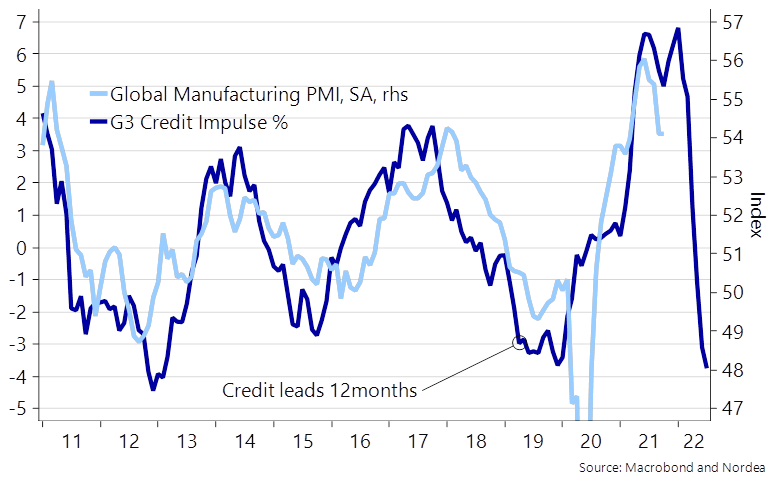

MANUFACTURING PMIs

New orders are the lifeblood of businesses; new export orders are the lifeblood of world trade. Here are what the various manufacturing surveys tell us:

- USA: “strong demand conditions; expansion in new orders remained sharp and historically elevated. New export sales rose only fractionally.”

- Canada: “greater client demand; sharp upsurge in new orders; exports also rose at quicker pace with the rate of growth the steepest since May 2018.”

- Eurozone: “new business intakes continued to rise during October, but the rate of expansion was the weakest since January; new export orders expanded at the weakest pace since the beginning of the year.”

- China: Markit’s survey shows “total new orders rising to the greatest extent in four months; the upturn was largely driven by stronger domestic demand, as foreign orders fell for the third month in a row.” The official survey of larger companies, says that “new orders and new export orders are in contraction at 48.8 and 46.6.”

- Japan: “new orders returned to expansion territory in October following a reduction in September. The pace of growth was marginal however, and weaker than the average seen in the year to date. New export sales also increased in October, with growth easing to a fractional pace.”

- ASEAN: Order book volumes saw a similar trend, rising for the first time in five months and at the steepest pace in the series history, albeit one that was slightly slower than for output, in part due to a broad stabilisation of new export orders.”

My conclusion in terms of momentum: the U.S. domestic economy is the strongest followed by Canada, its main trading partner and also very generous with direct rescue payments.

But just about everywhere else, demand is slowing with export orders particularly weaker across the board, particularly in China. The world economy is slowing with only North American domestic demand showing any momentum. Let’s hope Americans keep spending…

USA: Output growth hampered further by material shortages, but expansion in new orders remains sharp

October PMITM data from IHS Markit signalled a steep improvement in operating conditions across the U.S. manufacturing sector. Although the overall upturn slowed to the softest in 2021 so far, the expansion in new orders remained sharp and historically elevated. Nonetheless, output growth eased again to the weakest since July 2020 amid capacity constraints including material shortages. A lack of input availability and transportation delays led to a severe deterioration in vendor performance, with input costs rising markedly. At the same time, firms passed through higher input prices to their clients, as charges rose at the fastest pace on record. Meanwhile, concerns regarding supply chain disruption and inflation weighed on business confidence which dropped to the weakest for a year.

The seasonally adjusted IHS Markit U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) posted 58.4 in October, down from 60.7 in September and below the earlier released ‘flash’ estimate of 59.2. The latest improvement in the health of the U.S. manufacturing sector was sharp, despite being the weakest for ten months.

