Economy Strengthens as Spending, Hiring Pick Up The recovery is accelerating as stimulus money, Covid-19 vaccinations and business re-openings spur a spring surge in consumer spending, a sharp pullback in layoffs and a bounceback in factory output.

Retail sales—a measure of purchases at stores, at restaurants and online—jumped 9.8% in March, the Commerce Department reported Thursday. (…) The gains in retail sales last month were broad-based, and showed a robust spending pickup in some categories that suffered early in the pandemic as people stayed at home to avoid the coronavirus.

Sales at restaurants and bars, for example, jumped 13.4% last month from February and 36% from March 2020, at the beginning of the pandemic.

Retail sales also jumped at clothing and department stores last month, which could reflect Americans seeking to refresh their wardrobes as they resume activities outside the home, said Michelle Meyer, head of U.S. economics at Bank of America. (…)

The federal government has since mid-March disbursed about 159 million stimulus payments of more than $376 billion to households from the latest virus-aid package, the Treasury Department said this week. (…)

Sales are now 17% above their level in February 2020, before the Covid-19 crisis struck. (…) (WSJ)

Excluding Food Services, Retail Sales are up 23.7% in Q1’21 over Q1’19!

The notion that Americans spent themselves out of goods during the pandemic does not verify: full year 2020 retail sales ex-Food Services were up 3.2%, down from +3.4% in 2019 and +4.4% on average in 2017-18.

The +16.9% jump in Q1’21 is the first quarter of actual splurge and most of it occurred in March (+13.0%), coming along many states reopening their economy with vaccination allowing people to hope for normality come spring and summer. So long precautionary savings!

The relationship between labor income and consumption/retail sales has always been very tight. The chart below plots these 3 series’ YoY changes using annual data to the end of 2020. Notice how spending in 2020 remained very much in line with the payroll index. The stimmies were not used to splurge.

Same series but monthly to March 2021 when we clearly see the March explosion, admittedly off a weakening base in March 2020 but nonetheless up 20.8% over March 2019. The stimmies are being spent.

The trend is continuing in April. The Chase Card Spending data, which forewarned the March sales boom, continues to track spending up 20% from 2019 levels through April 11, excluding pandemic-impacted categories:

Meanwhile, labor income is gradually recovering:

Jobless claims, a proxy for layoffs, fell to 576,000 last week from 769,000 a week earlier, the Labor Department said. While claims are still above levels that prevailed early last year, last week’s figure was the lowest since March 2020. The total number of people receiving benefits also fell across a range of state and federal pandemic-related programs.

The four-week moving average for jobless claims, which smooths out weekly volatility, declined last week to a pandemic low of 683,000. (…) About 16.9 million people were collecting unemployment benefits through state and federal programs in the week ended March 27, down from 18.2 million a week earlier.

