New feature: EDGE AND ODDS’ DaiLY CHAT.

Most days, I will provide a link to an AI generated chat on the day’s post courtesy of Google’s NotebookLM. Not totally satisfying but worth offering to readers on the go. No support charts however and some AI generated conclusions not really mine….

And there is much more on the blog itself.

And if you sense hallucinations, editorializing and patronizing, I will totally fault AI ![]() .

.

CONSUMER WATCH

Overall, in our view, the consumer continues to show modest forward momentum. Bank of America aggregated credit and debit card spending per household fell 0.9% year-over-year (YoY) in September, following a 0.9% YoY rise in August. But the timing of Labor Day impacted the YoY comparisons over August and September. Seasonally adjusted spending rose 0.6% month-over-month (MoM) in September, following a 0.2% decline in August.

Looking at quarterly averages, Services spending growth remains very persistent, with no clear direction to retail spending growth.

Hurricane Helene, which resulted in a tragic loss of life and widespread displacement of communities, occurred relatively late in the month, so the impact on overall credit and debit card spending was limited at the national level. However, in the last week of September, card spending was down sharply in impacted states.

Bank of America internal data on after-tax wages and salaries growth continues to be supportive of consumer spending. Though higher-income growth has made notable gains over the past six months, lower-income wage growth remains strongest at 3.5% YoY in September.

Americans’ home equity as a percentage of home values is at its highest since the 1950s, according to Federal Reserve data. This is a product of many factors. For one, house prices have increased sharply over the past five years. And at the same time, the level of housing transactions has been low, with many homeowners reluctant to move given rising mortgage rates and often being ‘locked in’ to much lower, fixed rates.

Wage Growth and Labor Market Tightness

Just released by the NY Fed:

Good measures of labor market tightness are essential to predict wage inflation and to calibrate monetaryvpolicy. This paper highlights the importance of two measures of labor market tightness in determiningvwage growth: the quits rate and vacancies per effective searcher (V/ES)—where searchers include bothvemployed and non-employed job seekers.

Amongst a broad set of indicators of labor market tightness, wevfind that these two measures are independently the most strongly correlated with wage inflation and alsovpredict wage growth well in out-of-sample forecasting exercises.

Conversely, transitory shocks to productivity have little impact on wage growth.

The Heise-Pearce-Weber (HPW) Tightness Index uses both the quits rate and V/ES jointly:

Figure 3 demonstrates the fit of the HPW Index visually by plotting it against wage growth, measured using a 3-period moving average of the 3-month growth in the ECI (both series are normalized to have a mean of zero and variance of one for ease of comparison). We compare our measure against a common measure of labor market tightness: the Conference Board’s survey measure of consumers’ perception of job availability.

Both the Conference Board measure and the HPW index track wage growth well in the prepandemic period. However, in the pandemic period, our measure performs significantly better.

Having shown the ability to predict contemporaneous wage growth, we now turn to a forecasting exercise where we leverage the quits rate and V/ES to make predictions on wage growth.

Based on our methodology, we predict an annualized 3-month ECI reading of 3.33 percent in 2024:q3 (0.82 percent compared to the previous quarter), after 3.41 percent annualized in 2024:q2.

FYI, the ECI wage growth was 4.0% YoY in Q2, down from 4.3% in Q1 and 3.0% in Q4’19. On a QoQ basis, ECI-Wages slumped from +1.1% in Q1 to +0.8% in Q2. In 2019, ECI-Wages growth averaged +0.74% per quarter.

Also FYI, the Atlanta Fed Wage Growth Tracker was at 4.6% YoY in August (3m m.a.):

German Government Slashes Economic Forecasts Germany has struggled to recover from the economic hit from Russia’s full-scale invasion of Ukraine

The German economy should contract 0.2% this year, Germany’s economy ministry said in a fall economic projection, considerably lower than the 0.3% rise it anticipated in April.

That would mean Germany’s economy would shrink for the second-straight year—it contracted 0.3% in 2023—for the first time since the early-2000s. That marks a contrast with other developed economies, such as the U.S., which grew 2.9% last year and 3% in the second quarter of this year on an annualized basis.

Germany has struggled to recover from the economic hit from Russia’s full-scale invasion of Ukraine, which caused energy prices to spike, scarring its energy-intensive manufacturing sector that has yet to recover its pre-pandemic output.