Contributing to the overall upturn was a steep rise in new business at manufacturing firms in October. Companies continued to highlight strong demand conditions, but some noted that raw material shortages were hampering demand from clients as stocks of inputs had already been built or delivery times were too extensive. The pace of new order growth was the slowest for ten months. New export sales rose only fractionally as foreign demand was also weighed down by the knock-on effects of uncertain supply.

In line with capacity constraints, production growth slowed to the softest since July 2020 in October. Raw material and labour shortages were commonly cited as hampering the upturn.

Alongside supplier shortages, transportation delays and strong demand for inputs exacerbated an already substantial deterioration in vendor performance. The extent to which lead times lengthened was broadly unchanged from that seen in September and among the most marked on record.

The rate of input cost inflation remained substantial at the start of the fourth quarter, as hikes in vendor prices and greater transportation surcharges pushed costs up. With the exception of August and September’s record rises, the latest increase was the fastest since data collection began in May 2007.

At the same time, firms continued to partially pass on higher costs to clients. The rate of charge inflation accelerated to the fastest on record.

Despite marked increases in costs, firms expanded their input buying sharply again in October. Although at the slowest pace for seven months, companies attributed higher purchasing activity to efforts to build stocks amid greater new order inflows. Meanwhile, stocks of purchases rose only modestly as firms utilised current input holdings to supplement production. Similarly, stocks of finished goods fell solidly as companies sought to meet new order deadlines.

Backlogs of work rose markedly, and at one of the sharpest paces on record as firms grappled with pressure on capacity. The rate of growth eased to a four-month low, however, as employment increased at a solid pace.

Finally, output expectations dropped to a 12-month low in October amid concerns regarding inflation and supply-chain disruption.

From the ISM Manufacturing Survey, supply chain issues and rising prices are not mending just yet:

- “Global supply chain issues continue. Getting anything from China is near impossible — extreme delays. Microchip and circuit breaker shortages continue and are expected to continue into 2022.” [Computer & Electronic Products]

- “Business is getting stronger, but the supply chain is getting worse every day.” [Chemical Products]

- “Strong sales continue; however, we have diverted chips (semiconductors) to our higher-margin vehicles and stopped or limited the lower-margin vehicle production schedules.” [Transportation Equipment]

- “Import costs and delays hurting business, requiring more safety stock for uncertainty. Rolling blackouts in China starting to hurt shipments even more.” [Food, Beverage & Tobacco Products]

- “Domestic original equipment manufacturer (OEM) capital-expenditure spending is trending up for our business. We are seeing an increase of capital equipment with life spans of more than 10 years in the fourth quarter.” [Fabricated Metal Products]

- “Demand continues to be strong, but we continue to be held back by supply chain issues — logistics delays, as well as capacity and labor issues at suppliers.” [Electrical Equipment, Appliances & Components]

- “Business remains strong, with brisk incoming orders. We have become much more supply driven versus demand driven, due to shortages of labor, materials and freight. Costs continue to increase on all fronts, and we are considering our third price increase of the year for our customers.” [Furniture & Related Products]

- “Customer demand remains high. COVID-19 related supply chain issues still hamper our ability to meet demand. Labor is still difficult for our suppliers to obtain, and labor costs are rising.” [Machinery]

- “Demand for our products remains strong, but we continue to struggle to secure enough raw material to keep our manufacturing lines running.” [Miscellaneous Manufacturing]

- “My prediction is that 2022 will be very similar to 2021 — similar demand, constrained supply, restricted logistics and rampant inflation.” [Plastics & Rubber Products]

Canada: PMI hits seven-month high, but severe delivery delays and supply shortages persist

October PMI® data revealed another robust improvement in the health of Canada’s manufacturing sector. Expansions were seen across output, new orders, employment and purchasing activity. However, supply-chain pressures continued to mount with firms registering a record lengthening in lead times. This, paired with greater client demand and concerns of future supply shocks, led companies to raise their pre-production inventories at a record pace. Nevertheless, firms remained optimistic that global economic conditions will improve over the coming 12 months and support expansions in output.

