contributed 68% to GDP growth, which is getting more and more dependent on consumer spending:

Net exports keep dragging GDP growth down. The resulting high trade deficit is thus really…

…mainly because of rising consumer expenditures boosting imports while exports are negatively impacted by the stronger dollar:

Corporate investment has had no positive contribution to economic growth for 20 years. The effects of the numerous and significant incentives adopted by the Trump administration seem to be fleeting as seen above. Rather unfortunate and dangerous…

…given the pretty strong correlation between investment and employment growth and the recent divergence:

The recent slight improvement in employment growth rate and the tax cuts have helped consumer spending but both expenditures and after tax income have grown faster than pretax income (red line). In 2019, tax cuts will disappear and growth in after tax income will more closely track pretax income. Nominal spending growth should normally slow by about 0.5% to the 4.5% range.

I am no economist but, from my lens, this economy is not resting on a very solid footing. And the Fed seeks 4 more rate increases just to get to “neutral”.

Speaking of the Fed, Heartland Advisors posted this chart showing debt as a percent of revenues which is, currently, at levels last seen at the worst of the financial crisis.

U.S. Corporate Debt as a % of Revenue

(Cornerstone Macro)

(Cornerstone Macro)

This makes it easy to estimate the effect that rising interest rates can have on corporate margins. At 94% debt/revenue, each 1% rise in the effective interest rate eats 0.94% of pretax margins. With the tax rate now at 21%, net margins are shaved by 0.74%. Given the popularity of leveraged loans in recent years, we can assume that the proportion of total corporate debt that is at floating rates has increased (Factset calculates that 51.5% of Russell 2000 companies’ debt was at floating rates in September 2018). At 30%, each 1% hike in rates cuts net margins by about 0.2%. At 50%: 0.4%.

As the Fed hikes and yield spreads expand, the bite on margins grows. There will be blood!

For those who missed this last week:

The BIS estimates that 12% of OECD companies are “Zombie companies” that don’t generate enough EBIT to cover their debt service, up from 8% in 2008. A majority of those 536 companies are U.S. based. In fact, Bianco Research estimated at the end of 2017 that 14.6% (220 companies) of the S&P 1500 companies were Zombies, nearly triple the number in 2008 nearly 4 times the number in 2000. Last August, David Hay, CIO at Evergreen/Gavekal found that 20% of the Russell 2000 companies can’t cover interest with EBIT. That’s 400 companies.

Last April, in TOPSY CURVY: SMALL IS NOT THAT BEAUTIFUL, I showed this truly scary alligator chart from David Hay, calculating that small cap Alli’s lower jaw below will sink by $5B for every 100 bps increase in interest rates. Assume that the average Russell 2000 company incurred a 4% average interest rate in 2017, a doubling in that number would eat $20B off the $150B in ebitda, a 13% drop before including any revenue impact from a weaker following such rate shock. Recall that tax reform makes interest costs more expensive than before.

Stan Druckenmiller talks about how “crazy priced” the credit market is. Last week, the WSJ wondered why the high yield market performed so well during the recent equity market sell off, in spite of disappearing lender protections. Maybe the absence of any serious recession warning coupled with the profit boost from the tax reform is keeping credit ratios acceptable, so far.

But the crazy wheel is in motion and it normally only gets stopped during the necessarily ensuing debt crisis. Druckenmiller’s point is that rising interest rates and increasingly restrictive central banks, aggravated by their own need to restore their balance sheets, will eventually trigger the collapse.

But something is actually happening in this crazy debt market:

- U.S. HY spreads have jumped almost 100 basis points since Oct. 3rd to reach 411 bps, the highest level since March 2017. Still a long way from the 850-900 bps range reached in 2011 and 2016 but the biggest reversal in 18 months, happening when most economic data sound great. Somebody must be getting scary of Zombies here. This can easily become a self fulfilling fear…

- The share of the U.S. investment grade (IG) nonfinancial bond market that is rated BBB, the lowest credit rating still considered IG, has increased to 54% in 2018. Actually, the universe of BBB rated bonds is now bigger than that of all BB rated bonds (the highest-rated speculative grade bonds) combined.