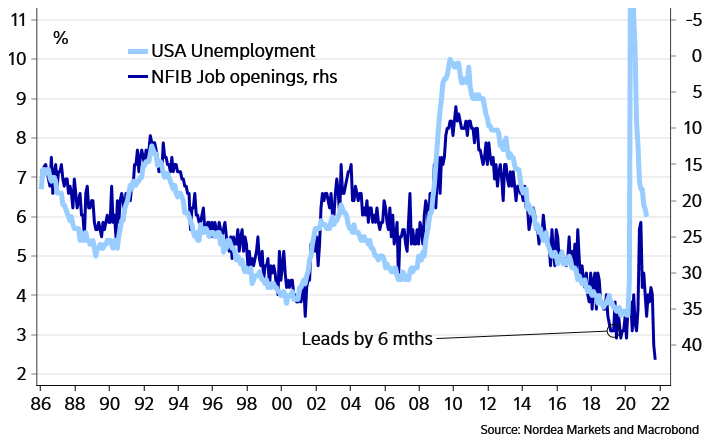

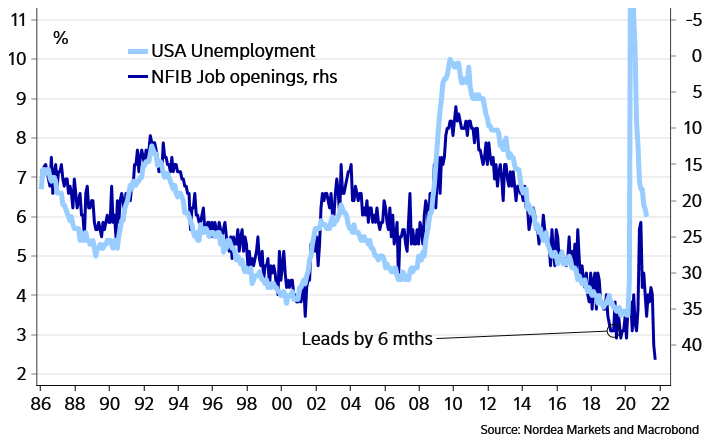

In other words, the total number of all state, federal, and PUA and PEUC continuing claims declined 1.236 million last week. Recall that employment jumped by 916k in March and stood 8.4 million below the February 2020 peak. This Nordea chart should be prominently displayed in the next FOMC members briefing. That 3.5% target may be reached sooner than expected:

The Fed’s recent Beige Book informed us that “Wage growth accelerated slightly overall, with more significant wage pressures in industries like manufacturing and construction where finding and retaining workers was particularly difficult. (…) Some contacts mentioned raising starting pay and offering signing bonuses to attract and retain employees.”

Yesterday, the WSJ revealed that Trucking Companies Boost Pay in Hunt for Drivers as Demand Surges:

Knight-Swift Transportation Holdings Inc., the largest truckload carrier in North America, is the latest trucking company to raise pay. It said last week that its wages for recently certified drivers have jumped by 40% or more in recent months.

The company said its driving-school graduates are on track to earn more than $60,000 a year in their first year after training. Median pay for heavy-truck and tractor-trailer drivers last year was $47,130, according to the Bureau of Labor Statistics. (…)

Three-quarters of carriers responding to a Cowen survey in the first quarter of this year said they believe they will have to increase driver pay this year, compared with 50% in the same period in 2020.

Per-mile truckload costs rose 8.1% in February from the previous year, the biggest annual increase since October 2018, according to Cass Information Systems Inc., which handles freight payments for companies.

The swings are even sharper on trucking’s spot market, where shippers book last-minute transportation and pricing tends to be more volatile. The ratio of available loads to trucks more than doubled in March from the previous year, according to online freight marketplace DAT Solutions LLC, while the average cost to hire a big rig rose by 41.9%, to $2.65 a mile. (…)

As of March, overall employment in the sector was down by 33,500 jobs, compared with the same month in 2020, when the pandemic hit the U.S. (…)

“It’s not a driver shortage; it is a driver-pay shortage.”

Mr. Vieth said it could take until early next year “before the driver supply starts finally catching up with the freight to be hauled.”

Most goods sold in the USA need truck transportation. Whether this eventually translates into higher prices or lower margins remains to be seen. The Beige Book:

There were widespread reports of increased selling prices also, but typically not on pace with rising costs. Contacts generally expect continued price increases in the near term.