Meanwhile, material scarcity for a wide range of inputs, as well as higher transportation and energy costs led to a near-record rate of input cost inflation. Selling prices also rose, and at the second-most marked rate in the series history.

The headline seasonally adjusted IHS Markit Canada Manufacturing Purchasing Managers’ Index® (PMI®) registered at 57.7 in October, up from 57.0 in September. The latest reading extended the period of growth to 16 successive months, with the latest expansion the third-strongest in over 11 years of data collection.

Central to growth was a sharp upsurge in new orders amid improvements in domestic demand and new product launches. Exports also rose at quicker pace with the rate of growth the steepest since May 2018.

Output expanded solidly during the month with the rate of growth little-changed from that seen in September. Larger workforces and rising orders were key drivers of production growth, though some firms did mention that delivery delays and material shortages did soften the overall uptick.

Goods producers continued to register substantial deteriorations in vendor performance with lead times lengthening at the most marked rate in the survey to date. Raw material and container shortages alongside transportation bottlenecks led to extensive delays.

As a result, cost burdens soared once again. Material shortages, especially for metals, packaging, and electronic components, drove the uptick. There were also reports of higher shipping, fuel, and energy costs. The rate of cost inflation was the second-steepest on record, close to September’s peak. Fortunately, the relatively strong demand environment allowed firms to raise their selling charges, which they did so at the second-fastest rate on record.

With supply-chain disruption persisting, and lead times especially lengthy, firms increased their input buying. Consequently, stocks of purchases rose, and at the steepest rate on record as firms sought to protect against future supply shocks and delivery delays. Postproduction inventories meanwhile fell only marginally, with firms reportedly making active efforts to boost output and prepare for greater demand in the coming months.

Finally, business confidence improved to the strongest since April 2018. Strengthening demand and hopes for improved global economic conditions underpinned optimism.

Eurozone: PMI drops to eight-month low as supply issues disrupt manufacturers

The eurozone manufacturing sector lost further momentum in October, latest PMI® data showed, as supply-side issues interrupted production schedules and dented order books, causing growth of both metrics to slow.

Firms’ struggles to obtain manufacturing inputs was also clear in survey data, with supplier delivery times lengthening to one of the most severe extents on record. Subsequently, input cost and output price inflation rates surged to new survey peaks.

The final reading of the IHS Markit Eurozone Manufacturing PMI dipped to 58.3 in October, from the ‘flash’ estimate of 58.5 and down from 58.6 in September. Overall, this signalled the slowest improvement in manufacturing sector conditions since February.

PMI movements varied by euro area constituents during October. The fastest-growing manufacturing sectors, the Netherlands, Ireland and Italy respectively, all recorded

stronger expansions, as did Greece. Meanwhile, the remaining monitored countries registered slowdowns, especially Germany and France, where the respective Manufacturing PMIs slumped to nine-month lows.

Supply-side issues were central to the softer expansion in the euro area manufacturing sector during October. Average lead times on input deliveries lengthened drastically and to the third-greatest extent in the survey history (since 1997), beaten only by those seen in May and June. Low shipping container availability, widespread shortages of components and raw materials and issues with transportation were all mentioned as sources of supply-chain pressures in October.

Difficulties in acquiring the inputs necessary for production was a frequently-cited reason by companies who lowered output in the latest survey period. Although production increased, the rate of expansion slumped to the slowest in the current 16-month growth sequence.

These issues had a similar impact on order books, according to firms. New business intakes continued to rise during October, but the rate of expansion was the weakest since January. Anecdotal evidence suggested that demand conditions had eased because of supply-side problems, as appetite for finished and semi-finished goods waned due to reduced availability. Similarly, new export orders expanded at the weakest pace since the beginning of the year.

As a result of supply restraints, inventory trends moved in opposing directions during October. While stocks of finished goods fell as firms filled orders from their warehouses, pre-production inventories increased at the fastest rate on record as firms upped their efforts at building precautionary stocks due to on-going shortages and lengthy lead times. Purchasing activity rose sharply in October, albeit at a rate unchanged on September’s eight-month low.

