ADVANCE MONTHLY SALES FOR RETAIL AND FOOD SERVICES, JANUARY 2021

Advance estimates of U.S. retail and food services sales for January 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $568.2 billion, an increase of 5.3 percent (±0.5 percent) from the previous month, and 7.4 percent (±0.7 percent) above January 2020.

Total sales for the November 2020 through January 2021 period were up 4.6 percent (±0.5 percent) from the same period a year ago. The November 2020 to December 2020 percent change was revised from down 0.7 percent (±0.5 percent) to down 1.0 percent (±0.3 percent).

White House Extends Mortgage Relief A foreclosure moratorium will now run through June 30, and borrowers will get more time to seek help with payments

Homeowners will now be able to receive up to six months of additional mortgage payment forbearance, in increments of three months, for those borrowers who entered forbearance before June 30, 2020, the White House said. Borrowers who enter into such plans can skip payments if they suffer a pandemic-related hardship but have to make them up later.

Some 2.7 million homeowners have active forbearance plans—representing 5% of all mortgage-holders—and more than half of the plans are set to end for good in March, April, May or June, according to mortgage-data firm Black Knight Inc. (…)

Many of the borrowers who are still postponing payments have Federal Housing Administration loans. FHA borrowers typically have lower incomes and smaller down payments than individuals with other government-backed loans, such as those guaranteed by Fannie Mae and Freddie Mac. Job losses during the pandemic have disproportionately affected low-wage workers, including employees of the restaurants, hotels and shopping malls that have been devastated by the stay-at-home economy. (…)

Tuesday’s changes don’t apply to borrowers with loans guaranteed by Fannie and Freddie, the two government-controlled mortgage companies that back about half of the $11 trillion mortgage market. The companies’ regulator, the Federal Housing Finance Agency, operates independently of the White House and has already extended forbearance for up to 15 months for borrowers who enter into such plans by the end of February.

Roughly 30% of the 907,000 existing Fannie and Freddie forbearances were previously set to expire at the end of March, according to Black Knight.

About 75% of U.S. mortgages are guaranteed or insured by the U.S. government, according to Black Knight.

U.S. shale could face weeks of depressed oil production due to cold Roughly 500,000 to 1.2 million barrels per day of the state’s crude production has been shut-in by the weather.

UK inflation heads up as locked-down consumers spend from home

Annual consumer price inflation rose to a three-month high of 0.7% last month, and many economists expect it to overshoot the Bank of England’s 2% target later this year as temporary tax cuts and a cap on household fuel bills expire. (…) Economists polled by Reuters had mostly thought the consumer price index would hold at December’s 0.6% increase. (…)

A core version of the CPI, which excludes volatile fuel and food prices, held steady at 1.4%.

Factory gate prices fell again, dropping by 0.2% on the year, but manufacturers’ input costs rose by 1.3%, the biggest increase since May 2019. (…)

House prices in December were up by 8.5%, the ONS said, the biggest annual increase in over six years. (Reuters)

Reflation bets push German yield curve to steepest since March

With Super Mario now at the wheel, Italy yesterday sold €10 billion ($12.2 billion) in 10-year debt, attracting a record €110 billion of bids. That blistering demand was enough for Rome to trim the auction premium to four basis points over existing 10-year bonds, half the initial guidance. Italy’s benchmark 10-year yield finished the day at 0.57%, near a record low 0.46% reached Thursday. Almost Daily Grant’s informs us that so far this month, Spain and Portugal sold 8B euros of 50 and 30-year bonds that drew a combined total of 105B euros in bids.

That said, ADG adds that “More broadly, the global stock of negative-yielding debt fell to $15.1 trillion yesterday, from about $18.5 trillion in mid-December. (…) With yields showing signs of life and the return of inflation an increasing possibility, the onus could soon shift back to the European Central Bank. Last week, the ECB bought €17.1 billion worth of bonds, up 26% on a sequential basis.”

‘Go Big’ Reflation Bet Sees Virus Victory Assured A sharp increase in economic activity is now the base case for markets.

From John Authers:

(…)The potential for a sharp increase in economic activity, bringing with it the kind of jump in growth that bond markets should hate, is very real. In the last few weeks, the market has adopted it as a base case. (…)

But as it stands, the market is telling us that final victory over the virus is in sight, and that this won’t stop the authorities from going big in response, meaning quite an economic boom. It would be nice if they were right.