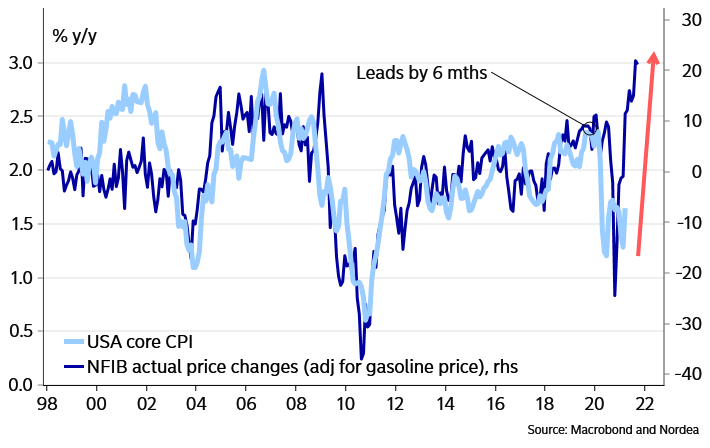

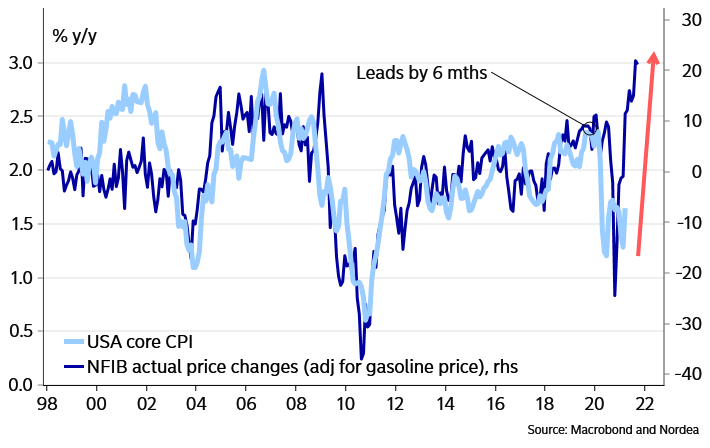

Another smart Nordea chart:

No relief in price hiking plans

Speaking of inflation:

Reuters Introduces Online Paywall in Digital-Subscriber Push

Reuters.com will charge $34.99 a month for a subscription, according to the New York Times. Excluding promotions, that’s the same price as a monthly digital subscription to Bloomberg.com and $4 less per month than what the Wall Street Journal charges. A digital subscription to the Financial Times is $40 a month.

These 4 basic subscriptions in finance will now total $1788. When I started blogging in 2009, they were all free…And I won’t bore you with all these newsletters that now offer “premium” subscriptions for their better stuff. I’m a poor lonesome cowboy now, and add-free!

- SUPPORT EDGE AND ODDS: Donations, single or recurring, can now be made using your Paypal account or a credit card.

So, the stimmies are being spent on goods, employment is coming back fast, even faster when services will be in full swing:

- Delta says domestic leisure travel recovered to 85% of pre-pandemic levels, but there’s still low demand for international and business travel.

Unsurprisingly, manufacturing activity is strong:

U.S. Industrial Production Rebounded in March

Industrial production rebounded in March, rising 1.4% m/m (+1.0% y/y) after a downwardly revised 2.6% m/m drop in February (initially -2.2% m/m). The February decline had been due largely to unusually cold and severe weather across much of the country, particularly the south central region. The 1.0% y/y increase was the first annual rise since August 2019. The Action Economics Forecast Survey looked for a 3.0% m/m gain for March. For the first quarter of 2021, IP rose 2.5% saar, down from 9.5% in 2020 Q4.

The more normal March weather was clearly observed in the industry breakdown. Manufacturing output rose 2.7% m/m (3.1% y/y) in March after having fallen 3.7% m/m in February. This was the largest monthly rise since last July. (…)

Durable manufacturing output rose 3.0% m/m (6.4% y/y) in March following a 3.3% m/m decline in February. All major categories of durables registered increases, most of which were between 2% and 3%. The output of motor vehicles and parts rose 2.8% m/m in March after falling 10.0% in February. Shortages of semiconductors held down vehicle production in both months, while cold weather also curbed production in February.

Nondurable goods output increased 2.6% m/m (0.4% y/y) in March following a 4.1% m/m decline in February. Among nondurables, all major industry categories recorded gains except plastics and rubber products. (…)

That was for March. Previews for April:

The Federal Reserve Bank of Philadelphia’s Factory Sector Business Conditions Index jumped to 50.2 during April following a rise to a revised 44.5 in March. Earlier data also was revised. It was the highest reading since April 1973. The Action Economics Forecast Survey expected a reading of 40.0. The percentage of firms reporting improving conditions rose to 58.6% after surging to 53.9% in March, while the share reporting weaker conditions fell to a lessened 8.4%.