Subsequently, inflationary pressures intensified across the euro area, with input costs and output prices both rising at new survey-record rates in October.

Elsewhere, backlogs of work continued to rise during October, once again reflecting the ill effects of supply-chain disruption as firms lacked the necessary components to complete production. Meanwhile, efforts to boost operating capacities continued as employment rose for the ninth month running.

Finally, although business confidence remained strong and above its historical average in October, the level of positive sentiment slumped to a one-year low.

China: Demand conditions improve, but power shortages weigh on output in October

Chinese manufacturers noted an improvement in demand during October, but power shortages and rising costs weighed on production, according to latest PMI data. Limited power supply and material shortages also dampened supplier performance, with lead times increasing at the fastest rate since March 2020. As a result, inflationary pressures intensified, with average input prices rising at the sharpest rate since December 2016, while the pace of output charge inflation also accelerated notably since September.

The headline seasonally adjusted Purchasing Managers’ Index™ (PMI™) picked up from 50.0 in September to 50.6 in October, to signal a renewed improvement in the health of China’s manufacturing sector. Although only slight, the rate of expansion was the strongest recorded since June.

Stronger demand conditions helped to lift the headline PMI, with total new orders rising to the greatest extent in four months. Panel members often mentioned that client demand had improved over the month. However, underlying data indicated that the upturn was largely driven by stronger domestic demand, as foreign orders fell for the third month in a row. Some manufacturers mentioned that difficulties securing sales and shipping products to overseas clients had weighed on export business.

Despite rising amounts of overall new work, manufacturers recorded a third successive monthly decline in production, albeit one that was only mild. Panel members often indicated that limited power supply, material shortages and rising costs had constrained output at the start of the fourth quarter.

Lower production contributed to a further drop in manufacturing sector employment in October. That said, the rate of job shedding eased to a marginal pace. At the same time, backlogs of work expanded for the eighth month in a row, though the rate of accumulation was modest overall.

In line with the trend for output, buying activity fell in October. Anecdotal evidence indicated that reduced production and high purchasing costs had led firms to cut back on input buying. As a result, companies depleted their inventories of inputs for the fourth month in a row, and at the fastest rate since March 2020. Meanwhile, stocks of finished goods fell for the first time in three months.

Supply chain delays became more widespread in October, with average lead times for inputs increasing at the fastest rate since March 2020. There were reports that a lack of stock at vendors and reduced power supply drove the latest deterioration in supplier performance.

Higher costs for materials, energy and transport drove a sharper rise in average input prices in October. The rate of inflation was the steepest seen since December 2016 and rapid overall. Consequently, output charges also rose at a notably quicker rate during October.

Chinese manufacturers were generally optimistic that output will rise over the next 12 months, though the degree of positive sentiment eased slightly since September. Some firms expressed concerns over ongoing supply chain disruptions and rising costs.

China’s official PMI, covering fewer but larger companies than Markit’s, fell to 49.2 in October from 49.6 in September.

New orders and new export orders are in contraction at 48.8 and 46.6, respectively.

Non-manufacturing PMI fell to 52.4 in October from 53.2 in September. The key reason comes from the real estate sector, which had lower sales volume. The deleveraging reform in the real estate sector will continue despite more developers being at risk of defaulting on their bonds. So we expect the selling activities from the real estate sector should continue to edge downward.

Another reason for a lower non-manufacturing PMI came from another policy, which is the shutdown of tuition centres.

China has decided to adhere to the zero Covid policy, which means opening the borders with fewer days of quarantine may not happen in 2021 or even the first half of 2022. This will continue to affect demand for tourism-related services. (ING)

Japan: Manufacturing sector records stronger expansion in October

Businesses in the Japanese manufacturing sector signalled a further improvement in operating conditions in October. Renewed rises in both production and new order inflows contributed to a stronger overall rise in conditions as restrictions related to COVID-19 were eased further. That said, ongoing material shortages and delivery delays placed continued strain on manufacturers, resulting in an intensification of input price pressures not exceeded since August 2008. Nonetheless, firms remained strongly optimistic that production would rise over the coming 12 months, with the level of positive sentiment the highest on record.