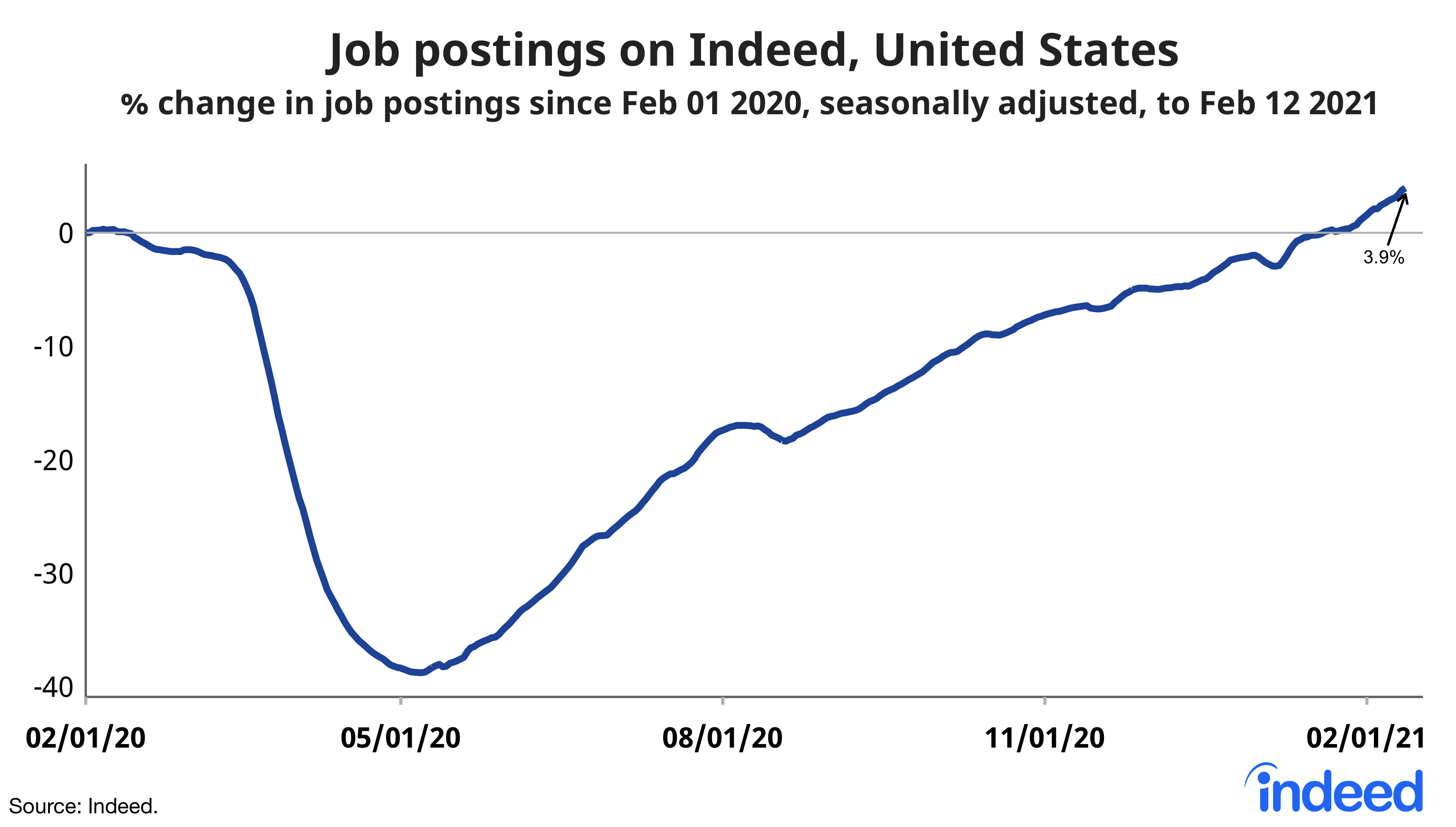

From Indeed:

SENTIMENT WATCH

RISK APPETITE NEAR CLIMAX

From Goldman’s RAI, to BofA’s risk profile and low cash holdings, to call volume and 2000-type Call/Put ratio, to SPAC and bitcoin mania’s, the signs are piling up.

(The Market Ear)

SentimenTrader sees “more speculative records across a broad array of indicators, with few counter-examples. It has pushed models beyond all other extremes, with Dumb Money Confidence being on the right side of the market to the greatest degree ever. (…) We’re in an extremely speculative environment that is enough to become defensive, especially with recent cracks showing in what had been pristine breadth conditions.” Jason explains the spike in calls:

Options traders continue to get ever more aggressive. (…) These trades have an outsized impact on stock prices, and it only takes a pause in their activity to help trigger an unwind in underlying positions. As it climbs, it just piles more snow upon a mountain that’s ripe for an avalanche.

The smallest of options traders, those executing 10 or fewer contracts at a time, bought to open almost 25 million call contracts last week, versus only a little more than 6 million put options. Overall volume on the NYSE was down (more volume has been flowing into ultra-speculative penny stocks) so the net speculative purchases of these options traders spiked yet again to a new relative record.