Haver Analytics calculates an ISM-Adjusted General Business Conditions Index using the same methodology as the national ISM index. The reading improved to 63.0, the highest level since March 1973.

Amongst the subindexes, the employment reading rose to a record 30.8. A higher 35.1% of survey respondents reported increased employment while a reduced 4.2% reported less hiring. The unfilled orders measure surged to 27.2, nearly a 50-year high. Shipments and inventories also strengthened. Falling was the new orders measure to 36.0 from 38.2 and the average workweek to 29.8 from 36.4.

On the pricing front, the index of prices paid eased to 69.1 in April from 72.6 in March, but remained up from -9.3 twelve months earlier. A slightly lessened 71.4% of respondents paid higher prices while 2.3% paid less. The index of prices received improved.

The Philadelphia Fed also surveys expectations for business activity in six months. The Future Activity Index rose to 66.6 in April from 59.1 in March. Employment, new orders and shipments rose sharply. The future prices paid measure surged to the highest level since January 1989.

The Empire State Manufacturing Index of General Business Conditions jumped 9 points to 26.3, up from 17.4 in March, and well surpassing the reading of 19 expected in the Action Economics Forecast Survey. 39% of the respondents reported improved conditions over the month, while only 12% reported that conditions had worsened, down from 17% last month.

All the Empire State components rose measurably in April.

Strong gains in orders and shipments pushed the new orders component to 26.9 in April from 9.1 in March, and the shipments measure to 25 from 21.1 in March. Unfilled orders surged to 21.2 from 4 in March, while the delivery time jumped to 28.1 from 11.4, pointing to significantly longer delivery times. Inventories were also up, reaching 11.6 up from 8.1 in March. The index for the number of employees jumped to 13.9 from 9.4 in March, with 21% of respondents reporting increased hiring, similar to March’s reporting, while 7% reported lower hiring compared to 11% in March. The average workweek rose to 12.7, up from 10.9 in March.

Prices paid rose 10.3 points to 74.7 from 64.4 in March and its highest level since 2008, underscoring sharp input price increases. 75% of the respondents cited higher prices paid. The prices received measure rose 11 points, to 34.9, a record high. The New York Fed reported that selling prices rose at their fasted pace in more than 20 years. The index of business conditions in six months moved to 39.8 in April from 36.4 in March, underscoring optimism in months ahead.

U.S. Housing Market Nearly 4 Million Homes Short of Demand Mortgage-finance company Freddie Mac said the shortfall in single-family homes has grown by half in just two years as builders contend with shortages of labor, materials and developed land.

The U.S. housing market is 3.8 million single-family homes short of what is needed to meet the country’s demand, according to a new analysis by mortgage-finance company Freddie Mac.

The estimate represents a 52% rise in the nation’s home shortage compared with 2018, the first time Freddie Mac quantified the shortfall. (…)

The shortage is especially acute for entry-level homes, which makes it more expensive for first-time home buyers to enter the market, said Sam Khater, chief economist at Freddie Mac. (…)

Freddie Mac reached its shortage figure by assessing the amount of single-family home building needed to match demand from household formation, second-home purchases and replacements of damaged or aging U.S. homes, and comparing that with the pace of construction. (…)

Home builders would need to construct between 1.1 million and 1.2 million single-family homes a year to meet long-term demand, but the start rate would need to be even higher to shrink the existing deficit, said Rob Dietz, chief economist at the National Association of Home Builders.

