U.S. private sector growth eases to seven-month low in April

- Flash U.S. Composite Output Index at 52.7 (53.0 in March). 7-month low.

- Flash U.S. Services Business Activity Index at 52.5 (52.8 in March). 7-month low.

- Flash U.S. Manufacturing PMI at 52.8 (53.3 in March). 7-month low.

- Flash U.S. Manufacturing Output Index at 53.4 (54.3 in March), 7-month low.

The PMI data suggest the US economy lost further momentum at the start of the second quarter. The surveys are signalling a GDP growth rate of 1.1% after 1.7% in the first quarter.

There were signs of a squeeze on operating margins in April, as input price inflation reached its strongest since June 2015. At the same time, prices charged by U.S. private sector firms increased only marginally and at the slowest pace since November 2016. (…)

Services:

New business growth remained moderate in April, although the latest upturn was stronger than the 12-month low seen in March. April’s survey suggested a lack of pressure on operating capacity, as backlogs of work declined for the third month running.

Subdued demand growth and lower volumes of incomplete work acted as a brake on staff hiring in April. The latest rise in employment numbers was only marginal and the weakest since July 2010.

Manufacturing:

The main positive development was a slight rebound in manufacturing job creation from the seven-month low seen during March.

April data signalled a sharp and accelerated rise in average cost burdens across the manufacturing sector. The rate of input cost inflation was the fastest since December 2013, which survey respondents linked to rising commodity prices (particularly metals). Meanwhile, pressure on margins from higher input costs contributed to the strongest increase in factory gate charges for almost two-and-a-half years.

U.S. Leading Economic Indicators Suggest Continued Expansion

The Conference Board’s Composite Index of Leading Economic Indicators increased 0.4% (3.5% y/y) during March following a 0.5% February rise, initially reported as 0.6%. A 0.2% rise had been expected in the Action Economics Forecast Survey. The latest rise left three-month growth at 6.2% (AR) after 3.6% growth during Q4’16.

Most of the component series contributed to the index rise. A steeper interest rate yield curve and a higher ISM new orders index had the largest positive effects. These were followed by improved consumer expectations for business/economic conditions, higher stock prices, more building permits and the leading credit index. A shorter workweek and more initial claims for unemployment insurance contributed negatively to the index.

From Doug Short:

PHILLY FED SOFTENS

The index for current manufacturing activity in the region decreased from a reading of 32.8 in March to 22.0 this month. The index has been positive for nine consecutive months and remains at a relatively high reading but has moved down the past two months. Thirty-seven percent of the firms indicated increases in activity in April, while 15 percent reported decreases. The current new orders and shipments indexes remained at high readings but declined 11 points and 10 points, respectively. Both the delivery times and unfilled orders indexes were positive for the sixth consecutive month, suggesting longer delivery times and increases in unfilled orders.

BEIGE BOOK WORDING

The recent Beige Book mixed words such as mild, modest and moderate in ways which leave the reader mildly modest on his ability to understand what’s going on. Sometimes, images are more telling. From The Daily Shot (Source: @EMgist) and David Rosenberg:

Eurozone PMI hits fresh six-year high to signal strong start to second quarter

- Flash Eurozone PMI Composite Output Index at 56.7 (56.4 in March). 72-month high.

- Flash Eurozone Services PMI Activity Index at 56.2 (56.0 in March). 72-month high.

- Flash Eurozone Manufacturing PMI Output Index at 58.0 (57.5 in March). 72-month high.

- Flash Eurozone Manufacturing PMI at 56.8 (56.2 in March). 72-month high.

Job creation also rose to the highest for almost a decade as firms boosted operating capacity in line with buoyant demand and widespread optimism about future prospects. Price pressures meanwhile remained among the strongest seen over the past six years. (…)

Growth rates of incoming new business and backlogs of uncompleted work both remained close to March’s peak to register the second-strongest monthly improvements in six years. (…)

Supply chains also continued to tighten, signalling a growing trend towards a sellers’ market for many items. Suppliers’ delivery times lengthened to the greatest extent for nearly six years. Evidence of rising wage pressures also continued to be seen. (…)

The April flash PMI is running at a level consistent with 0.7% GDP growth, up from 0.6% in the first quarter. (…)

ETFs AND OVERALL MARKET RISKS

ETFs AND OVERALL MARKET RISKS

I have written intermittently on ETFs and the growing problems with their exponential growth. I have been trying to find time to write more extensively about the growing dislocations ETF popularity is creating, not only on equity markets but really on any markets attracting meaningful ETF money. I just stumbled on this excellent and hugely important presentation by Steven Bregman who does way better than I could have to alert you to the coming crisis.