Most of this option activity is concentrated in the very near-term, with expirations within the next few weeks. This activity has helped in part to press the VIX “fear gauge” lower in the near-term, while longer-term expectations are still elevated. This has been a sign of extreme complacency in the past. (…)

Citi Strategist Says 10% Correction in U.S. Stocks Is ‘Very Plausible’

(…) “Our current caution reflects several factors, including ebullient sentiment readings, stretched valuation levels and slipping earnings revision momentum,” the bank’s chief U.S. equity strategist wrote Tuesday. “With limited upside even to others’ bullish targets, a neutral stance is realistic.”

Citigroup has a year-end target of 3,800 for the S&P 500 and the strategy team expects the index to trade in a 3,600 to 4,000 range. (…) “While they can back off 10%-20%, we do not envision a 50%-plus collapse,” he wrote.

TAPER TANTRUM 2.0

Nordea refreshes our memory:

Most of us recall the taper tantrum and how it began with Chair Bernanke hinting of tapering QE3 purchases in May 2013. The markets responded by pricing a swifter Fed lift-off of more than 125 basis points over the next 3 years. In September 2013, the Fed ended the taper tantrum by delivering a huge dovish surprise in which it postponed its taper process, thereby regaining control of the short-to-medium term Fed funds expectations, but it was not without a major scare first. The million USD question is then, how far are we from a similar duration scare or taper tantrum this year?

JP Morgan says don’t worry (via ZeroHedge):

- Bond yields are likely to move higher from here, and that the move should be absorbed well by the equity market.

- Bond yields are likely to move up further, reflecting not just the upcoming normalization inactivity, starting in Q2, but also the potential for overshooting given pent-up demand and continued fiscal support. A significant gap remains open between bond yields and inflation forwards, and between bond yields and US PMIs.

- JPM would not expect the stocks-bonds correlation to break down while US 10-year yields are sub 2%, especially if the central banks’ liquidity provision remains ample, and growth backdrop positive. P/Es did not tend to de-rate during cyclical earnings upswings.

- Bond yields would need to move up by 100-200bp in order to erase the equity attractiveness.

Nordea is much more cautious:

In short, 2013 tells us that the Fed struggles to separate tapering of asset purchases and lift-off expectations. What is clearly different today is the Feds introduction of Average Inflation Targeting. So far this has kept lift-off expectations muted despite an increase in term premiums and long-term rates/inflation expectations, but, and that is a big but, the average inflation targeting regime (with vague mechanics and no actual proposal of a mathematical reaction function) has yet to be tested. This is likely to happen during Q2 2021.

We see several interesting similarities to the fundamental backdrop ahead of the taper tantrum in 2013, why we find 2.0 taper tantrum risks elevated. Back in 2013, positive data surprises during 2013, in combination with the proposed tapering from the Fed, gave rise to a huge bond market sell-off. Today, the upcoming reopening of the economy thanks to wide-spread vaccinations coupled with leading indicators pointing towards a strong growth and inflation rebound increases the likelihood of a similar bond sell-off.

Markets will likely again find it hard differentiate between tapering and a quicker future lift-off, should the Fed be “forced” into debating the balance sheet during Q2 due to elevated CORE inflation. (…)

On top of the tantrum risks, we also envisage a possible melt-up in USD liquidity as the US Treasury now intends to bring down the Treasury General Account (TGA) swiftly over the coming months. (see yesterday’s Daily Edge)

Lack of Earnings Is No Obstacle for U.S. Tech-Stock Surge

Earnings have been anything but a prerequisite for U.S. technology stocks to surge in the past 10 months. The performance of a Goldman Sachs Group Inc. index of unprofitable companies shows as much. The gauge increased almost fivefold from a record low on March 18 through last Wednesday, when it set a record. Goldman’s indicator also climbed five times as much as the S&P 500 Technology Index during the period.

It’s not only the lack of earnings, there’s even the lack of actual businesses behind the investments:

Just another SPAC filed for an IPO. Really. Just Another Acquisition Corp., capturing the spirit of the blank-check surge, is raising $60 million but hasn’t detailed what company in which sector it plans to buy. It joins 145 SPACs that went public in the U.S. in the first 30 trading days of the year—an average of 4.8 a day. (Bloomberg)

CLOSINGS

- More vaccines are on the way. Pfizer and Moderna agreed to speed up sales to the U.S. after President Biden invoked federal law that could force production. Europe is also getting more. Pfizer and BioNTech will deliver an additional 200 million doses to the EU this year. And Moderna agreed to supply the bloc with 150 million more, the FT said.

- Taiwan accuses China of blocking efforts to buy Covid vaccines Health minister says German group BioNTech was put under ‘political pressure’