Freddie Mac in 2018 estimated that the U.S. was 2.5 million units short of what it needed to meet long-term demand. The new estimate is as of the end of 2020. (…)

The mix of newly built homes has also changed, with large, expensive homes making up a greater share of home-building activity. Builders built 65,000 homes smaller than 1,400 square feet in 2020, compared with more than 400,000 such homes annually in the late 1970s, Freddie Mac said.

U.S. Import & Export Prices Continue to Rise in March

Import prices increased 1.2% (6.9% y/y) during March following a 1.3% February rise. A 0.9% increase had been expected in the Action Economics Forecast Survey. Price gains y/y have accelerated markedly across product categories.

A 6.7% rise (53.9% y/y) in petroleum import prices followed four months of strong increase. Nonpetroleum import costs improved 0.9% (4.1% y/y) after firm gains in each of the prior three months. Industrial supplies & materials costs rose 4.8% (29.5% y/y) led higher by the gain in fuel costs. Foods, feeds & beverages prices strengthened 2.0% (3.8% y/y), the strongest of four straight monthly gains. Capital goods prices edged 0.1% higher (1.3% y/y) as they did in February, compared to a 2.0% y/y price decline late in 2019.

Nonauto consumer goods prices also rose for a second month by 0.1%. The 0.7% y/y increase was up from 0.6% y/y price deflation in March of last year. Motor vehicle & parts prices held steady, but here again the 1.1% y/y gain compares to 0.7% y/y price deflation as of late-2019.

Export prices strengthened 2.1% after three months of strong increase. The 9.1% y/y increase compared to 7.0% y/y price deflation last April. A 0.9% gain had been expected.

Agricultural prices rose 2.4% (20.5% y/y) while nonagricultural export prices strengthened 2.0% (7.9% y/y). Both y/y price increases compared to deflation in early in 2020. Industrial supplies & materials prices rose 5.0% (21.9% y/y) while foods, feeds & beverage prices improved 2.8% (20.0% y/y). Nonauto consumer goods prices gained 0.6% (0.7% y/y), the strongest m/m increase in six months. Capital goods prices improved 0.1% (0.6% y/y) following two months of 0.4% improvement. Motor vehicle & parts prices held steady but the 0.5% y/y increase compared 0.6% y/y price deflation in July of last year.

Nonpetroleum import prices are soaring, +9.5% a.r. in the last 3 months.

The chart below plots nonpetroleum prices (blue = index) with their YoY change against the CPI-Durable Goods, most of which are imported.

Surprise!, after all the above:

U.S. Treasury Yields Fell Sharply Yields’ biggest one-day drop since November reflects renewed demand for government debt after sustained selling in first quarter

The yield on the benchmark 10-year U.S. Treasury note settled at 1.531%, according to Tradeweb, compared with 1.637% on Wednesday. (…)

That came despite a strong retail sales report that might normally be expected to push yields higher since they tend to rise when the economic outlook improves.

Debt investors, though, have shrugged off good economic data in recent days as much as they ignored some weak data over the winter. Instead, higher yields have lured buyers, apparently aided by technical factors such as renewed demand from Japanese investors. (…)

Now, there is evidence that they are buying again, with new government data showing that Japanese investors bought the equivalent of $15.6 billion of overseas bonds on net last week, the most since November. (…)

John Authers: But why would bonds choose a moment like this to rally?

Comments Wednesday by Fed Chairman Jerome Powell that monetary policy would stay lenient doubtless helped. The decision to order a pause in the Johnson & Johnson vaccine, potentially damaging to recovery hopes, might have contributed — although it has had precious little effect in other markets. Strong demand at this week’s Treasury auctions may have brought people who had been betting on a bond “tantrum” back into the market. Another explanation comes from geopolitics. U.S. relations with Russia have worsened again; speculation is rife over China’s intentions toward Taiwan; Israel appears to have sabotaged Iran’s nuclear program. None of this has discombobulated the stock market, but it might make Treasuries more appealing.