When it comes to good investment, these 42 minutes are way up there. The next correction or bear market (yes, these words will be used again) will surprise many, many people.

Please take the time to watch and analyse the accompanying charts if you are even remotely serious about investing. The video is courtesy Steven Bregman and Horizon Kinetics. The chart book is courtesy Steven Bregman and Horizon Kinetics as well as Grants Financial Publishing via Valuewalk.

-

Steven Bregman’s Grant’s Fall 2016 Presentation on the ETF Divide

-

Chart Book

- Also worth reading: When an ETF Changes Its Stripes

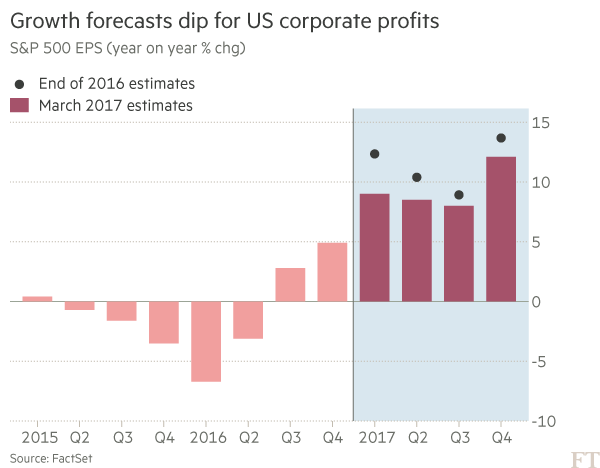

EARNINGS WATCH

- 87 companies (22.5% of the S&P 500’s market cap) have reported. Earnings are beating by 5.9%, with 75% of companies surpassing bottom-line estimates. Revenues are surprising by 0.4%.

- Expectations are for revenue, earnings, and EPS growth of 6.7%, 9.5%, and 11.4%, respectively.

- EPS is on pace for 15.2%, assuming a typical beat rate for the remainder of the season. (RBC)

SENTIMENT WATCH

-

Markets Send a Worrying Message About the Economy Markets are flashing red on growth as investors begin to return to pre-election bets on the “new normal”—a persistently weak economic expansion.

(…) The sharp drop in government-bond yields is the most obvious signal that something is amiss. It is backed up by ominous signs from raw-materials markets, where copper and iron-ore prices have tumbled, and a swing in leadership of the stock market away from go-go bank shares and cheap “value” stocks to safety-first utilities, real estate and companies with high-quality balance sheets and reliable earnings. All this has come as inflation expectations priced into bonds have fallen and as some weak data has led to downgrades of economic forecasts.

Technology stocks’ return to favor also suggests investors are looking for companies able to deliver growth even if the economy is weak. (…)

-

Larry Fink: ‘Warning Signs Are Getting Darker’ for the U.S. Economy

-

U.S. Stocks Should ‘Terrify’ Janet Yellen, Paul Tudor Jones Says

-

Sure, Stocks Are Overvalued. Now What?

-

Banks and Borrowers Are Waiting on Washington Regional banks are seeing both optimism and angst in the American heartland, reporting that their customers are waiting for clues from Washington before taking action.

-

Trump, GOP Race to Revive Health Bill, Avoid Government Shutdown The president and his allies in Congress are rushing to avoid a government shutdown while reviving a failed overhaul of the Affordable Care Act.

-

Mnuchin Says Administration Will Release Tax Proposal Soon Treasury Secretary Steven Mnuchin said the administration plans to release its tax reform proposal “very soon” and promised a sweeping overhaul of the tax code will get done.

-

Mnuchin Sees Significant Regulatory Changes

![]() America sure needs helps:

America sure needs helps:

Hoisington Investment Management Co.

Now things are different. This week the Fed raised rates for the second time in three months—thanks partly to the vigour of the American economy, but also because of growth everywhere else. Fears about Chinese overcapacity, and of a yuan devaluation, have receded. In February factory-gate inflation was close to a nine-year high. In Japan in the fourth quarter capital expenditure grew at its fastest rate in three years. The euro area has been gathering speed since 2015. The European Commission’s economic-sentiment index is at its highest since 2011; euro-zone unemployment is at its lowest since 2009.

Now things are different. This week the Fed raised rates for the second time in three months—thanks partly to the vigour of the American economy, but also because of growth everywhere else. Fears about Chinese overcapacity, and of a yuan devaluation, have receded. In February factory-gate inflation was close to a nine-year high. In Japan in the fourth quarter capital expenditure grew at its fastest rate in three years. The euro area has been gathering speed since 2015. The European Commission’s economic-sentiment index is at its highest since 2011; euro-zone unemployment is at its lowest since 2009.