Europe’s largest economy is also weakly placed as a typically export-driven nation amid the recent global economic slowdown, with demand for German goods in China tailing off.

The economy minister, Robert Habeck, said Wednesday that Germany also has less leeway to stimulate the economy than other leading nations, including the U.S., due to a constitutionally enshrined fiscal rule that prohibits large deficits. (…)

Berlin expects gross domestic product to rise 1.1% in 2025 and 1.6% in 2026, as private consumption and a recovery of exports help boost growth. (…)

Germany’s government expects inflation to fall from an average of 5.9% last year to 2.2% in 2024 and 2.0% in 2025—the latter matching the ECB’s target.

France’s government is to deliver its 2025 budget on Thursday with plans for 60 billion euros ($65.68 billion) worth of tax hikes and spending cuts to tackle a spiralling fiscal deficit.

Prime Minister Michel Barnier’s new government is under increasing pressure from financial markets and France’s European Union partners to take action after tax revenues fell far short of expectations this year and spending exceeded them.

But the budget squeeze, equivalent to two points of national output, has to be carefully calibrated to placate opposition parties, who could not only veto the budget bill but also band together and topple the government with a no-confidence motion.

Lacking a majority by a sizeable margin, Barnier and his allies in President Emmanuel Macron’s camp will have little choice but to accept numerous concessions to get the budget bill passed, which is unlikely before mid to late December. (…)

Barnier has said he will spare the middle class and instead target big companies with a temporary surtax and people earning over half a million euros per year.

All taxpayers will nonetheless be hit by plans to restore a levy on electricity consumption to where it was before an emergency reduction during the 2022-2023 energy price crisis.

The government has said the budget bill will reduce the public deficit to 5% of gross domestic product (GDP) next year from 6.1% this year – higher than almost all other European countries – as a first step towards bringing the shortfall into line with an EU limit of 3% in 2029.

China Wages End Two Quarters of Gains, Adding Deflationary Risks Salaries offered to new hires decrease 0.6% from a year ago

Average monthly salaries offered by companies to new recruits in 38 key Chinese cities fell 0.6% in the third quarter from a year ago to 10,058 yuan ($1,423), according to data provided by online recruitment platform Zhaopin Ltd. and compiled by Bloomberg. The decrease follows a modest uptick of 2.2% and 0.5% in the first and second quarters, respectively.

The figures add to other recent data in revealing a worsening job market that’s discouraging residents from spending more and deepening a cycle of price and wage declines. (…)

The Q3 earnings season begins.

The stock market rally continues to broaden as more stocks participate. The percentage of S&P 500 companies with positive y/y price changes is at 85% (chart).

The stock market has rallied even as the 10-year Treasury bond yield rose from 3.62% on September 16 to 4.07% today (chart). That surprised plenty of bond investors who expected the Fed’s 50bps cut in the federal funds rate (FFR) and very dovish forward guidance to push yields lower.

We weren’t surprised because the backup in the bond yield confirms our view that the Fed is stimulating an economy that doesn’t need additional stimulus. Today’s reading of the Atlanta Fed’s GDPNow tracking model shows a 3.2% (saar) increase in Q3’s real GDP, following Q2’s 3.0% (chart). In other words, real GDP also continues to notch new record highs. (…)

We think the FOMC will leave rates unchanged next month. None-and-done is still our outlook for the rest of this year.

From Goldman Sachs:

The much stronger-than-expected September employment report accelerated the adjustment higher in UST yields as the market quickly reduced the likelihood of large Fed cuts, and we think the upward pressure on rates has room to run. While the adjustment has so far played out most prominently in front-end rates, we continue to think that, over the medium term, further accumulation of good growth news should drive yields higher across the curve.

The strong employment report also further boosted the broad Dollar, and we think the report is sufficient to put a floor under the Dollar, which should also continue to benefit from its safe-haven status.

Further escalation in the Middle East conflict has continued to raise questions about the growth and market impacts of a broader war in the region. We continue to think that the biggest impacts of such a scenario would come through a disruption in energy supplies, with a potential disruption to Iranian oil production likely to lead to a further rise in oil prices.

Indeed, we estimate that Brent prices could rise by $10-20/bbl by 2025 in the event of a 1mb/d persistent disruption or 2mb/d 6-month disruption to Iran supply, with the ultimate impact depending on whether OPEC chooses to offset the production losses by deploying spare capacity.