One last data point might be more important. International purchases of Treasuries show that Asian demand remains strong. Japan has had more Treasury holdings than China for a few years now, and the rally in yields over the last year only makes them more appealing. Yields at home aren’t enticing, after all:

The best answer may be “all of the above.” The inflation trade had come a long way in a hurry, but proof that that we have entered a new reflationary paradigm will take time. With the auctions revealing that demand remained robust, it seems a lot of people who bailed from the Treasury market prematurely decided to hedge their bets.

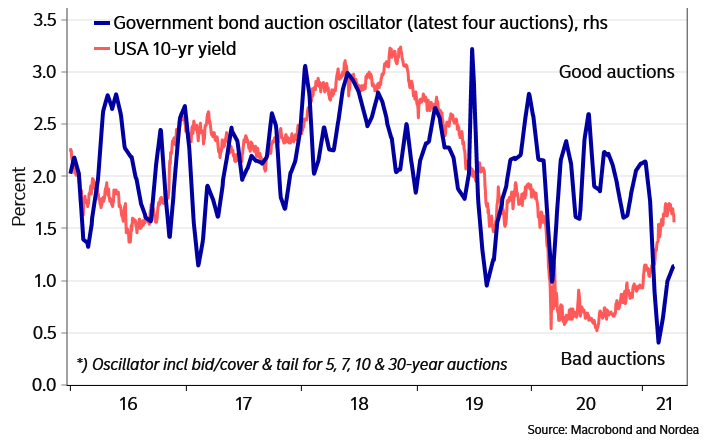

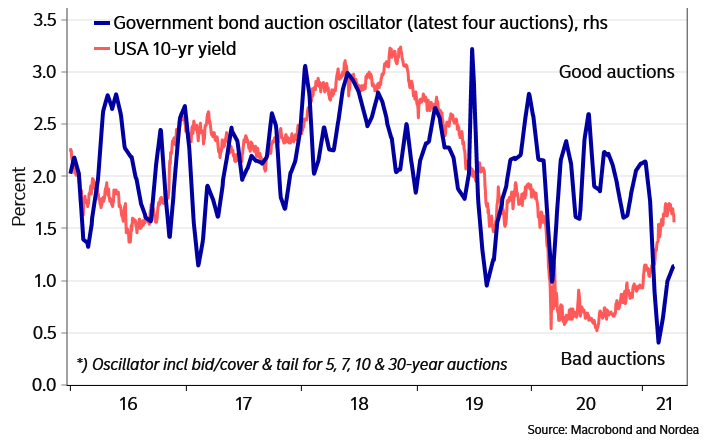

Nordea submits that the recent auctions were not good, only less bad:

Bloomberg this morning:

Hedge funds played a big part in this year’s Treasury selloff, offloading more than $100 billion in January and February. The biggest net sales were in the Cayman Islands, a domicile for leveraged accounts. Investors there dumped $62 billion in February and $49 billion the prior month. That may help explain yesterday’s rally, with many analysts pointing to short-covering demand.

The Fed reassures us:

Fed Will Begin Reducing Bond Purchases ‘Well Before’ Raising Interest Rates, Powell Says Federal Reserve Chairman Jerome Powell noted that most central-bank officials see interest rates remaining near zero through 2023.

(…) “We will taper asset purchases when we’ve made substantial further progress toward our goals, from last December when we announced that guidance,” Mr. Powell said in a virtual event held by the Economic Club of Washington, D.C. “That would in all likelihood be before—well before—the time we consider raising interest rates.”

The Fed has said it will hold rates near zero until it sees the labor market return to full employment and inflation rise to 2% and is forecast to moderately exceed that level for some time. Mr. Powell reiterated that he thinks it is highly unlikely that the Fed would raise interest rates this year and noted that most central-bank officials see rates remaining near zero through 2023. (…)

Powell said that before yesterday’s data releases…

China Posts Record Economic Growth China’s economy surged 18.3% in the first quarter from a year earlier, a record rate of growth that reflected the recovery from a deep coronavirus-induced trough in early 2020.