The headline au Jibun Bank Japan Manufacturing Purchasing Managers’ Index™ (PMI) rose from 51.5 in September to 53.2 in October. This indicated a ninth consecutive monthly improvement in the health of the sector, with the pace of expansion the quickest since April.

The improved headline index was partly due to a return to growth in output. Production volumes reversed the fall from the previous period, though the increase was only marginal overall. Firms cited that output was boosted by the lifting of COVID-19 restrictions, although growth continued to be hampered by ongoing raw material shortages.

Similarly, new orders returned to expansion territory in October following a reduction in September. The pace of growth was marginal however, and weaker than the average seen in the year to date. Higher sales were commonly linked to an increase in client demand as infection rates slowed, though this was dampened by sustained supply chain delays. New export sales also increased in October, with growth easing to a fractional pace.

At the same time, employment levels continued to increase in October, and at a slightly faster pace than that seen in the previous month. As a result, the rate of job creation was the strongest since April 2019, as firms noted higher capacity requirements as demand rose. In line with higher new orders, outstanding business rose further in October. However, the pace of accumulation slowed to a three-month low and was only modest.

Japanese manufacturers indicated a rise in cost burdens for the seventeenth consecutive month in October. Moreover, the rate of input cost inflation accelerated from September to reach the fastest since August 2008. Rising input costs were widely attributed to higher raw material prices. Manufacturers sought to partially pass these higher cost burdens to customers through prices charged, which increased at the fastest pace in just over 13 years.

Buying activity rose for the seventh time in eight months in October, reversing September’s decline. Growth was modest overall and often attributed to firms purchasing additional raw materials to counteract delays and shortages. Such shortages of inputs remained significant in the latest survey period, and contributed the strongest deterioration in delivery times since April 2011. As a result of additional purchases, firms built up safety stocks of both inputs and finished items to protect against future disruption, with the respective seasonally adjusted indices rising to the highest levels in over seven and three years respectively.

Looking ahead, business confidence regarding output over the year ahead strengthened to the highest since the series began in July 2012. Expectations were underpinned by hopes that the end of the pandemic would support a broad-based market recovery.

ASEAN: Manufacturing sector returns to growth asCOVID-19 restrictions ease

The ASEAN manufacturing sector rebounded during the October, according to the latest IHS Markit Purchasing Managers’ Index (PMI™) data, as the easing of COVID-19 measures resulted in record rates of expansion in both factory production and new orders. Worsening supply disruptions contributed to more intense inflationary pressures, however, as both input costs and average charges rose at the fastest rate for eight years.

The headline PMI rose from 50.0 in September to 53.6 in October,signalling the first improvement in ASEAN manufacturing conditions since May, and one that was the quickest since data collection began in July 2012.

Improved operation conditions were recorded in all but one of the seven constituent ASEAN nations during October. Indonesia topped the rankings, with the headline PMI (57.2) the highest on record and indicative of a rapid improvement in the health of the sector, amid looser lockdown measures.

This was followed by Singapore, where the headline index (54.5) remained firmly in expansion territory for the second month in a row and signalled a sharp uplift in manufacturing conditions.

Elsewhere, Malaysia registered a return to growth, with the PMI posting above the neutral 50.0 level for the first time since May. At 52.2, the latest reading was indicative of the second-fastest improvement in the health of the sector since April 2014.

Vietnam too saw its first expansion since May, with the headline index (52.1) signalling a modest improvement in conditions.

At the same time, both the Philippines and Thailand recorded marginal improvements in the health of their goods producing sectors, with the PMI posting 51.0 and 50.9, respectively.

Finally, Myanmar was the only ASEAN nation to record a deterioration in operating conditions during October. At 43.3, the headline index was indicative of the slowest decline since PMI January, but one that was sharp nonetheless.