- Pimco reveals that

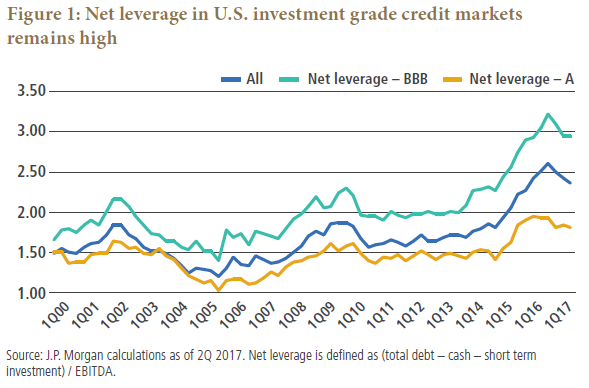

Back in 2000, net leverage of BBB rated nonfinancial corporates was 1.7x on average; in 2017, net leverage for these companies was 2.9x. This suggests a greater tolerance from the credit rating agencies for higher leverage, which in turn warrants extra caution when investing in lower-rated IG names, especially in sectors where earnings are more closely tied to the business cycle.

The higher leverage among U.S. investment grade issuers should also be seen in context: Back in 2010, only 6.6% of the IG nonfinancial market had net leverage greater than 4.0x, but as of 2017, that share increased to 19% (see Figure 2). In addition, only 26% of IG nonfinancial debt is leveraged less than 2.0x as of 2017, compared with 55% in 2010.

- There is a new Zombie in town, and a huge one. Rated triple-A since 1956, GE’s mammoth $110 billion debt is now rated triple-B+, only 3 steps before junk, as the 126-year-old conglomerate, once the most valuable U.S. corporation and a global symbol of American business power, faces the stark reality that Jack Welch and Jeff Immelt far from deserved their reputation. General Eclectic (its 10-K is 220 pages!) shares touched $60 in 2000 when it sold for 50 times EPS and 12 times book. Now: $8.00 and 9 times trailing earnings with zero visibility for future earnings, if any.

The next step in this crazy debt market will likely be the passing of a massive amount of BBB debt into the High Yield bucket and the impact that this huge overflow will cause. There will be blood! And were GE’s debt to lose 3 more notches, the $1.2T junk bucket would totally erupt. Refinancing in such an environment will only aggravate the look of the current Zombies and bring along a new wave of these beasts.

I wonder if the Fed is aware of this potential side effect…

![image_thumb[1] image_thumb[1]](https://i0.wp.com/www.edgeandodds.com/wp-content/uploads/2018/11/image_thumb1_thumb.png?resize=554%2C407)

![image_thumb[3] image_thumb[3]](https://i0.wp.com/www.edgeandodds.com/wp-content/uploads/2018/11/image_thumb3_thumb.png?resize=554%2C329)

![image_thumb[5] image_thumb[5]](https://i0.wp.com/www.edgeandodds.com/wp-content/uploads/2018/11/image_thumb5_thumb.png?resize=554%2C300)

![image_thumb[15] image_thumb[15]](https://i0.wp.com/www.edgeandodds.com/wp-content/uploads/2018/11/image_thumb15_thumb.png?resize=554%2C329)

![image_thumb[11] image_thumb[11]](https://i0.wp.com/www.edgeandodds.com/wp-content/uploads/2018/11/image_thumb11_thumb.png?resize=554%2C332)

![image_thumb[8] image_thumb[8]](https://i0.wp.com/www.edgeandodds.com/wp-content/uploads/2018/11/image_thumb8_thumb.png?resize=554%2C334)

![image_thumb[10] image_thumb[10]](https://i0.wp.com/www.edgeandodds.com/wp-content/uploads/2018/11/image_thumb10_thumb.png?resize=554%2C334)

![image_thumb[13] image_thumb[13]](https://i0.wp.com/www.edgeandodds.com/wp-content/uploads/2018/11/image_thumb13_thumb.png?resize=554%2C334)