(…) though it fell short of the 19.2% growth expected by economists polled by The Wall Street Journal. (…)

But stripping out the statistical distortion from last year’s low base of comparison, economists at HSBC in Hong Kong estimate that underlying year-over-year GDP growth in the first three months of 2021 was about 5.4%, lower than the pre-coronavirus trend of roughly 6% growth. The bank expects the economy to continue “running below full speed” in the coming months.

When compared with the last three months of 2020, the Chinese economy expanded just 0.6% in the first quarter of 2021, slowing from a newly revised 3.2% quarter-on-quarter GDP increase in the fourth quarter of 2020, according to data released Friday by the National Bureau of Statistics. (…)

Inflation has become more concerning in recent weeks, as rising prices for copper, aluminum and steel have prompted makers of home appliances, for example, to raise the prices of their products, even though many haven’t yet returned to their pre-virus sales levels.

Midea Group, a large appliance maker based in the southern province of Guangdong, increased the prices of its refrigerators by 10% to 15% beginning last month, citing the rapid run-up in raw material prices. (…)

Sentiment among Chinese consumers recovered to its pre-pandemic level for the first time in March and then continued to build on those gains in the first half of April, according to surveys conducted by research firm Morning Consult.

Morning Consult China Index of Consumer Sentiment

“Chinese consumers have emerged from the pandemic even stronger than they were before,” said John Leer, an economist at the research firm.

In March, retail sales jumped 34.2% from a year earlier, the National Bureau of Statistics said Friday. The result was higher than 33.8% growth posted in the first two months of the year and beat economists’ expectation for 28% growth.

In month-on-month terms, retail sales rose 1.75% in March, accelerating from 0.56% in February. (…)

(Bloomberg)

(Bloomberg)

Industrial output rose 14.1% in March from a year earlier, down from 35.1% year-over-year growth in the January to February period and lower than a 16.5% pace expected by the economists polled by The Wall Street Journal.

China’s fixed-asset investment rose 25.6% from a year earlier in the first quarter, slowing from 35% in the January to February period.

Home sales by volume, a major indicator of demand, soared 95.5% in the first three months of 2021 from a year earlier, though the pace was slower than the 143.5% year-over-year gain in the first two months of the year. Real-estate investment in China rose 25.6% in the January-to-March period, compared with a 38.3% gain for the January-to-February period.

(…) In 2020 alone, the country’s top banking regulator issued almost 3,200 violations against institutions and 4,554 against individuals ranging from senior executives to rank-and-file staff; it levied fines totaling 2.3 billion yuan ($352.2 million). In the U.S., which has a much longer history of bank regulation, the Federal Reserve took 58 enforcement actions in total.

Among the infractions, Chinese investigators found fabricated financial statements, executives’ nannies and chauffeurs installed as controlling shareholders, and favorable rates and sweetheart deals for investors and relatives.

The state has also bailed out three poorly-run small lenders and merged dozens more since its first crackdown three years ago. Still, out of 4,400 financial institutions, 12.4% are designated at high risk for failure by the central bank. Now, the government is rewriting the commercial banking law and will have “zero tolerance” for transgressions. (…)

Huarong, which has around $42 billion in outstanding debt at home and abroad, delayed its earnings report in early April, beginning a spiral that’s seen its bonds fall to a record low of about 52 cents on the dollar. Its shares are down 67% since the 2015 debut and currently suspended. (…)

It’s the second time in two years that creditors have been left at the mercy of bad actors. In 2019, China jolted global markets with a surprise seizure of Baoshang Bank Co., once seen as a model for funding regional economies. Triggered by the misappropriation of funds by its controlling shareholder, the takeover and eventual bankruptcy of Baoshang also called into question long-held assumptions of a perpetual government backstop. (…)

In response to the rising risks, the central bank is revising its commercial bank law. The proposed changes include a new chapter on corporate governance, which for the first time specifies the responsibilities of shareholders and the key role of the board of directors. It also bars entities from using borrowed money to invest in banks and prohibits directors from holding posts at more than one affiliated institution. (…)