The return to expansion territory was driven by rebounds in both output and new work during the opening month of the fourth quarter. Factory production rose for the first time since May, with the rate of growth the fastest on record. Order book volumes saw a similar trend, rising for the first time in five months and at the steepest pace in the series history, albeit one that was slightly slower than for output, in part due to a broad stabilisation of new export orders.

Greater production requirements were reflected in a renewed rise in purchasing activity at ASEAN goods producers in October, with the rate of increase the quickest on record. Pre-production inventories increased as a result, but only marginally.

Stronger input buying placed further pressure on supply chains, however, as average delivery times lengthened again. Delays were among the most severe on record.

Subsequently, ASEAN goods producers registered intense inflationary pressures in October. Cost burdens rose for the nineteenth month in a row, with the latest increase rapid and the quickest since October 2013. As a result, firms raised their average charges at the fastest rate for eight years.

Supply constraints were also echoed in sustained capacity pressures during October, as backlogs of work rose for the fourth month in a row. Notably, the rate of backlog accumulation was broadly unchanged from September’s series peak.

The return to growth for the ASEAN manufacturing sector was also reflected in improved confidence towards output over the year ahead. Sentiment was the strongest since June 2019 and broadly in line with the series long-run average.

The other conclusion from all of the above is that the goods inflation pipeline remains very strong and companies are still able to quickly pass their cost increases on to their clients. Let’s hope Americans keep spending…

Gallup’s initial measure of Americans’ 2021 Christmas spending intentions finds consumers planning to spend an average $837 on gifts this season. That is statistically similar to the $805 they estimated spending for the 2020 holiday season at the same time a year ago. Both pandemic-era estimates are lower than what Gallup found in the preceding few years, including the record-high $942 recorded in 2019. (…)

Gallup’s measure asking Americans to estimate their total spending on Christmas gifts has been a good harbinger of holiday retail sales in most years. While that is particularly true for the November estimate, the October measure sets the baseline for where things are headed. For now, it appears consumers are gearing up to spend enough to give retailers an average, if not great, holiday season. (…)

Supply Chain Crisis Risks Taking the Global Economy Down With It New Bloomberg Economics gauges show the extent of the global supply shortages that are pushing prices higher and putting economic recoveries at risk.

(…) The research quantifies what’s apparent to the naked eye across much of the planet — in supermarkets with empty shelves, ports where ships are backed up far offshore, or car plants where output is held back by a lack of microchips. Looming over all of these: rising price tags on almost everything.

Central banks, already retreating from their view that inflation is “transitory,” may be forced to counter rising prices with earlier-than-expected interest-rate hikes. That poses new threats to an already stumbling recovery, and could take the air out of bubbly equity and property prices.

Behind the logjams lies a mix of overloaded transportation networks, shortages of labor at key chokepoints, and demand in the U.S. that’s been bolstered by pandemic stimulus and focused more on goods than services. (…)

Inflation is already running high enough to be outside the comfort zone for monetary policy makers. In the U.S., it’s at 5.4% now and could stay lodged in the 4% to 5% range next year if supply constraints don’t ease, according to Bloomberg Economics models. (…)

Still, the current environment — call it stagflation-lite — is a challenging one for central bankers.

Keeping rates at their current lows would allow the recovery to continue, but risk prices spiraling higher if households and businesses come to expect more of the same. Tightening would quell inflation not by addressing inadequate supply, but rather by stifling demand. It could turn into the monetary policy equivalent of the surgeon who declares: “Operation successful, patient dead.” (…)

A Bloomberg Economics model of the Fed’s reaction function — its policy response to changes in the economy — suggests that if inflation runs strong and unemployment falls, even two hikes next year might not be enough. (…)

The Bloomberg gauge of shortages in the U.S. has edged down in the latest readings — while staying at historically elevated levels. It’s just that there’s no precedent that sheds much light on when, or how, conditions will normalize. (…)

Maersk warns no end in sight to supply chain crisis as profits soar

China Urges Stocking Up Ahead of Winter, Prompting Worries Online

A statement from China’s government urging local authorities to ensure there was adequate food supply during the winter and encouraging people to stock up on some essentials prompted concerned talk online, with people linking it with the widening coronavirus outbreak, a forecast cold snap, or even rising tensions with Taiwan.