In both disruption scenarios, we caution that a potential reversal in speculative positioning—which currently sits in the lowest 1% of history—may increase the upward pressure on prices and risk premia.

On the gas front, we estimate that a full, sustained disruption to Israel’s Leviathan and Tamar gas fields this winter would tighten the global LNG market by around 2%, which would leave European markets vulnerable to price spikes, especially this winter.

AI CORNER

Internet Hype in the ’90s Stoked a Power-Generation Bubble. Could It Happen Again With AI? The current electricity boom has echoes of—but also important differences from—an earlier boom-bust cycle

(…) Hugh Wynne, co-head of utilities and renewable-energy research at SSR, worked at a power-project development company from the mid-1990s to 2001. He said developers at the time assumed that the long-term power price would match the long-run marginal cost of new power-plant capacity, covering both variable operating costs as well as capital costs. In fact, Wynne said, after the aggressive build-out resulted in a surplus of capacity in many markets, power prices fell sharply, covering only the operating costs of these power plants—not enough for the companies to pay off the debt they raised to build them.

Could the current market face similar problems? Likely not in quite the same way. For one thing, the drivers of electricity-demand growth are more tangible this time around. Tech companies are spending real money on building out AI infrastructure, and the Chips Act contains clear incentives for nearshoring chip manufacturing. At the same time, energy demand from transportation and industrial applications—including fracking equipment—is steadily shifting to electricity.

Secondly, the industry today is more familiar with how competitive power markets work. Independent power producers and the financiers backing their projects were burned enough by the last gold rush that they aren’t likely to invest in new power plants without some kind of long-term power-purchase agreement, Wynne said. Always-available power is important for data centers, and tech companies have been willing to sign long-term contracts at premium prices. (…)

Notably, utilities’ long-term demand forecasts have changed a lot over the past few years and are likely to keep being revised. In early 2021, utilities in aggregate expected load to grow 8.2% by 2035 compared with 2021 levels, according to analysis by the Rocky Mountain Institute. As of June 2024, the expected growth was 23.9%. (…)

Independent power producers might not be the only beneficiaries of rising electricity demand. Regulated utilities have been teaming up with tech companies to develop new generation, including Berkshire Hathaway-backed NV Energy and Duke Energy. Utilities in certain states aren’t allowed to own their generation, but some have said they would push for legislation to change that.

The power industry has matured a lot in the past two decades. But the same fundamental lesson holds: High-voltage expectations can lead to painful burns.

Related: Power Play

- Amazon Unveils AI Tool to Help Drivers Find Packages Faster Technology will shorten typical delivery route by 30 minutes

The technology projects a green circle on packages to be delivered at each stop and red Xs on those to be delivered later, Amazon said Wednesday at a Nashville media event focused on its logistics and online shopping initiatives.

Called Vision Assisted Package Retrieval and in development since 2020, the tool will be deployed in 1,000 Amazon vans next year and will shorten the typical delivery route by about 30 minutes, the company said.

The tool uses computer-vision technology initially developed in Amazon warehouses to identify products without using barcode scanners. The technology was adapted for vans’ cramped cargo areas and integrated with delivery-route navigation software.

“Delivery drivers will no longer have to spend time organizing packages by stops, reading labels or manually checking key identifiers like a customer’s name or address to ensure they have the right packages,” Amazon said in a release. “They simply have to look for VAPR’s green light, grab and go.”

-

OpenAI may be a tech darling but data indicate it won’t actually turn a profit until 2029, The Information reported. Losses are expected to be as high as $14 billion in 2026. (Bloomberg)

@StephaneDeo

@StephaneDeo

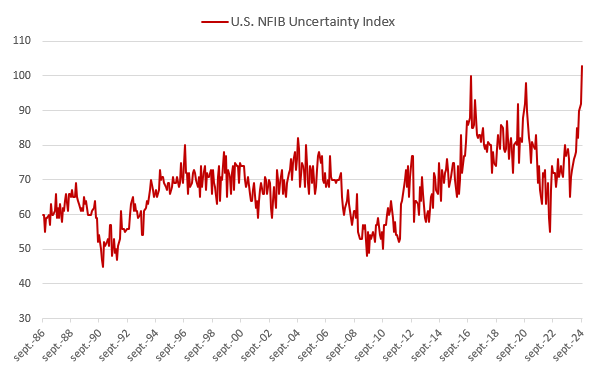

Is it really only about the elections?

Is it really only about the elections?