Another Bloomberg piece was more short-term practical:

(…) With some $7.4 billion worth of bonds needing to be repaid or refinanced this year, the company and its subsidiaries will need to find new funds, and soon. The plunge in its dollar bonds makes raising cash in the offshore market highly unlikely for now. Some of its existing bonds fell to as low as 45 cents on the dollar Thursday, compared with 100 cents at the end of last month. (…)

Adding to the nervousness is the fact that the country’s Ministry of Finance — China Huarong’s largest shareholder — has yet to pledge government support. This all in a company whose former chairman was executed earlier this year after being found guilty of accepting bribes. (…)

Yet another Bloomberg article this a.m.:

(…) The company reiterated on Thursday it has “adequate” liquidity and has repaid all bonds that matured on time. It has funds for a full repayment of a S$600 million ($450 million) offshore note due April 27, a person with direct knowledge of the company’s plan has said. Huarong’s onshore securities unit has wired funds to repay a local bond maturing Sunday, according to people familiar with the matter. (…)

Still, that’s a drop in the ocean and won’t remove investor concerns. Huarong has domestic and offshore debt equivalent to $42 billion, with $17.1 billion due by the end of 2022, according to Bloomberg-compiled data. Huarong counts Warburg Pincus, Goldman Sachs Group Inc., and Malaysia’s sovereign wealth fund among uts shareholders, according to data compiled by Bloomberg. The stock has collapsed 67% since its listing.

Hu Jianzhong, chief supervisor at Huarong, said at an event in Beijing on Friday that China will see more difficulties in bad-asset disposal market over the next three to five years as the volume of bad assets will rise while prices will fall. Hu didn’t mention Huarong’s debt situation in the speech and declined to comment on the company’s bond repayment plan or the timing for its annual report on the sidelines of the event.

The nation’s distressed loan managers are facing mounting pressure as the pandemic has made it harder to dispose of assets, according to a closely watched survey by China Orient Asset Management Co. released on Friday.

Increasing credit losses at the managers themselves threaten to hurt profits and have adverse impact on their capital strength over the long term, China Orient, one the nation’s four state-owned bad loan banks, said in the report. It also warned of growing difficulties to manage the maturity mismatch as their liabilities are mostly short-term.

Separately, the regulator also revealed on Friday that Chinese banks saw their non-performing loans climb to 3.6 trillion yuan ($552 billion) as of March 31, up 118.3 billion yuan from the end of 2020. The NPL ratio eased to 1.89%, 0.02 percentage point lower than at the end of 2020. (…)

Taiwan Drought Threatens to Make Chip Shortage Worse The island’s worst dry spell in half a century has added strain to a center of semiconductor manufacturing during a global scarcity of chips.

The drought’s impact on semiconductor producers, which require voluminous quantities of water to churn out chips, is so far modest as the government creates exceptions for these manufacturers. But companies are starting to make adjustments, and officials have warned that the water shortage could worsen without adequate rainfall.

Taiwan’s semiconductor wafer-fabrication factories, or fabs, account for 65% of global production, according to the research firm TrendForce. (…)

TSMC Chief Executive C.C. Wei said Thursday that while Taiwan water supplies are currently tight, the company doesn’t expect to see any material impact on operations.

Taiwan officials and scholars have warned that water scarcity could become a more persistent problem in the years to come because of climate change, a worrying possibility for the global semiconductor industry given the concentration of chip production in Taiwan.

More than half of Taiwan’s water supply comes from typhoons, said Yuei-An Liou, a professor at the National Central University’s Center for Space and Remote Sensing Research in Taoyuan, Taiwan. As global temperatures rise, typhoons will become stronger over the Pacific Ocean but also are more likely to change course before reaching Taiwan, he said. (…)

(Bloomberg)

(Bloomberg)