The Ministry of Commerce urged local authorities to stabilize prices and ensure supplies of daily necessities including vegetables this winter and next spring, according to a statement Monday evening. Chinese households were also encouraged to stock up on a certain amount of daily necessities in preparation for the winter months or emergencies.

(…) this new appeal sparked speculation that it’s linked to a widening coronavirus outbreak which has prompted a new round of lockdowns and travel restrictions after it spread to over half the mainland’s provinces. (…)

European Gas Market on Edge as Russia Keeps Grip on Supply

U.S. Construction Spending Unexpectedly Declines in September

Construction spending declined 0.5% (+7.8% y/y) during September after edging 0.1% higher in each of the prior two months. The August figure was revised from little change. A 0.4% increase had been expected in the Action Economics Forecast Survey.

Total private construction declined 0.5% (+11.1% y/y) during September, the largest of three straight monthly declines. Residential construction weakened 0.4% (+19.3% y/y) after rising 0.1% in August. Single-family building fell 0.6% (+30.4% y/y) after a 0.5% decline. Multi-family construction was off 0.3% (+10.5% y/y) after slipping 0.1% in August. The value of spending on improvements eased 0.1% (8.1% y/y) after rising 1.1% in August.

Private nonresidential construction fell 0.6% in September (-0.5% y/y) following a 0.9% August drop. Power construction declined 1.2% but was unchanged y/y. Transportation construction fell 0.4% (-4.6% y/y). Lodging construction was down 0.7% (-32.8% y/y). Factory sector building fell 1.6% (4.7% y/y) in September.

The value of public construction weakened 0.7% in September (-2.4% y/y) after two roughly 1.0% increases. Commercial construction declined 3.1% (-13.1% y/y) but office construction rose 1.2% in September (-5.0% y/y). Highway & street construction fell 0.7% (7.1% y/y) and heath care construction weakened 3.6% (-2.7% y/y) in September.

Construction spending levels (Feb 2020 =100)

(Source: Macrobond, ING)

(…) The worsening affordable housing shortage is clear in the low number of vacant housing units, which continues to decline. The percent of the housing stock for rent and sale that is unoccupied has fallen sharply since the housing crash and is now as low as it has been in more than 30 years. The shortfall in affordable housing is close to an estimated 1.8 million homes, equal to more than a year of new construction at its current pace.

And this housing shortage continues to get worse. The current annual supply of new housing units is still running an estimated 100,000 below the trend for new-housing demand. Total supply equals new single- and multifamily units and manufactured homes, and trend housing demand equals household formations, new homes needed to replace those that become obsolete, and second and vacation homes. (…)

Even these figures understate the severity of the problem. The lion’s share of the undersupply is concentrated in the lower end of the market, particularly in areas that offer significant economic opportunity, driving up house prices and rents for low- and moderate-income families precisely where they want to live. Prices for homes sold in the bottom quartile are up nearly 8% per annum over the past decade, almost double that for homes in the top quartile. And rents for those families who rent because they cannot afford to own, rather than by choice, have increased nearly 4% per annum over the past decade—a trend that has continued even during the pandemic.

The rising rents leave more and more renters with little to live on. Today, one in four renters pays over half of their monthly income toward rent, leaving barely enough to cover food, clothing and healthcare, much less save for emergencies or build wealth. The typical renter saves less than $500 a year, not enough to cover run-of-the-

mill financial emergencies let alone save for a down payment on a home. And the rise in house prices is putting the economic opportunity of homeownership out of reach for more and more families, particularly those of color. (…)

(

(