December CPI:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent on a seasonally adjusted basis in December, after rising 0.3 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.9 percent before seasonal

adjustment.The index for all items less food and energy rose 0.2 percent [0.19%] in December, after increasing 0.3 percent in each of the previous 4 months. Indexes that increased in December include shelter, airline fares, used cars and trucks, new vehicles, motor vehicle insurance, and medical care. The indexes for personal care, communication, and alcoholic beverages were among the few major indexes that decreased over the month.

The all items index rose 2.9 percent for the 12 months ending December, after rising 2.7 percent over the 12 months ending November. The all items less food and energy index rose 3.2 percent over the last 12 months.

Services CPI: +0.3%, unchanged.

US Wholesale Inflation Surprisingly Eases on Drop in Food Prices Producer price index rose 0.2% in December, below estimates

The producer price index for final demand rose 0.2% from a month earlier, according to a Bureau of Labor Statistics report released Tuesday. The median forecast in a Bloomberg survey of economists called for a 0.4% gain. A measure excluding food and energy was unchanged from November.

Compared with a year earlier, the overall PPI climbed 3.3% and core measure advanced 3.5%, both the highest since February 2023.

(…) the PPI report showed services prices were unchanged, one of the tamest readings of 2024 and reflecting declines in margins. (…)

Monthly volatility…

…quarterly stability at +2.3% annualized since Q2’23.

NFIB Small Business Survey: Optimism Surges to Six-Year High

The Trump jump!

Here is an excerpt from NFIB Chief Economist Bill Dunkelberg in the latest news release:

“Optimism on Main Street continues to grow with the improved economic outlook following the election. Small business owners feel more certain and hopeful about the economic agenda of the new administration. Expectations for economic growth, lower inflation, and positive business conditions have increased in anticipation of pro-business policies and legislation in the new year.”

All “optimistic expectations”

Europe Threatens to Trigger a Global Scramble for Natural Gas

The world is bracing for a fight for natural gas supplies this year, prolonging the pain of higher bills for consumers and factories in energy-hungry Europe and putting poorer emerging countries from Asia to South America at risk of getting priced out of the market.

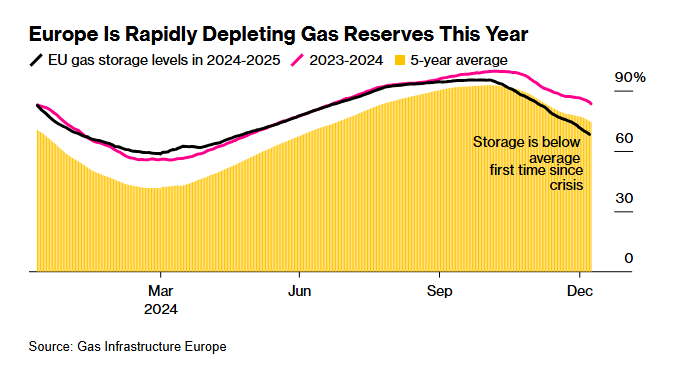

For the first time since the energy crisis was turbocharged by Russia’s war in Ukraine, Europe risks failing to meet its storage targets for next winter, setting the stage for one last scramble for supplies before new liquefied natural gas capacity starts to ease the situation next year.

While Europe has enough gas reserves to get through this winter and prices have eased since the start of the year, inventories are being eroded by cold weather, which swept across the continent this weekend. Supply options have been squeezed since the start of this year, when Russian pipeline deliveries through Ukraine ceased following end of a transport agreement.

“There will certainly be an energy gap in Europe this year,” said Francisco Blanch, commodity strategist at Bank of America Corp. “That means that all the incremental LNG that’s coming online this year around the world will go into making up for that shortfall in Russian gas.”

To cover its projected demand, Europe will need to import as much as an extra 10 million tons per year of LNG — about 10% more than in 2024, according to Saul Kavonic, an energy analyst at MST Marquee in Sydney. New export projects in North America could help ease market tightness, but that hinges on how quickly the facilities can ramp up production.

With fewer options to restock for next winter, Europe will need LNG shipments, pulling some away from Asia, home to the world’s biggest consumers. Depending on how demand shapes up, the competition would drive prices higher than countries like India, Bangladesh and Egypt can afford and weigh on Germany’s economic recovery.

Gas futures in Europe, which typically also impact Asian spot LNG prices, are still about 45% higher than at the same period last year and contracts are trading at around triple pre-crisis levels so far in 2025. (…)

It isn’t easy for all utilities and industries to find alternatives to gas. That’s a particular problem for Germany, which was reliant on Russia for more than half of its gas supplies before the Kremlin invaded Ukraine in 2022. (…)

It’s a similar situation in South America. Brazil struggled to replace waning hydropower generation following a drought-stricken period, and Argentina could be drawn into the competition for LNG for its upcoming heating season.

Egypt is also exposed. The country surprised the market last year when it shifted from LNG exporter to importer as it grappled with summer blackouts, boosting purchases to the highest level since 2017, according to ship-tracking data compiled by Bloomberg. The country may still require dozens of shipments this year to survive summer heat. (…)

That puts the spotlight on the US. The world’s biggest LNG supplier has for years pitched to save Europe from gas starvation and the message is likely to get louder after Donald Trump enters office. He has already threatened tariffs if Europe doesn’t buy more American energy.

This year, US LNG exports are expected to rise by about 15%, according to Kpler, as Venture Global LNG Inc.’s Plaquemines and Cheniere Energy Inc.’s Corpus Christi expansion increase production. But the pace is in doubt. Cheniere has already warned the ramp-up this year will be “relatively slow.”

In Russia, still Europe’s second-biggest source of LNG, the focus will be on whether the nation will be able to maintain its exports after the US on Friday imposed sanctions on two smaller facilities. Western sanctions have already stifled the major Arctic LNG 2 project and affected key equipment and service supplies, delaying its full completion by two to three years, according to Claudio Steuer, energy consultant and faculty member of IHRDC in Boston.

Trump, who has vowed to end Russia’s war in Ukraine, could also change the overall market outlook, especially if a peace deal includes energy, as expected. Russian pipeline gas exports via Ukraine could eventually continue in 2025, according to a note by Anthony Yuen and other analysts at Citigroup Inc.

For now, Asia has enough slack to cede LNG supply to Europe. China’s LNG importers have been reselling shipments for delivery through March and have largely halted purchases from the spot market, where prices are elevated. Indian gas importers have turned to cheaper alternatives, while Bangladesh has been forced to adjust purchase tenders after offer prices were too high. Egypt turned to gasoil.

Relief is on the horizon though. From 2026 onwards, delayed projects are slated to finally start shipping fuel. At that point, tight markets could become loose, according to Jefferies Financial Group Inc.

An additional 175 million tons of new supply will start arriving by 2030, primarily from the US and Qatar. That could cause downward pressure on prices and bring back customers in countries that are getting squeezed out this year.

“If current LNG expansion plans hold, 2026 should be the light at the end of the tunnel,” said Florence Schmit, a European energy strategist at Rabobank. (…)

Trump’s threat to US liberal democracy We must hope that the American people will not lightly abandon the enlightenment traditions of their country

I hope this free link to Martin Wolf’s piece in today’s FT works.